Crypto's Maturation Demands Updated Tax Laws: A 2024 Perspective

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto's Maturation Demands Updated Tax Laws: A 2024 Perspective

The cryptocurrency landscape has exploded in recent years, transitioning from a niche digital asset to a globally recognized investment class and a burgeoning technological force. This rapid growth, however, has left existing tax laws woefully inadequate, creating confusion and uncertainty for both taxpayers and regulators alike. As we enter 2024, the urgent need for updated cryptocurrency tax laws is undeniable.

The Current Regulatory Maze: A Patchwork of Confusion

Current tax laws often treat cryptocurrency transactions as property sales, leading to complex calculations and significant reporting burdens. This approach fails to account for the unique characteristics of cryptocurrencies, such as their volatility, decentralized nature, and use in decentralized finance (DeFi) applications. The lack of clear guidance on staking rewards, airdrops, and other DeFi activities further exacerbates the problem. This uncertainty frequently results in:

- Inconsistent Reporting: Taxpayers struggle to accurately report their crypto transactions due to the lack of standardized reporting mechanisms from exchanges and other platforms.

- High Audit Risk: The complexity of crypto tax calculations significantly increases the risk of IRS audits and potential penalties for unintentional errors.

- Hindered Innovation: The unclear regulatory environment stifles innovation within the crypto space, discouraging both individual investors and businesses from engaging with the technology.

Why Updated Tax Laws are Crucial in 2024

The call for updated tax laws isn't merely a matter of convenience; it's a necessity for several key reasons:

- Fairness and Equity: The current system disproportionately burdens cryptocurrency investors compared to investors in traditional assets. Clearer rules would ensure a level playing field.

- Economic Growth: A well-defined regulatory framework fosters investor confidence and encourages greater participation in the crypto market, boosting economic growth.

- Revenue Generation: Updated tax laws with clear reporting requirements can actually increase tax revenue for governments by making it easier to track and tax crypto transactions.

- International Harmonization: Developing consistent international standards for cryptocurrency taxation would create a more stable and predictable global market.

What Changes are Needed? A Look Ahead

Experts suggest several key changes are necessary to modernize cryptocurrency tax laws:

- Simplified Reporting Mechanisms: Implementing streamlined reporting processes, potentially leveraging blockchain technology itself, could significantly reduce the burden on taxpayers.

- Clearer Definitions and Classifications: Providing precise definitions for various crypto activities, such as staking and DeFi interactions, is essential.

- Cost Basis Clarification: Establishing clear rules for determining the cost basis of cryptocurrencies, particularly in complex scenarios involving forks and airdrops, is crucial.

- Tax Rate Considerations: A review of the appropriate tax rates for cryptocurrency gains and losses, considering the inherent volatility of the market, is needed.

Conclusion: A Necessary Evolution

The maturation of the cryptocurrency market necessitates a corresponding evolution in tax laws. 2024 should be the year where policymakers prioritize creating a regulatory framework that is clear, fair, and conducive to both the growth of the crypto industry and the effective collection of tax revenue. Failure to act decisively will only perpetuate the current uncertainty and potentially stifle the enormous potential of this transformative technology. The future of finance depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto's Maturation Demands Updated Tax Laws: A 2024 Perspective. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analise O Impacto Das Tres Derrotas De Filipe Luis No Flamengo

