Crypto's Maturation Outpaces Antiquated Tax Laws

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto's Maturation Outpaces Antiquated Tax Laws: A Regulatory Catch-Up Game

The cryptocurrency market has exploded in recent years, evolving from a niche digital asset to a global phenomenon impacting finance, technology, and even art. However, the rapid maturation of this innovative sector is drastically outpacing the antiquated tax laws designed for traditional financial instruments. This mismatch creates a complex and often frustrating landscape for both individual investors and businesses operating within the crypto ecosystem.

The Problem: A Regulatory Lag

Many existing tax codes struggle to adequately address the unique characteristics of cryptocurrencies. These digital assets, often operating on decentralized blockchains, present challenges unlike anything seen in traditional markets. This leads to several key issues:

-

Classification Confusion: Are cryptocurrencies assets, commodities, or currencies? This seemingly simple question has significant tax implications, impacting capital gains calculations, reporting requirements, and overall tax liability. The lack of clear legal definition leaves room for ambiguity and inconsistent enforcement.

-

Tax Reporting Complexity: Tracking cryptocurrency transactions can be incredibly complex. Unlike traditional brokerage accounts, which provide consolidated statements, users often manage their crypto across multiple exchanges and wallets. Reconciling these transactions for tax purposes demands significant record-keeping and often requires specialized software.

-

Global Decentralization vs. National Regulations: The decentralized nature of cryptocurrencies clashes with the geographically bound nature of tax laws. Transactions occur across borders, making it difficult to determine which jurisdiction holds taxing authority. This creates jurisdictional ambiguities and potential for double taxation.

-

Stagnant Legislation: Governments worldwide are still grappling with how to effectively regulate cryptocurrencies. The pace of legislative change is often far slower than the innovation within the crypto space itself, leaving a regulatory gap ripe for exploitation and uncertainty.

The Impact on Investors and Businesses:

The lack of clear tax rules creates significant challenges for both individual investors and businesses operating in the crypto space.

-

Increased Compliance Costs: Individuals and businesses face increased costs associated with record-keeping, tax preparation, and potentially legal advice to ensure compliance.

-

Uncertainty and Risk: The ambiguous regulatory environment creates uncertainty, leading to potential for errors, penalties, and legal disputes. This uncertainty also discourages broader adoption and investment.

-

Limited Access to Financial Services: The complex tax landscape can limit access to traditional financial services, as banks and other institutions may be hesitant to engage with crypto-related transactions due to regulatory complexities.

The Path Forward: Towards Clearer Regulations

Several steps are needed to bridge the gap between the evolving crypto landscape and the lagging tax laws:

-

Clearer Legal Definitions: Governments must establish clear legal definitions for cryptocurrencies, outlining their classification and tax treatment.

-

Simplified Reporting Mechanisms: Streamlined reporting systems, potentially utilizing blockchain technology itself, could facilitate more efficient tax compliance.

-

International Collaboration: International cooperation is essential to address the jurisdictional challenges posed by the global nature of cryptocurrencies. Harmonized tax regulations could prevent double taxation and create a more predictable environment.

-

Education and Awareness: Increased public awareness and education regarding cryptocurrency taxation are crucial to fostering better compliance.

The cryptocurrency revolution is here to stay. Addressing the current regulatory shortcomings is not just a matter of fairness; it’s vital for promoting innovation, fostering investment, and ensuring the long-term sustainable growth of this transformative technology. The future of finance depends on bridging this crucial gap between technological advancement and legal framework.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto's Maturation Outpaces Antiquated Tax Laws. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Manchester Citys De Bruyne Guardiola Expresses Satisfaction With Players Late Career Performance

May 03, 2025

Manchester Citys De Bruyne Guardiola Expresses Satisfaction With Players Late Career Performance

May 03, 2025 -

Wwe Cuts Jakara Jackson And Gallus Coffey Wolfgang And Mark Released

May 03, 2025

Wwe Cuts Jakara Jackson And Gallus Coffey Wolfgang And Mark Released

May 03, 2025 -

34 C Heatwave Thunderstorms And Heavy Rain To Hit Singapore This May

May 03, 2025

34 C Heatwave Thunderstorms And Heavy Rain To Hit Singapore This May

May 03, 2025 -

Jakara Jackson And Gallus Released Wwe Roster Shakeup

May 03, 2025

Jakara Jackson And Gallus Released Wwe Roster Shakeup

May 03, 2025 -

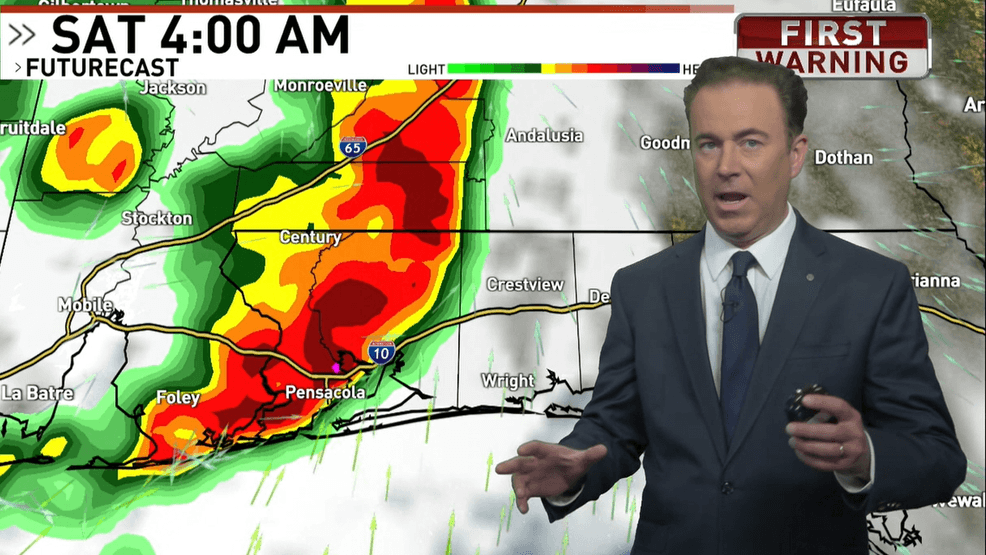

Weekend Forecast Prepare For Heavy Rainfall And Potential Storms

May 03, 2025

Weekend Forecast Prepare For Heavy Rainfall And Potential Storms

May 03, 2025

Latest Posts

-

The Hardships Faced By Marina Rodriguez In Her Rise Through The Ufc

May 04, 2025

The Hardships Faced By Marina Rodriguez In Her Rise Through The Ufc

May 04, 2025 -

Britains Got Talent Itv Addresses Teddy Magics Absence From Live Performances

May 04, 2025

Britains Got Talent Itv Addresses Teddy Magics Absence From Live Performances

May 04, 2025 -

Maxs May 2025 Lineup New Movies To Watch Now

May 04, 2025

Maxs May 2025 Lineup New Movies To Watch Now

May 04, 2025 -

De Um Mergulho No Litoral E Na Natureza Com Cotas De Casas Um Guia Pratico

May 04, 2025

De Um Mergulho No Litoral E Na Natureza Com Cotas De Casas Um Guia Pratico

May 04, 2025 -

Game 7 Showdown Stars Face Avalanche Without Heiskanen And Robertson

May 04, 2025

Game 7 Showdown Stars Face Avalanche Without Heiskanen And Robertson

May 04, 2025