DBS Q1 Profit Surges, Bank Bolsters Reserves To Navigate Uncertain Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

DBS Q1 Profit Surges, Bank Bolsters Reserves to Navigate Uncertain Market

Singapore's DBS Bank reported a stellar start to the year, with first-quarter profit surging on the back of strong growth across its core businesses. However, the bank is also taking a cautious approach, bolstering its reserves to navigate the ongoing uncertainties in the global market.

The announcement sent ripples through the financial world, highlighting the resilience of Asia's largest bank while acknowledging the persistent headwinds impacting the global economy. DBS's robust performance underscores its strategic positioning and proactive risk management in a period marked by geopolitical tensions and rising interest rates.

Record Profits Amidst Global Uncertainty

DBS reported a net profit of S$2.1 billion (US$1.56 billion) for the first quarter of 2024, a significant increase compared to the same period last year. This impressive growth was driven by strong performances across its key segments:

- Wealth Management: Experienced robust growth in assets under management, fueled by increased client activity and positive market sentiment in certain sectors.

- Consumer Banking: Showed resilience despite economic headwinds, with healthy loan growth and controlled credit costs.

- Corporate Banking: Benefited from strong regional trade and continued investment activity, particularly in Southeast Asia.

This surge in profitability highlights DBS's successful diversification strategy and its ability to capitalize on growth opportunities across various market segments. The bank's strong performance in the face of global uncertainty positions it favorably for the remainder of the year.

Proactive Risk Management: Building Reserves for a Stormy Market

While celebrating its impressive financial results, DBS emphasized its commitment to prudent risk management. The bank announced a significant increase in its reserves, acknowledging the ongoing challenges presented by:

- Geopolitical Instability: The ongoing war in Ukraine and escalating tensions in other regions continue to create uncertainty in the global economic outlook.

- Inflationary Pressures: Persistently high inflation rates globally are impacting consumer spending and business investment, creating potential risks for loan defaults.

- Interest Rate Hikes: Central banks worldwide are continuing to raise interest rates to combat inflation, potentially slowing economic growth and impacting profitability in the long term.

By strategically increasing its reserves, DBS is demonstrating its commitment to safeguarding its financial health and mitigating potential future losses stemming from these macroeconomic headwinds. This proactive approach reflects a responsible and conservative banking strategy, reassuring investors and stakeholders alike.

Looking Ahead: Navigating the Uncertain Landscape

While the first quarter results paint a positive picture, DBS remains cautious about the outlook for the rest of the year. The bank's management team highlighted the need to remain vigilant and adaptable in navigating the complex and evolving global landscape. Their focus remains on:

- Strengthening its digital capabilities: DBS continues to invest heavily in technology to enhance customer experience and operational efficiency.

- Expanding its regional footprint: The bank is pursuing strategic growth opportunities across Southeast Asia, leveraging its strong regional presence.

- Maintaining disciplined risk management: The bank will continue to prioritize prudent risk management practices to protect its financial stability.

The robust Q1 results, coupled with the bank's proactive approach to risk management, position DBS favorably to navigate the challenging global environment. Its strong financial position and strategic focus solidify its standing as a leading financial institution in Asia and a key player in the global financial landscape. Investors will be watching closely to see how the bank performs in the coming quarters as it navigates this period of uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on DBS Q1 Profit Surges, Bank Bolsters Reserves To Navigate Uncertain Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Shai Gilgeous Alexanders 2019 Trade Fuel For A Playoffs Showdown Against The Clippers

May 08, 2025

Shai Gilgeous Alexanders 2019 Trade Fuel For A Playoffs Showdown Against The Clippers

