DBS Increases Reserves Amidst Economic Uncertainty, Exceeds Q1 Profit Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

DBS Increases Reserves Amidst Economic Uncertainty, Exceeds Q1 Profit Expectations

Singapore's DBS Bank, Asia's largest lender, has reported a stronger-than-expected first-quarter profit, driven by higher net interest income. However, the bank also significantly increased its reserves, reflecting a cautious approach to navigating the current global economic uncertainty.

The robust Q1 results, released on [Date of Release], showcase DBS's resilience despite a challenging macroeconomic environment marked by inflation, rising interest rates, and geopolitical tensions. The bank's proactive move to bolster its reserves underscores its commitment to prudent risk management in the face of potential future headwinds.

Exceeding Expectations: A Strong Q1 Performance

DBS announced a net profit of [Insert Exact Figure], surpassing analysts' forecasts of [Insert Analyst Forecast]. This impressive performance was primarily fueled by a substantial increase in net interest income, a direct result of rising interest rates globally. The bank's strong performance across its various segments, including consumer banking, wealth management, and corporate banking, further contributed to the positive results.

- Higher Net Interest Income: The increase in net interest income is a key driver of the bank's strong Q1 performance. This reflects the bank's ability to effectively manage its assets and liabilities in a rising interest rate environment.

- Strong Performance Across Segments: DBS demonstrated robust performance across its various business units, highlighting the diversification and resilience of its business model.

- Growth in Key Markets: The bank experienced growth in key markets across Asia, further solidifying its position as a leading financial institution in the region.

Building Reserves: A Cautious Approach to Uncertainty

Despite the positive financial results, DBS significantly increased its reserves, adding [Insert Amount] to its provisions. This proactive measure reflects the bank's cautious outlook on the global economic landscape. The bank cited increasing economic uncertainty, geopolitical risks, and potential loan defaults as key factors influencing this decision.

This strategic move demonstrates a commitment to responsible banking and prioritizes long-term stability over short-term gains. The increased reserves provide a strong buffer against potential economic downturns and strengthen the bank's overall financial resilience.

Looking Ahead: Navigating the Global Economic Landscape

While the Q1 results are encouraging, DBS acknowledges the challenges posed by the current global economic climate. The bank remains vigilant in monitoring macroeconomic trends and adapting its strategies accordingly. This includes a continued focus on prudent risk management, strategic investments, and maintaining a robust capital position.

Keywords: DBS Bank, Q1 Results, Profit, Economic Uncertainty, Reserves, Asia, Banking, Net Interest Income, Financial Performance, Singapore, Global Economy, Risk Management, Interest Rates, Wealth Management, Corporate Banking, Consumer Banking.

Conclusion:

DBS's Q1 results paint a picture of a financially strong institution navigating a complex global economic landscape. The bank's decision to increase reserves, despite exceeding profit expectations, underlines its commitment to prudent risk management and long-term stability. This proactive approach positions DBS favorably to weather potential future economic storms and maintain its position as a leading bank in Asia.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on DBS Increases Reserves Amidst Economic Uncertainty, Exceeds Q1 Profit Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Left Ankle Sprain Doesnt Stop Anthony Edwards In Game 2 Comeback

