DBS Q1 Profit Surges Despite Increased Allowance Reserves

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

DBS Q1 Profit Surges Despite Increased Allowance Reserves: A Sign of Strength or Caution?

Singapore's DBS Bank, Asia's largest lender, reported a stunning surge in first-quarter profit, defying expectations amidst a tightening global economic climate. The bank's robust performance, however, comes with a caveat: a significant increase in allowance reserves, signaling a cautious approach to potential future risks. This raises important questions about the bank's outlook and the broader health of the Asian economy.

The headline figure is undeniably impressive. DBS announced a net profit of S$2.1 billion (US$1.6 billion) for the first quarter of 2024, a substantial year-on-year increase. This growth surpassed analyst predictions and underlines the bank's resilience in the face of global headwinds. But a closer examination reveals a more nuanced picture.

Increased Allowance Reserves: A Preemptive Strike?

While the profit surge is noteworthy, the bank also reported a significant jump in its allowance for credit losses (ACL). This increase, often seen as a barometer of a bank's assessment of potential loan defaults, reflects a proactive approach by DBS to manage potential risks stemming from the uncertain global economic environment. Factors contributing to this increase likely include concerns about rising interest rates, inflation, and geopolitical instability.

- Higher Interest Rates: The impact of rising interest rates on borrowers, particularly in the corporate sector, is a primary concern. Increased borrowing costs can lead to higher default rates.

- Inflationary Pressures: Persistent inflation erodes purchasing power and can strain borrowers' ability to repay loans.

- Geopolitical Uncertainty: Global geopolitical tensions and economic slowdown in key markets add to the uncertainty facing the financial sector.

This strategic move to bolster allowance reserves demonstrates DBS's commitment to prudent risk management. While it may impact short-term profitability, it ultimately strengthens the bank's long-term stability and resilience.

Strong Performance Across Key Sectors

Despite the increased allowance reserves, DBS demonstrated robust performance across various key business segments:

- Wealth Management: This sector continued its strong growth trajectory, benefiting from increased client activity and market volatility.

- Corporate Banking: While facing headwinds, corporate banking maintained a steady performance, showcasing the strength and diversification of DBS's client portfolio.

- Consumer Banking: This sector witnessed solid growth driven by healthy consumer spending and demand for financial services.

These positive results across diverse segments highlight the bank's diversification and its ability to adapt to changing market conditions.

Outlook and Implications

The Q1 results from DBS offer a mixed but largely positive signal. The substantial profit increase demonstrates the bank's underlying strength and ability to navigate economic challenges. However, the increased allowance reserves underscore the prevailing uncertainty in the global economy.

The bank's proactive approach to risk management is commendable and suggests a cautious yet optimistic outlook for the remainder of 2024. The performance of DBS will undoubtedly be closely watched as an indicator of the health of the Asian banking sector and the wider regional economy. Further analysis will be needed to determine whether this increase in allowance reserves is a temporary measure or a reflection of a more sustained period of economic uncertainty. Investors and analysts alike will be keenly awaiting further updates from the bank in the coming quarters.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on DBS Q1 Profit Surges Despite Increased Allowance Reserves. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Reserve Bank Holds Interest Rates April Decision Impacts Households

May 08, 2025

Reserve Bank Holds Interest Rates April Decision Impacts Households

May 08, 2025 -

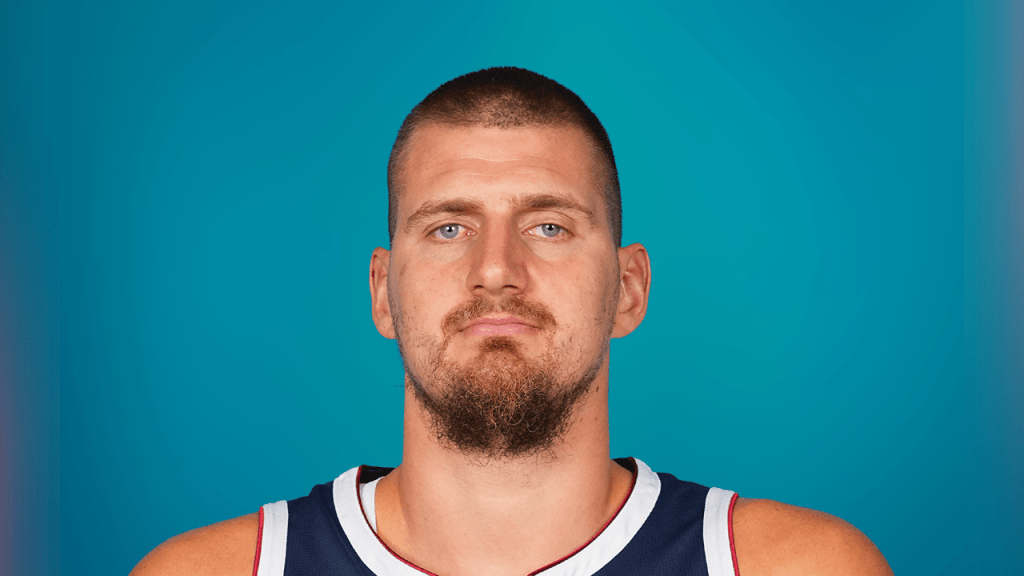

Jokics Amusing Response To Free Throw Criticism From Opposing Fans

May 08, 2025

Jokics Amusing Response To Free Throw Criticism From Opposing Fans

May 08, 2025 -

Taiwan Issues Urgent Travel Advisory Citizens Urged To Evacuate India Pakistan Border Region

May 08, 2025

Taiwan Issues Urgent Travel Advisory Citizens Urged To Evacuate India Pakistan Border Region

May 08, 2025 -

Bitcoin Etf Boom Black Rocks Fund Attracts 530 Million Ethereum Funds See No Change

May 08, 2025

Bitcoin Etf Boom Black Rocks Fund Attracts 530 Million Ethereum Funds See No Change

May 08, 2025 -

Musa Of Kano Pillars Confirmed For Super Eagles Unity Cup Tournament

May 08, 2025

Musa Of Kano Pillars Confirmed For Super Eagles Unity Cup Tournament

May 08, 2025

Latest Posts

-

Offseason Moves Addressing The Andrew Wiggins Question For The Miami Heat

May 08, 2025

Offseason Moves Addressing The Andrew Wiggins Question For The Miami Heat

May 08, 2025 -

Two Ministers On The Brink Albaneses Cabinet Shake Up Imminent

May 08, 2025

Two Ministers On The Brink Albaneses Cabinet Shake Up Imminent

May 08, 2025 -

Al Hilal Faces Stiff Test Against Al Raed In Saudi Pro League

May 08, 2025

Al Hilal Faces Stiff Test Against Al Raed In Saudi Pro League

May 08, 2025 -

India Pakistan Border Crisis Current Situation And Travel Advisory

May 08, 2025

India Pakistan Border Crisis Current Situation And Travel Advisory

May 08, 2025 -

Game 7 Showdown Dallas Stars Triumph Over Avalanche

May 08, 2025

Game 7 Showdown Dallas Stars Triumph Over Avalanche

May 08, 2025