Crypto's Maturation Demands Updated Tax Regulations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto's Maturation Demands Updated Tax Regulations

The meteoric rise of cryptocurrency has left tax authorities worldwide scrambling to keep pace. What began as a niche digital asset is now a multi-trillion dollar market influencing global finance, demanding a significant overhaul of existing tax regulations. The current frameworks, designed for traditional assets, are simply inadequate for the complexities and rapid evolution of the crypto landscape. This necessitates urgent action from lawmakers to create clear, comprehensive, and future-proof tax laws for digital assets.

The Challenges of Existing Tax Regulations

Many countries still grapple with classifying cryptocurrencies for tax purposes. Are they property, commodities, or currencies? This fundamental ambiguity creates significant uncertainty for both taxpayers and tax authorities. The lack of clarity leads to:

- Inconsistent reporting: Individuals struggle to accurately report their crypto transactions, often leading to unintentional errors and penalties.

- Difficulty in valuation: Determining the fair market value of cryptocurrencies at the time of transactions remains a significant challenge due to their volatile nature.

- Cross-border complexities: International transactions involving cryptocurrencies pose further complications, requiring international cooperation and harmonization of tax rules.

- Lack of specific guidance: Existing tax codes often lack the specific provisions needed to address unique aspects of cryptocurrency transactions, such as staking, airdrops, and decentralized finance (DeFi) activities.

The Need for Modernized Tax Frameworks

The current regulatory landscape is not only confusing but also hinders the growth of the legitimate cryptocurrency market. Clear and consistent tax rules are crucial to:

- Boosting investor confidence: Well-defined regulations reduce uncertainty and encourage greater participation in the crypto market.

- Enhancing tax compliance: Clear guidelines make it easier for individuals and businesses to accurately report their crypto transactions, improving tax collection efficiency.

- Preventing tax evasion: Ambiguous rules create loopholes that can be exploited for tax evasion. Modernized regulations help close these loopholes and ensure fair tax collection.

- Promoting innovation: A predictable and stable regulatory environment fosters innovation within the cryptocurrency space, attracting investment and driving further development.

What Changes are Needed?

Several key areas require urgent attention:

- Clear definitions: Governments need to explicitly define cryptocurrencies and related activities within their tax codes.

- Standardized valuation methods: Establishing consistent methods for determining the fair market value of cryptocurrencies is crucial.

- Simplified reporting mechanisms: Developing user-friendly platforms and procedures for reporting crypto transactions will enhance compliance.

- International collaboration: International cooperation is essential to address the cross-border complexities of crypto taxation.

- Adaptability to technological advancements: Tax regulations need to be flexible enough to adapt to the constantly evolving nature of the cryptocurrency ecosystem.

Looking Ahead: A Future-Proof Approach

The future of cryptocurrency is intertwined with the development of robust and adaptable tax regulations. A proactive approach that embraces technological advancements and promotes international cooperation is vital to fostering a healthy and sustainable crypto market. The time for action is now. Failure to update tax regulations risks stifling innovation and creating significant challenges for both taxpayers and governments alike. Ignoring this crucial aspect will only exacerbate existing issues and hinder the potential benefits of this revolutionary technology.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto's Maturation Demands Updated Tax Regulations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

El Octavo Y Ultimo Definicion De Liguilla Esta Misma Noche

May 05, 2025

El Octavo Y Ultimo Definicion De Liguilla Esta Misma Noche

May 05, 2025 -

Oasis Pulls Inappropriate Track After Convicted Paedophile Connection

May 05, 2025

Oasis Pulls Inappropriate Track After Convicted Paedophile Connection

May 05, 2025 -

7 Billion In Unnecessary Nasa Spending Time For Reform

May 05, 2025

7 Billion In Unnecessary Nasa Spending Time For Reform

May 05, 2025 -

Sri Lanka Women Vs India Women Live Score Updates And Highlights From The 4th Match

May 05, 2025

Sri Lanka Women Vs India Women Live Score Updates And Highlights From The 4th Match

May 05, 2025 -

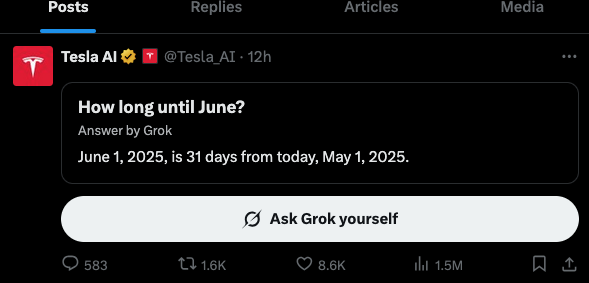

June 2025 Teslas Austin Robotaxi Service Begins Operation

May 05, 2025

June 2025 Teslas Austin Robotaxi Service Begins Operation

May 05, 2025