Crypto's Evolving Landscape Demands Modern Tax Reform

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto's Evolving Landscape Demands Modern Tax Reform

The cryptocurrency market's explosive growth has left tax laws struggling to keep pace, creating a complex and often confusing landscape for both investors and regulators. From Bitcoin's initial surge to the proliferation of thousands of altcoins and the rise of DeFi (Decentralized Finance), the need for modern tax reform tailored to the digital asset space is more urgent than ever. The current system, designed for traditional assets, simply isn't equipped to handle the unique characteristics of cryptocurrencies.

The Challenges of Current Tax Laws

Existing tax regulations often fail to account for the nuances of cryptocurrency transactions. This leads to several key challenges:

-

Defining Crypto as Property: While the IRS currently classifies crypto as property, this broad categorization doesn't adequately address the intricacies of staking, lending, airdrops, and other DeFi activities. The lack of clarity creates significant ambiguity and increases the risk of unintentional tax violations.

-

Tracking Transactions: The decentralized and pseudonymous nature of many blockchain networks makes tracking transactions challenging. Reconciling numerous transactions across multiple exchanges and wallets is a laborious process, prone to errors and potentially leading to underreporting or overreporting of taxable income.

-

Valuation Challenges: Determining the fair market value of cryptocurrencies at the time of transactions can be difficult, especially for less-liquid assets. Fluctuations in value can significantly impact tax liabilities, creating uncertainty and potential disputes with tax authorities.

-

International Tax Implications: The borderless nature of cryptocurrencies presents further complications for international tax laws. Determining residency and tax obligations across jurisdictions is a complex and often unresolved issue.

The Urgent Need for Reform

The current tax framework is not only burdensome for individual investors but also hinders the growth and adoption of cryptocurrencies. A clearer and more efficient tax system is crucial for:

-

Encouraging Innovation: Uncertainty surrounding tax regulations discourages investment and innovation within the crypto space. Streamlining tax laws would foster a more predictable and attractive environment for businesses and developers.

-

Improving Tax Compliance: A simplified and more understandable tax system would improve compliance, reducing the likelihood of unintentional errors and disputes. This would also reduce the burden on tax authorities.

-

Protecting Investors: Clearer regulations would protect investors from scams and fraudulent activities, providing a more transparent and secure market.

-

Boosting Economic Growth: The crypto industry has the potential to create significant economic opportunities. Modern tax reforms could unlock this potential, fostering growth and creating jobs.

Potential Solutions and the Path Forward

Several potential solutions are being explored, including:

-

Simplified Tax Reporting: Developing user-friendly reporting systems could significantly ease the burden of tax compliance for individual investors.

-

Clarification of DeFi Tax Treatment: Providing clear guidance on the tax implications of DeFi activities such as staking and lending is essential.

-

Harmonization of International Tax Laws: International cooperation is necessary to address the cross-border nature of cryptocurrency transactions.

The evolution of cryptocurrency demands a proactive approach to tax reform. A collaborative effort between lawmakers, regulators, and industry stakeholders is crucial to create a tax system that is fair, efficient, and conducive to the growth of the digital asset ecosystem. Failure to adapt will not only hinder the potential of this transformative technology but also create significant challenges for both taxpayers and governments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto's Evolving Landscape Demands Modern Tax Reform. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Optimize Your Digital Life A Step By Step Guide To I Phone Screen Time

May 04, 2025

Optimize Your Digital Life A Step By Step Guide To I Phone Screen Time

May 04, 2025 -

Aussie Fighter Rejects Delusional Rivals Claims Addresses Ufc Superfight Threat

May 04, 2025

Aussie Fighter Rejects Delusional Rivals Claims Addresses Ufc Superfight Threat

May 04, 2025 -

Russell Westbrooks Electrifying Playoffs The Ucla Factor

May 04, 2025

Russell Westbrooks Electrifying Playoffs The Ucla Factor

May 04, 2025 -

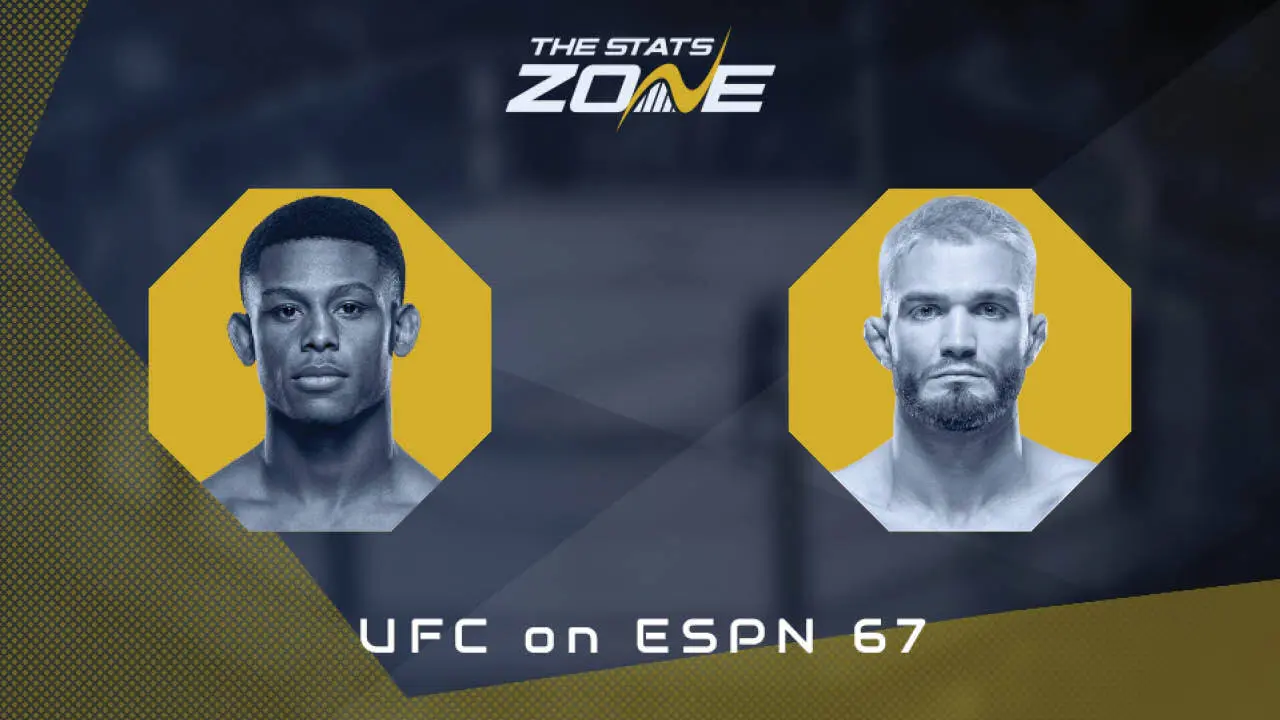

Ufc Espn 67 In Depth Look At Smotherman Vs Sidey Who Wins

May 04, 2025

Ufc Espn 67 In Depth Look At Smotherman Vs Sidey Who Wins

May 04, 2025 -

From Street Style To The Met Gala The Evolution Of Black Dandyism

May 04, 2025

From Street Style To The Met Gala The Evolution Of Black Dandyism

May 04, 2025