Crypto's Tax Code: Still Stuck In 2014?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto's Tax Code: Still Stuck in 2014? A Call for Modernization

The cryptocurrency landscape has exploded since its inception, evolving from a niche digital asset to a multi-trillion-dollar global phenomenon. Yet, the tax codes governing crypto transactions in many jurisdictions, including the United States, remain stubbornly stuck in the past, clinging to outdated frameworks ill-equipped to handle the complexities of the modern crypto market. This creates significant challenges for both individual investors and the burgeoning crypto industry.

The Problem: A 2014 Mindset in a 2024 World

The Internal Revenue Service (IRS) initially classified cryptocurrency as property in 2014. This classification, while seemingly straightforward, fails to account for the nuanced nature of crypto transactions. The complexities of staking, lending, DeFi protocols, NFTs, and airdrops are not adequately addressed in a tax code designed for a pre-blockchain era. This leads to several critical issues:

-

Ambiguity and Uncertainty: The lack of clear guidance leaves taxpayers vulnerable to misinterpretations and potential penalties. The IRS's pronouncements, while helpful, often lack the specificity required to navigate the intricacies of decentralized finance (DeFi) and other advanced crypto applications.

-

Burdensome Reporting: Tracking every crypto transaction, including minor gains and losses from DeFi interactions, presents an immense administrative burden. The current system necessitates meticulous record-keeping, often exceeding the capabilities of average investors. This complexity fosters a climate of non-compliance, potentially harming tax revenue collection.

-

Inhibiting Innovation: The outdated tax framework discourages investment and innovation within the crypto ecosystem. Uncertainty regarding tax implications can deter both institutional and individual participation, hindering the growth of this transformative technology.

H2: The Need for Modernization: A Call to Action

The crypto industry is not a static entity. Its constant evolution necessitates a flexible and adaptable tax code. Policymakers need to engage with the industry to create a system that is:

-

Clear and Comprehensive: Tax laws must provide clear and unambiguous guidance on the taxation of all crypto-related activities, including DeFi, NFTs, and staking.

-

Proportionate and Fair: The reporting requirements should be proportionate to the scale of crypto activity. Minor transactions should not be subject to the same level of scrutiny as large-scale trading.

-

Future-Proof: The tax code should be designed to adapt to future innovations within the crypto space. A flexible framework will prevent future legislative stalemates and avoid leaving taxpayers in a perpetual state of uncertainty.

H2: Potential Solutions: Looking Towards the Future

Several potential solutions could address the inadequacies of the current crypto tax code. These include:

-

Simplified Reporting Mechanisms: Implementing user-friendly reporting systems, potentially through integration with crypto exchanges and wallets, could dramatically reduce the administrative burden on taxpayers.

-

De Minimis Exclusions: Introducing thresholds below which transactions are not taxable could streamline reporting for smaller investors.

-

Increased Regulatory Clarity: Providing more detailed guidance and FAQs on specific crypto activities can improve taxpayer compliance.

-

International Collaboration: Harmonizing crypto tax regulations across jurisdictions could reduce ambiguity and create a more stable global crypto ecosystem.

Conclusion: A Critical Crossroads

The crypto tax code is at a critical juncture. Continuing to rely on an outdated framework will only exacerbate the existing issues. Proactive legislative action is urgently needed to create a fair, transparent, and forward-looking system that fosters growth within the crypto industry while ensuring fair and efficient tax collection. The future of crypto taxation hinges on the willingness of policymakers to embrace change and create a regulatory environment fit for the 21st century.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto's Tax Code: Still Stuck In 2014?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Exploring Love And Loss In Pbss Miss Austen

May 06, 2025

Exploring Love And Loss In Pbss Miss Austen

May 06, 2025 -

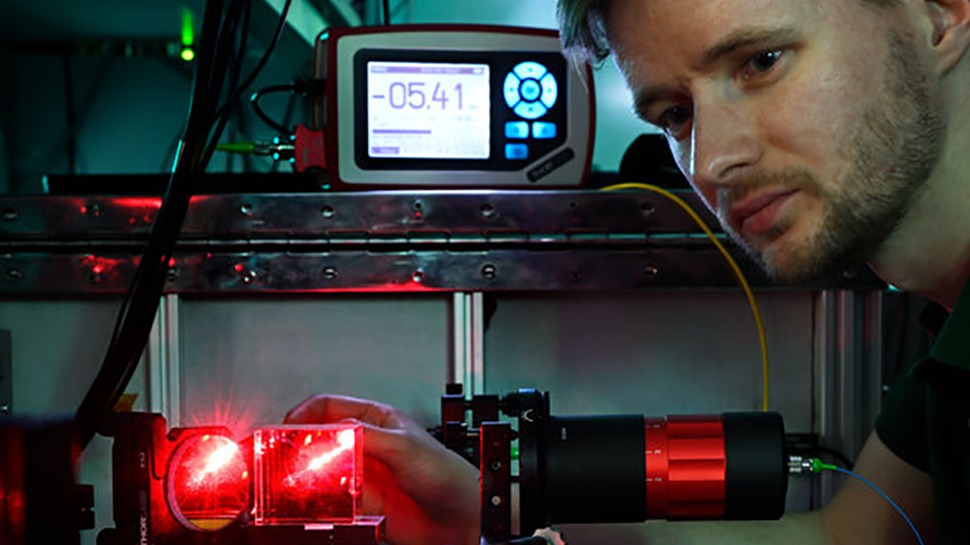

Breakthrough In Data Transmission Almost 2 Million Hd Streams Via Single Infrared Beam

May 06, 2025

Breakthrough In Data Transmission Almost 2 Million Hd Streams Via Single Infrared Beam

May 06, 2025 -

Smart Spending Getting High Quality On A Low Budget

May 06, 2025

Smart Spending Getting High Quality On A Low Budget

May 06, 2025 -

Next Generation Smartphone Powerful Projector Advanced Night Camera And Portable Light

May 06, 2025

Next Generation Smartphone Powerful Projector Advanced Night Camera And Portable Light

May 06, 2025 -

Venus Williams French Open Analysis Exclusive To Tnt Sports

May 06, 2025

Venus Williams French Open Analysis Exclusive To Tnt Sports

May 06, 2025

Latest Posts

-

Houston Astros Win Big 8 3 Victory Over Chicago White Sox 05 03 2025

May 06, 2025

Houston Astros Win Big 8 3 Victory Over Chicago White Sox 05 03 2025

May 06, 2025 -

Knicks Upset Celtics 108 105 In Playoff Thriller May 5th 2025 Recap

May 06, 2025

Knicks Upset Celtics 108 105 In Playoff Thriller May 5th 2025 Recap

May 06, 2025 -

Celtics Vs Knicks Prediction Team News And Form Guide

May 06, 2025

Celtics Vs Knicks Prediction Team News And Form Guide

May 06, 2025 -

Shai Gilgeous Alexanders Thunder Take On Jokic And The Nuggets Second Round Showdown

May 06, 2025

Shai Gilgeous Alexanders Thunder Take On Jokic And The Nuggets Second Round Showdown

May 06, 2025 -

Finding Value In Ai The Struggle For Global Businesses To Achieve Roi

May 06, 2025

Finding Value In Ai The Struggle For Global Businesses To Achieve Roi

May 06, 2025