Crypto's Tax Code: Stuck In The Past, Hurting The Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto's Tax Code: Stuck in the Past, Hurting the Future

The meteoric rise of cryptocurrency has left tax codes worldwide scrambling to catch up. While digital assets have revolutionized finance, outdated tax regulations are creating a complex and often unfair landscape for investors, stifling innovation and hindering the broader adoption of blockchain technology. This isn't just a matter of inconvenience; it's a significant hurdle impacting the future of the crypto industry.

Outdated Regulations: A Barrier to Growth

Many countries still treat cryptocurrencies as property, applying antiquated tax laws designed for traditional assets. This approach fails to account for the unique characteristics of digital assets, leading to several significant problems:

- Complex Reporting: Tracking every transaction, including staking rewards, airdrops, and DeFi interactions, is incredibly challenging for individual investors and requires specialized software. This complexity often leads to unintentional errors and costly penalties.

- High Tax Burdens: The frequent nature of crypto transactions, combined with capital gains taxes applied to each trade, can significantly reduce profits, particularly for active traders. This high tax burden discourages investment and participation in the market.

- Lack of Clarity: The lack of clear and consistent regulatory frameworks across different jurisdictions creates legal uncertainty, making it difficult for businesses and individuals to navigate the tax landscape with confidence. This uncertainty hinders investment and international collaboration.

- Difficulty in Valuing Assets: Determining the fair market value of cryptocurrencies at the time of acquisition and disposal can be subjective and complex, particularly for less established tokens. This ambiguity can lead to disputes with tax authorities.

The Need for Modernized Crypto Tax Laws

To foster innovation and unlock the full potential of the cryptocurrency market, significant changes to tax codes are urgently needed. These changes should include:

- Clearer Definitions: Tax laws must clearly define cryptocurrencies and related activities, distinguishing between different types of transactions and assets.

- Simplified Reporting Mechanisms: User-friendly reporting systems and potential tax deductions for crypto-related expenses should be implemented to reduce the burden on taxpayers.

- Harmonized International Standards: Collaboration between governments is crucial to establish a global framework for crypto taxation, ensuring consistency and preventing tax arbitrage.

- Consideration of Crypto's Unique Characteristics: Tax codes should reflect the inherent volatility and decentralized nature of cryptocurrencies, potentially incorporating mechanisms to account for losses and the cost of securing digital assets.

The Future of Crypto Taxation

The current state of crypto taxation is unsustainable. It discourages investment, breeds legal uncertainty, and ultimately hinders the broader adoption of a technology with the potential to reshape the global financial system. Moving forward, governments must prioritize clear, efficient, and fair tax policies that encourage innovation and participation in the rapidly evolving cryptocurrency market. Failure to do so will only serve to push this vital sector further into the shadows, hindering its potential for economic growth and development. The future of finance depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto's Tax Code: Stuck In The Past, Hurting The Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tornado Damage And Made In China Vessels Australian Navy Under Scrutiny