May 09, 2025

Left Ankle Sprain Doesnt Stop Anthony Edwards In Game 2 Comeback

May 09, 2025 -

Will Steph Curry Play Game 2 Injury Update Warriors Vs Timberwolves

May 09, 2025

Will Steph Curry Play Game 2 Injury Update Warriors Vs Timberwolves

May 09, 2025 -

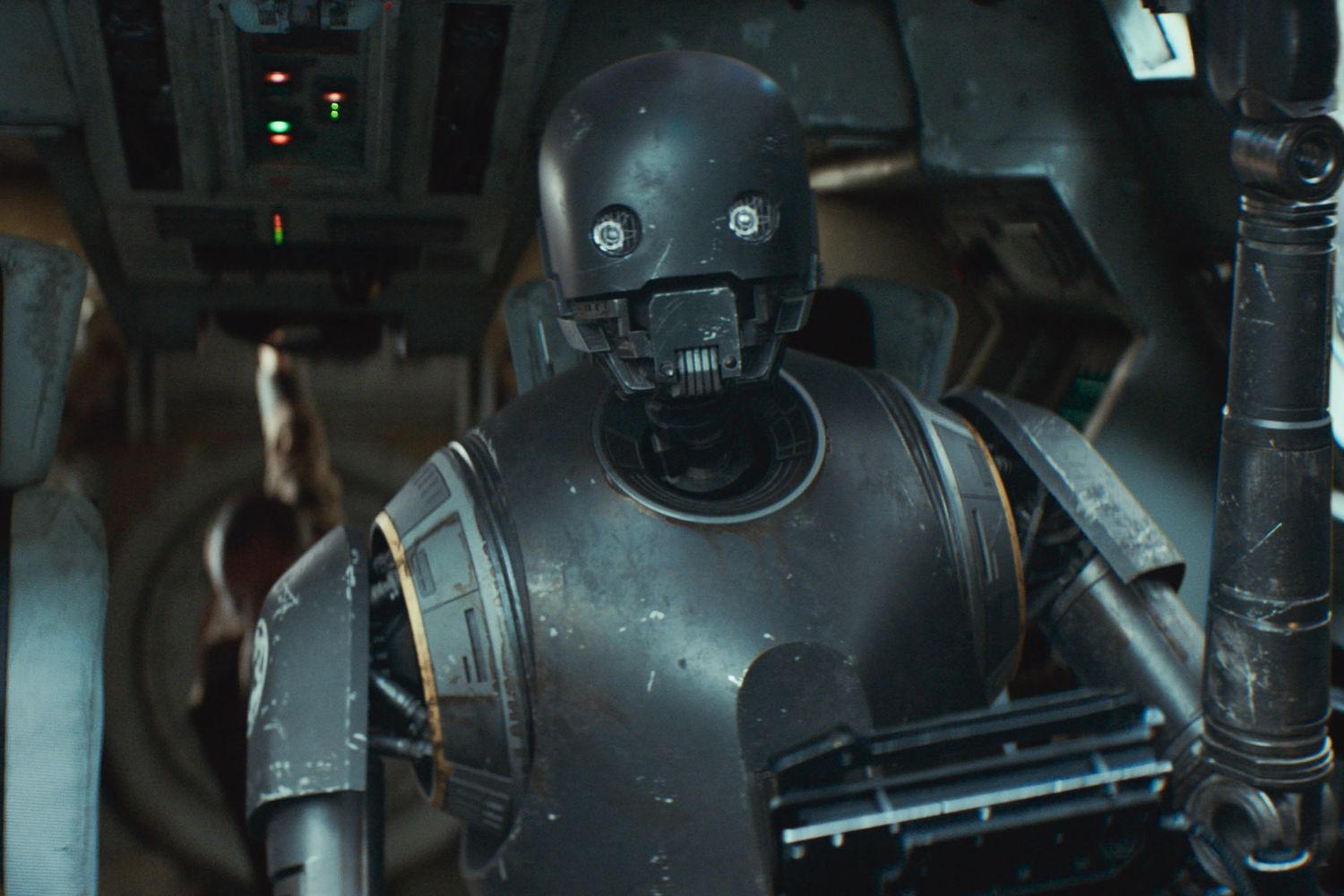

Andor Showrunner Reveals Cut K 2 So Horror Episode

May 09, 2025

Andor Showrunner Reveals Cut K 2 So Horror Episode

May 09, 2025 -

Coles Creek Emergency Police Respond To Reports Of Gunfire On Bruce Highway

May 09, 2025

Coles Creek Emergency Police Respond To Reports Of Gunfire On Bruce Highway

May 09, 2025 -

Contempt Of Court Apples Financial Fallout From Epic Games Dispute

May 09, 2025

Contempt Of Court Apples Financial Fallout From Epic Games Dispute

May 09, 2025