Daily GST Payments Vs. Twice-Yearly Refunds: Philemon's GE2025 GST Reform Call

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Daily GST Payments vs. Twice-Yearly Refunds: Philemon's GE2025 GST Reform Call Sparks Debate

Philemon's proposal to overhaul the Goods and Services Tax (GST) system ahead of the 2025 General Election (GE2025) has ignited a firestorm of debate. His suggestion to replace the current twice-yearly GST refund system with daily payments has divided experts and the public alike. The proposal, unveiled last week, promises a smoother cash flow for businesses and increased government revenue, but critics raise concerns about administrative burden and potential complications.

This article delves into the core arguments surrounding Philemon's radical GST reform, examining the potential benefits and drawbacks of a daily payment system compared to the existing biannual refund model.

The Current GST Refund System: A Twice-Yearly Struggle

The current system, involving twice-yearly GST refunds, is widely criticized for its inherent complexities. Businesses often face significant delays in receiving their refunds, leading to cash flow issues and impacting their ability to invest and grow. This is particularly challenging for small and medium-sized enterprises (SMEs), who often operate on tighter margins. Furthermore, the process itself is often perceived as bureaucratic and time-consuming, requiring extensive paperwork and compliance procedures. These frustrations are amplified by:

- Lengthy processing times: Refunds can take months, impacting business planning and financial stability.

- Complex documentation requirements: The intricate paperwork involved adds to administrative burdens.

- Uncertainty and unpredictability: The timing and amount of refunds can be inconsistent.

Philemon's Vision: Daily GST Payments – A Streamlined Approach?

Philemon argues that a daily GST payment system would drastically improve the situation. His proposal envisions a near real-time system, allowing businesses to receive their GST credits on a daily basis. This, he contends, would offer several key advantages:

- Improved Cash Flow: Daily payments would provide businesses with consistent and predictable cash flow, bolstering their financial stability.

- Reduced Administrative Burden: While potentially requiring technological upgrades, the long-term aim is to simplify the process, minimizing paperwork.

- Enhanced Government Revenue: Faster processing and reduced delays could lead to improved government revenue collection.

- Increased Transparency and Accountability: Daily transactions would provide greater transparency and accountability in GST collection and disbursement.

The Challenges and Concerns

Despite the potential benefits, the transition to a daily payment system presents significant hurdles. Critics highlight concerns about:

- Technological Infrastructure: Implementing a reliable and secure system capable of handling daily transactions requires significant investment in technological infrastructure.

- Administrative Costs: The costs associated with maintaining and upgrading the system could be substantial.

- Potential for Errors: A system processing millions of transactions daily increases the risk of errors, requiring robust error detection and correction mechanisms.

- Impact on SMEs: While aiming to help SMEs, the transition might initially be challenging for smaller businesses lacking the resources to adapt quickly.

GE2025 and the Political Landscape

Philemon's proposal comes at a crucial time, ahead of the GE2025. The potential impact on businesses and the economy will undoubtedly play a significant role in the upcoming election. The debate surrounding this reform highlights the importance of finding a balance between streamlining the GST system and ensuring its stability and fairness for all stakeholders. Further discussion and a thorough cost-benefit analysis are critical before any implementation. The coming months will be crucial in shaping the future of GST in the country.

Conclusion: A Necessary Evolution or a Risky Gamble?

Philemon's call for GST reform is a bold move that sparks a critical conversation. While the vision of daily GST payments holds significant appeal, the practical challenges and potential risks cannot be overlooked. A comprehensive assessment of the technological, administrative, and economic implications is necessary to determine whether this ambitious plan is a beneficial evolution or a potentially disruptive gamble. Only time will tell if this bold proposal gains traction and becomes a reality.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Daily GST Payments Vs. Twice-Yearly Refunds: Philemon's GE2025 GST Reform Call. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Energy Industry Titans The Surprising Rise Of Bitcoin Mining In The Oil And Gas Sector

Apr 28, 2025

Energy Industry Titans The Surprising Rise Of Bitcoin Mining In The Oil And Gas Sector