May 08, 2025 -

Stunning Nba Playoffs Nuggets And Knicks Score Opening Round Victories

May 08, 2025

Stunning Nba Playoffs Nuggets And Knicks Score Opening Round Victories

May 08, 2025 -

Firebirds Road To Success Examining The Prospects Potential

May 08, 2025

Firebirds Road To Success Examining The Prospects Potential

May 08, 2025 -

Unique Apple Watch Pride Edition Band For 2025

May 08, 2025

Unique Apple Watch Pride Edition Band For 2025

May 08, 2025 -

Knicks Stage Epic Comeback Defeat Celtics In Game 2 2 0 Series Lead

May 08, 2025

Knicks Stage Epic Comeback Defeat Celtics In Game 2 2 0 Series Lead

May 08, 2025

Latest Posts

-

New York Knicks At Boston Celtics Game Recap May 7 2025

May 08, 2025

New York Knicks At Boston Celtics Game Recap May 7 2025

May 08, 2025 -

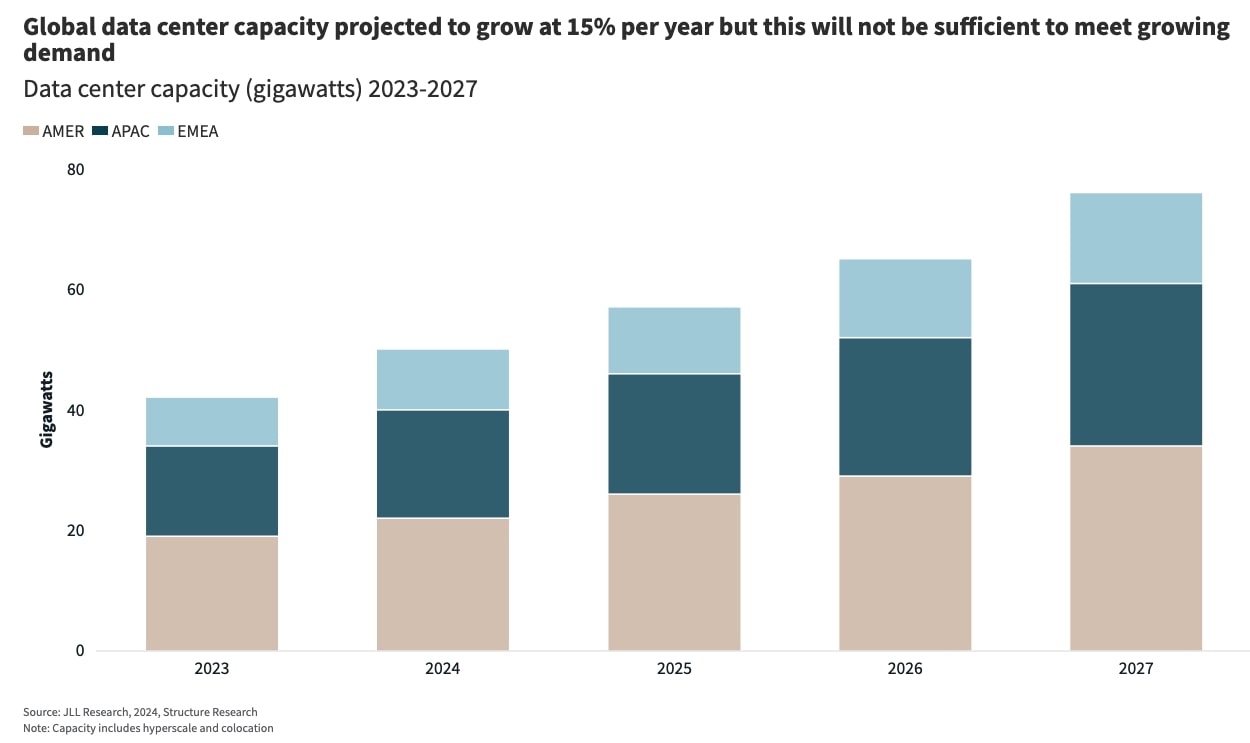

The Future Of Ai How Data Center Growth Is Shaping The Industry

May 08, 2025

The Future Of Ai How Data Center Growth Is Shaping The Industry

May 08, 2025 -

The Rise Of Workplace Robotics A Survey Explores Current Trends And Long Term Viability

May 08, 2025

The Rise Of Workplace Robotics A Survey Explores Current Trends And Long Term Viability

May 08, 2025 -

Al Raed And Al Hilal To Battle In Decisive Saudi Pro League Encounter

May 08, 2025

Al Raed And Al Hilal To Battle In Decisive Saudi Pro League Encounter

May 08, 2025 -

Sonos Ikea Partnership Dissolved Impact On Smart Speaker Market

May 08, 2025

Sonos Ikea Partnership Dissolved Impact On Smart Speaker Market

May 08, 2025