Apr 30, 2025

Tornado Damage And Made In China Vessels Australian Navy Under Scrutiny

Apr 30, 2025 -

Fin De Parcours Pour Shapovalov A Madrid Diallo Poursuit L Aventure

Apr 30, 2025

Fin De Parcours Pour Shapovalov A Madrid Diallo Poursuit L Aventure

Apr 30, 2025 -

Help Deciphering Dyson Fans A Comparison Of Popular Models

Apr 30, 2025

Help Deciphering Dyson Fans A Comparison Of Popular Models

Apr 30, 2025 -

Unlock I Phone Screen Times Potential Strategies For Productivity And Balance

Apr 30, 2025

Unlock I Phone Screen Times Potential Strategies For Productivity And Balance

Apr 30, 2025 -

Inter Milans Dip In Form A Season Defining Barcelona Away Game

Apr 30, 2025

Inter Milans Dip In Form A Season Defining Barcelona Away Game

Apr 30, 2025

Latest Posts

-

Answering Barcelonas Plea A Ukrainian Pop Stars Husband And His Football Journey

May 01, 2025

Answering Barcelonas Plea A Ukrainian Pop Stars Husband And His Football Journey

May 01, 2025 -

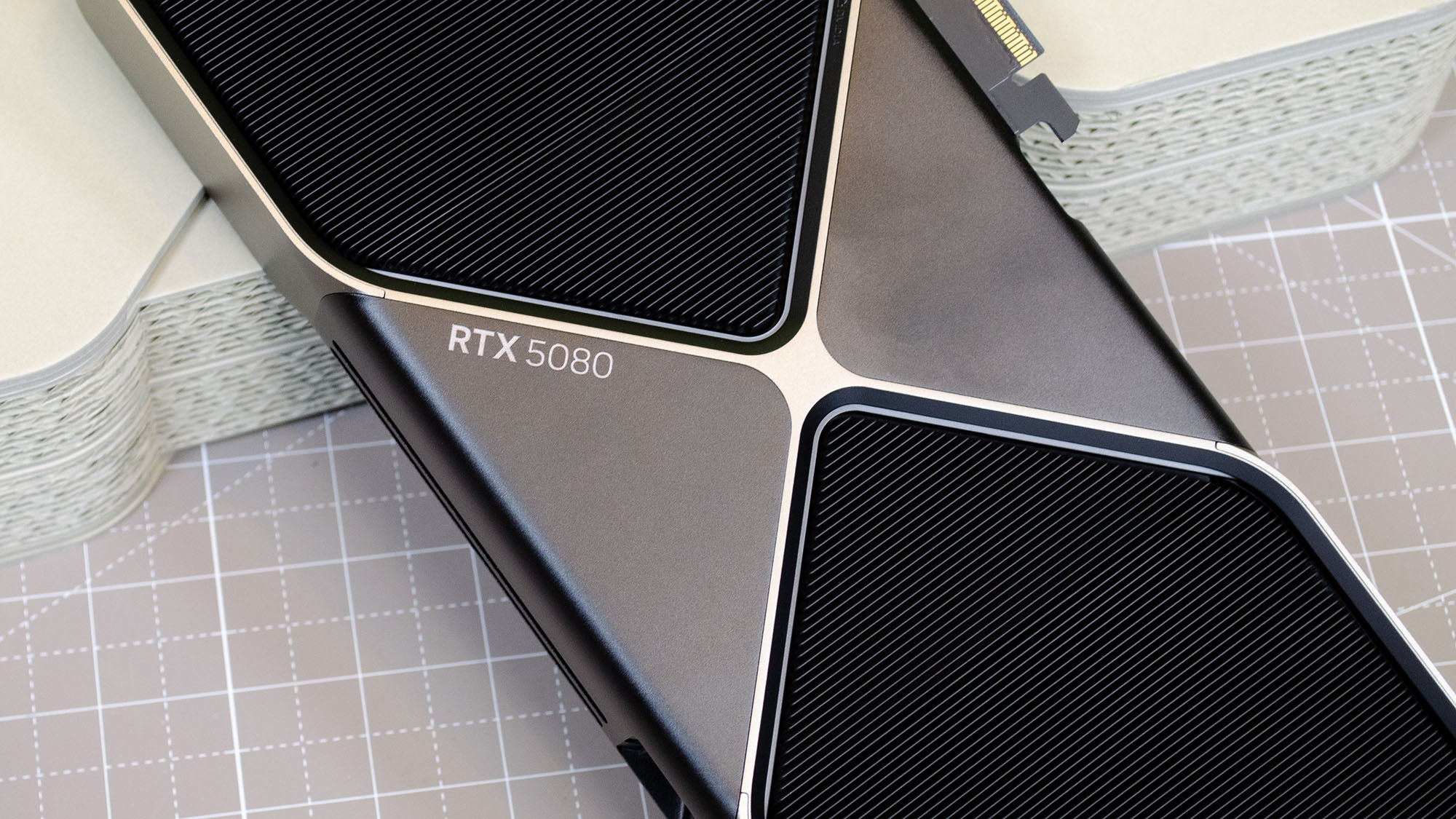

Why Unusual Methods For Buying Rtx 5090 And Rtx 5080 Gpus Are Proving Unsuccessful

May 01, 2025

Why Unusual Methods For Buying Rtx 5090 And Rtx 5080 Gpus Are Proving Unsuccessful

May 01, 2025 -

Understanding The Latest Improvements To Chat Gpts Search Functionality

May 01, 2025

Understanding The Latest Improvements To Chat Gpts Search Functionality

May 01, 2025 -

Taremi Su Itv La Fiducia In Noi Stessi E La Chiave Del Successo

May 01, 2025

Taremi Su Itv La Fiducia In Noi Stessi E La Chiave Del Successo

May 01, 2025 -

Will Chelsea Win The Wsl Aston Villas Victory Over Arsenal Adds To The Drama

May 01, 2025

Will Chelsea Win The Wsl Aston Villas Victory Over Arsenal Adds To The Drama

May 01, 2025