Apr 28, 2025 -

Decoding Web3 Verification Separating Fact From Illusion

Apr 28, 2025

Decoding Web3 Verification Separating Fact From Illusion

Apr 28, 2025 -

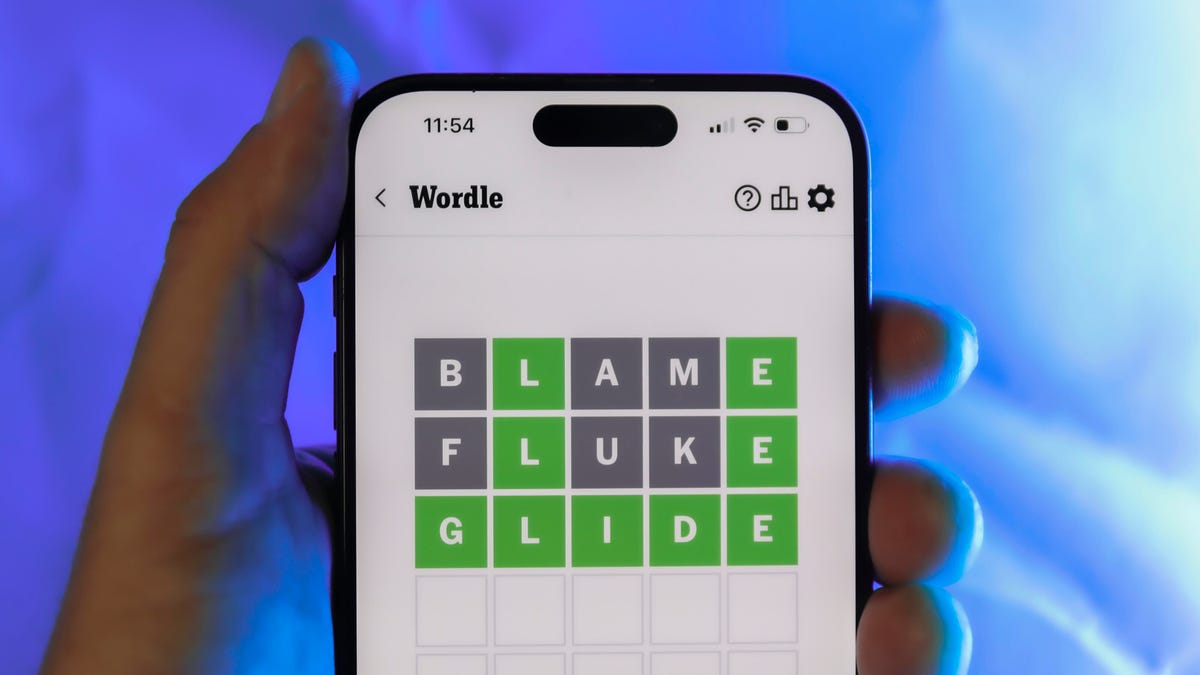

Conquer Wordle 1407 Hints And Answer For April 26th

Apr 28, 2025

Conquer Wordle 1407 Hints And Answer For April 26th

Apr 28, 2025 -

Nyt Strands Puzzle April 27th Spangram Solutions And Strategies

Apr 28, 2025

Nyt Strands Puzzle April 27th Spangram Solutions And Strategies

Apr 28, 2025 -

Premier League And Fa Cup Predictions 6 1 Treble And Expert Betting Advice

Apr 28, 2025

Premier League And Fa Cup Predictions 6 1 Treble And Expert Betting Advice

Apr 28, 2025

Latest Posts

-

2 35 Xrp Futures Etf Greenlight Fuels Price Jump

Apr 29, 2025

2 35 Xrp Futures Etf Greenlight Fuels Price Jump

Apr 29, 2025 -

Dte Energy Proposes 574 Million Rate Hike What It Means For Customers

Apr 29, 2025

Dte Energy Proposes 574 Million Rate Hike What It Means For Customers

Apr 29, 2025 -

The Smashing Machine Trailer Dwayne Johnson Aims For Academy Award Glory

Apr 29, 2025

The Smashing Machine Trailer Dwayne Johnson Aims For Academy Award Glory

Apr 29, 2025 -

Martinelli On Arsenal Vs Psg Biggest Game Of My Life

Apr 29, 2025

Martinelli On Arsenal Vs Psg Biggest Game Of My Life

Apr 29, 2025 -

Leaked Thunderbolts Post Credits Scene Fuels Online Discussion Premiere Reactions

Apr 29, 2025

Leaked Thunderbolts Post Credits Scene Fuels Online Discussion Premiere Reactions

Apr 29, 2025