May 05, 2025

Analise O Impacto Das Tres Derrotas De Filipe Luis No Flamengo

May 05, 2025 -

Live Score Pacers Vs Cavaliers Updates Stats And Play

May 05, 2025

Live Score Pacers Vs Cavaliers Updates Stats And Play

May 05, 2025 -

Outdoor Exoskeleton Breakthrough Mass Production Begins For Hip Motion Device

May 05, 2025

Outdoor Exoskeleton Breakthrough Mass Production Begins For Hip Motion Device

May 05, 2025 -

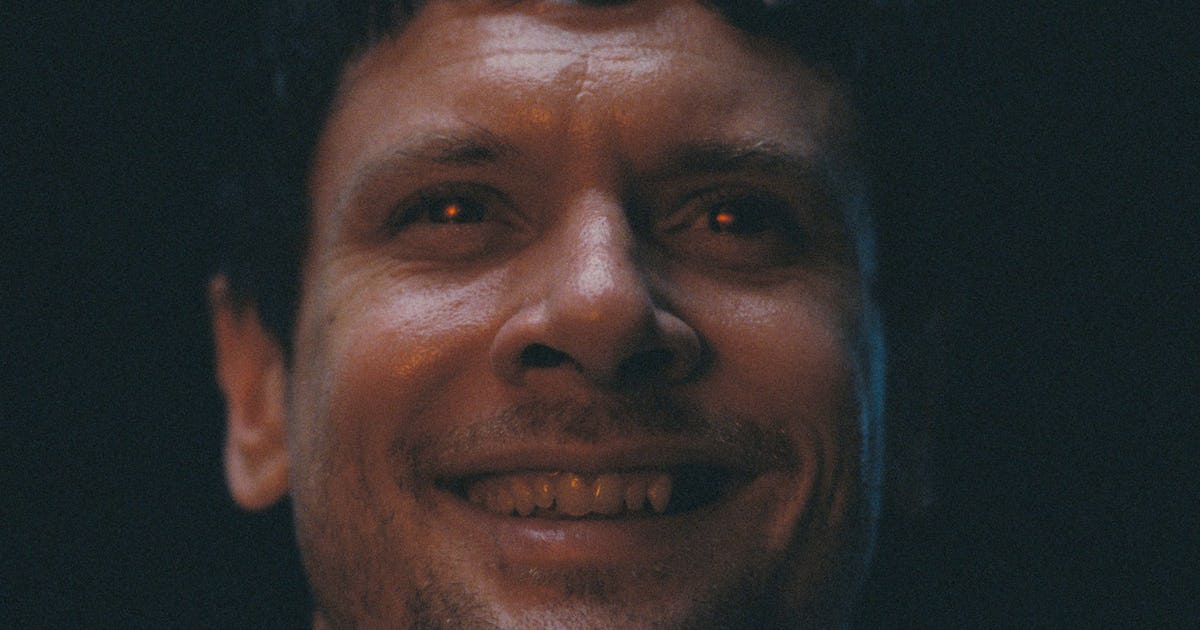

Ryan Cooglers Sinners Jack O Connells Unexpected Character

May 05, 2025

Ryan Cooglers Sinners Jack O Connells Unexpected Character

May 05, 2025 -

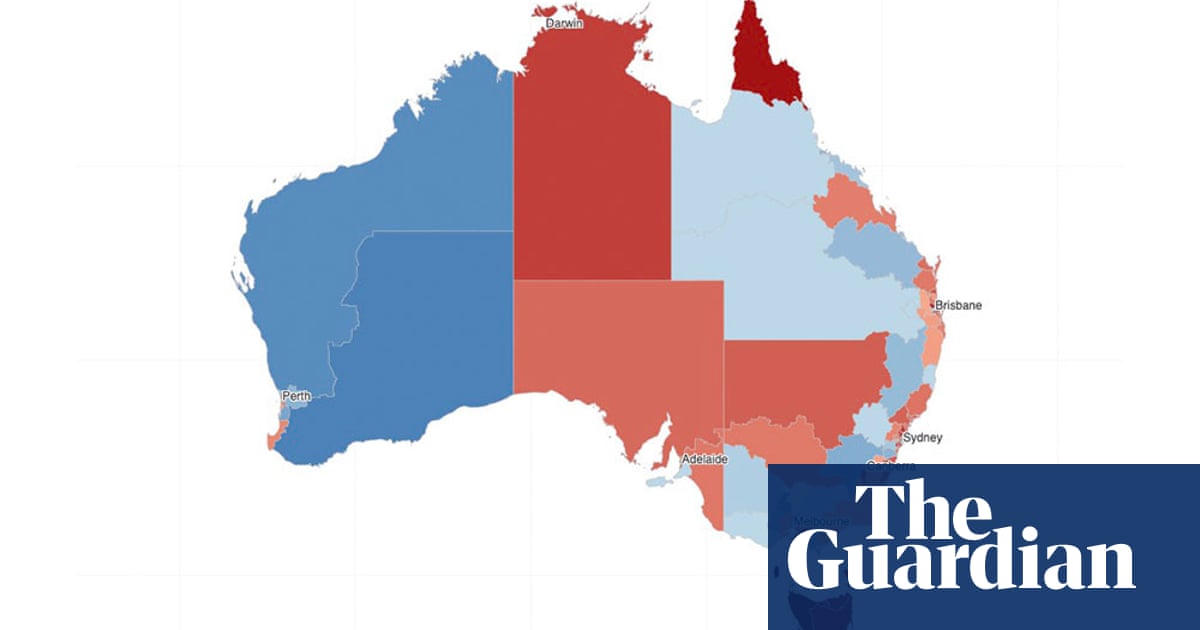

Australian Election 2023 Understanding Labors Lead And The Senate Picture Four Charts

May 05, 2025

Australian Election 2023 Understanding Labors Lead And The Senate Picture Four Charts

May 05, 2025