Daily GST Payments Vs. Semi-Annual Refunds: Philemon's GE2025 GST Reform Call

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Daily GST Payments vs. Semi-Annual Refunds: Philemon's GE2025 GST Reform Call Sparks Debate

Philemon's proposal to overhaul the Goods and Services Tax (GST) system ahead of the GE2025 elections is igniting a firestorm of debate across the nation. His suggestion to replace the current semi-annual GST refund system with daily payments has sent shockwaves through businesses and ignited a passionate discussion among economists and the general public. This radical shift, if implemented, could significantly alter the financial landscape for countless businesses, both large and small.

The core of Philemon's proposal revolves around streamlining GST processes and improving cash flow for businesses. Currently, businesses wait six months to receive GST refunds, which can create significant financial strain, particularly for smaller enterprises with limited working capital. Philemon argues that daily payments would alleviate this burden, injecting much-needed liquidity into the market and boosting economic activity.

<h3>The Arguments For Daily GST Payments</h3>

Proponents of Philemon's plan highlight several key advantages:

- Improved Cash Flow: Daily payments would provide businesses with immediate access to their GST refunds, significantly improving their cash flow and reducing reliance on expensive short-term loans.

- Enhanced Financial Planning: Predictable daily refunds would allow businesses to better manage their finances and make more informed investment decisions.

- Stimulated Economic Growth: Increased liquidity in the market could stimulate economic growth by encouraging investment and expansion.

- Reduced Administrative Burden: While the implementation would require significant technological upgrades, proponents argue that daily payments could, in the long run, streamline administrative processes and reduce paperwork.

<h3>Concerns and Challenges of Daily GST Payments</h3>

However, the proposal is not without its critics. Opponents raise several valid concerns:

- Technological Infrastructure: Implementing a daily payment system would require a substantial upgrade to the current GST infrastructure, potentially involving significant costs and logistical challenges. The system must be robust, secure, and capable of handling a massive increase in transactions.

- Administrative Complexity: Processing millions of daily transactions would dramatically increase the workload on GST authorities, requiring substantial investment in personnel and technology. This could lead to increased operational costs for the government.

- Potential for Errors: A system processing such a high volume of transactions daily increases the potential for errors, which could have serious consequences for businesses. Robust error-checking and dispute resolution mechanisms would be crucial.

- Impact on Smaller Businesses: While intended to benefit smaller businesses, the implementation may disproportionately impact those lacking the technological capability to adapt quickly to the new system.

<h3>Analyzing the Potential Impact on Businesses</h3>

The shift to daily GST payments would undeniably have a profound impact on businesses of all sizes. Larger corporations with established financial systems might adapt more easily, but smaller businesses could face challenges in managing the increased frequency of transactions. The government needs to consider measures to support these smaller businesses during the transition period, perhaps through targeted training and financial assistance programs.

<h3>The GE2025 Context and Public Opinion</h3>

Philemon's proposal comes at a crucial time, just ahead of the GE2025 elections. The public's reaction will undoubtedly play a pivotal role in shaping the political landscape. While many welcome the prospect of improved cash flow, concerns about the feasibility and potential costs of implementation remain. The success of this proposal hinges on the government’s ability to address these concerns transparently and convincingly.

In conclusion, Philemon's proposed GST reform is a complex issue with significant implications for the economy and businesses across the nation. While the potential benefits are considerable, careful consideration of the challenges and potential drawbacks is crucial before any implementation. The upcoming debate promises to be intense, and the outcome could significantly reshape the financial future of the country.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Daily GST Payments Vs. Semi-Annual Refunds: Philemon's GE2025 GST Reform Call. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wildfires Rage Through Pennsylvania State Forest Aerial Drone Perspective

Apr 27, 2025

Wildfires Rage Through Pennsylvania State Forest Aerial Drone Perspective

Apr 27, 2025 -

Fantacalcio Inter Roma Sommer Vs Svilar Lautaro Vs Dybala La Miglior Formazione

Apr 27, 2025

Fantacalcio Inter Roma Sommer Vs Svilar Lautaro Vs Dybala La Miglior Formazione

Apr 27, 2025 -

Fart Coin Rally Stalls Correction To 0 98

Apr 27, 2025

Fart Coin Rally Stalls Correction To 0 98

Apr 27, 2025 -

Canadian Election Voters Poised To Reject Trumps Trade Policies

Apr 27, 2025

Canadian Election Voters Poised To Reject Trumps Trade Policies

Apr 27, 2025 -

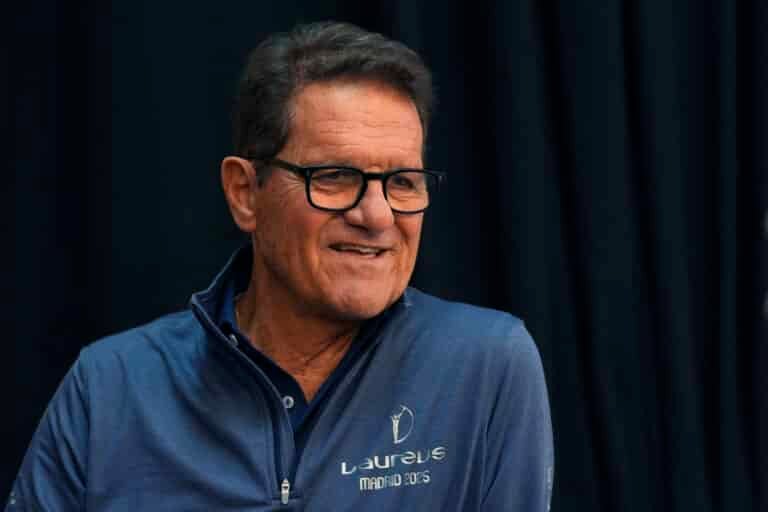

Tactical Analysis Capello Weighs In On Inter Vs Roma Showdown

Apr 27, 2025

Tactical Analysis Capello Weighs In On Inter Vs Roma Showdown

Apr 27, 2025