DBS Raises Reserves Amidst Global Uncertainty, Q1 Profits Exceed Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

DBS Raises Reserves Amidst Global Uncertainty, Q1 Profits Still Exceed Expectations

Singapore's banking giant, DBS, reported first-quarter profits that surpassed analyst estimates, showcasing resilience in a turbulent global economic climate. However, the bank also took a proactive step, bolstering its reserves to navigate increasing uncertainty. This strategic move highlights the cautious optimism within the financial sector as it grapples with inflation, geopolitical tensions, and potential recessionary risks.

The strong performance in Q1 2024 underscores DBS's robust position within the Southeast Asian market. Despite global headwinds, the bank's diverse portfolio and strategic focus on key growth sectors helped deliver impressive results. Let's delve into the details.

Q1 2024: Profitability Outperforms Projections

DBS announced net profit exceeding expectations, a testament to its effective risk management and strong performance across various business segments. While specific figures are available in the official press release, the overall sentiment points towards sustained growth despite the challenging global landscape. This performance is a significant achievement, considering the ongoing uncertainties plaguing the global financial system. Analysts attribute this success to a combination of factors including:

- Strong loan growth: Increased demand for loans across various sectors contributed significantly to the bank's revenue.

- Effective cost management: DBS demonstrated a commitment to operational efficiency, helping to boost profitability.

- Strategic investments: Prior investments in technology and digital banking solutions have paid off, enhancing customer experience and operational efficiency.

Proactive Reserve Build-up: A Cautious Approach

Despite the positive Q1 results, DBS isn't resting on its laurels. The bank announced a significant increase in its reserves, a clear indication of its proactive approach to managing potential risks associated with the current global economic climate. This cautious strategy reflects a broader trend among major financial institutions globally, prioritizing stability and resilience in the face of uncertainty. The increased reserves will act as a buffer against potential loan defaults or economic downturns, protecting the bank's long-term stability.

Navigating Global Uncertainty: What Lies Ahead for DBS?

The global economic outlook remains uncertain, with persistent inflation and geopolitical instability casting a shadow over the financial sector. However, DBS's strong Q1 performance and proactive reserve build-up position the bank well to navigate these challenges. The bank's focus on sustainable growth, diversification across various markets and sectors, and a robust risk management framework should contribute to continued success in the coming quarters.

The increase in reserves also sends a positive message to investors and stakeholders, demonstrating a commitment to financial prudence and long-term stability. This strategic decision underscores DBS’s commitment to safeguarding its financial strength and maintaining its position as a leading financial institution in Asia.

Keywords: DBS, Q1 results, profits, reserves, global uncertainty, economic outlook, Southeast Asia, banking, financial news, Singapore, risk management, inflation, geopolitical risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on DBS Raises Reserves Amidst Global Uncertainty, Q1 Profits Exceed Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

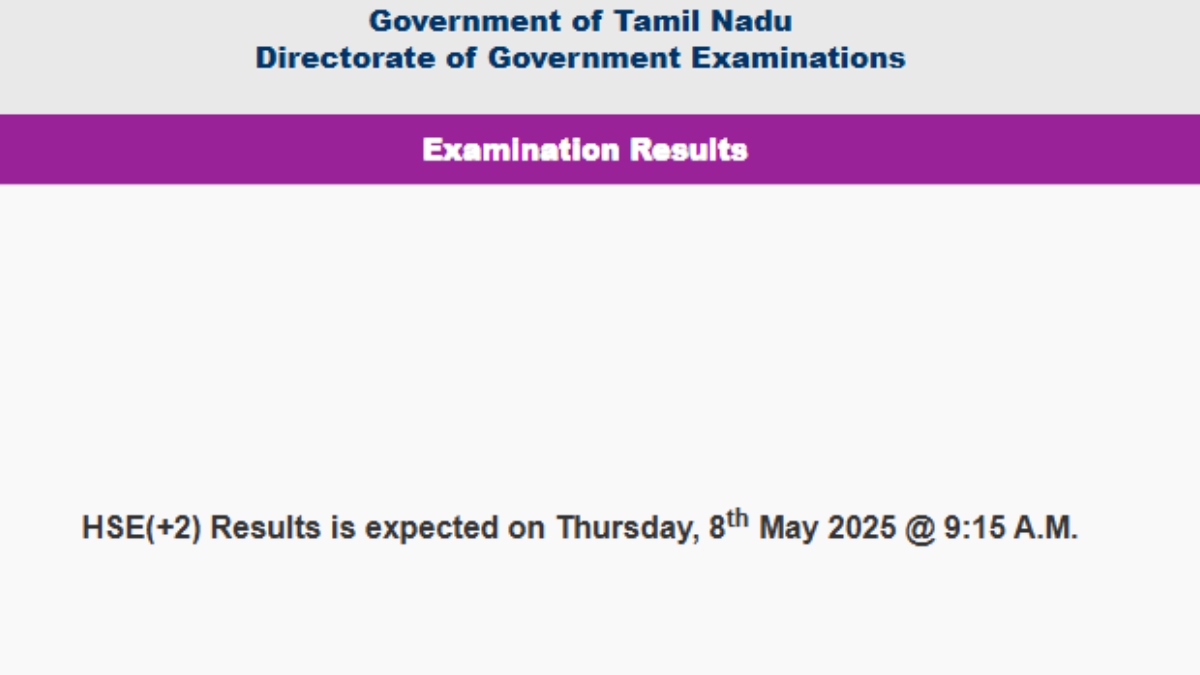

Tngde Tamil Nadu 2 Results 2025 Direct Link To Check Your Hsc Scores On Tnresults Nic In

May 08, 2025

Tngde Tamil Nadu 2 Results 2025 Direct Link To Check Your Hsc Scores On Tnresults Nic In

May 08, 2025 -

Arlc And Wa Government Announce Groundbreaking Partnership For New Nrl Team

May 08, 2025

Arlc And Wa Government Announce Groundbreaking Partnership For New Nrl Team

May 08, 2025 -

Abuja And Lagos To Host President Federation Cup Semi Finals

May 08, 2025

Abuja And Lagos To Host President Federation Cup Semi Finals

May 08, 2025 -

Australian Fashion Spending Surges Past 3 1 Billion In March

May 08, 2025

Australian Fashion Spending Surges Past 3 1 Billion In March

May 08, 2025 -

Hyeseong Kim On Getting On Base Analysis Of 10 1 Win

May 08, 2025

Hyeseong Kim On Getting On Base Analysis Of 10 1 Win

May 08, 2025

Latest Posts

-

Official Sydney Bears Rugby League Comeback Announced V Landys Hails 50 Million Deal

May 08, 2025

Official Sydney Bears Rugby League Comeback Announced V Landys Hails 50 Million Deal

May 08, 2025 -

Post Game Interview Hyeseong Kim Discusses Reaching Base In Dominant Win

May 08, 2025

Post Game Interview Hyeseong Kim Discusses Reaching Base In Dominant Win

May 08, 2025 -

Knicks Two Wins Away From Eastern Conference Finals After Celtics Fightback

May 08, 2025

Knicks Two Wins Away From Eastern Conference Finals After Celtics Fightback

May 08, 2025 -

Shai Gilgeous Alexanders 2019 Trade Fuel For A Playoff Matchup Against The Clippers

May 08, 2025

Shai Gilgeous Alexanders 2019 Trade Fuel For A Playoff Matchup Against The Clippers

May 08, 2025 -

Previsoes De Dividendos As Melhores Empresas Para Investir Esta Semana

May 08, 2025

Previsoes De Dividendos As Melhores Empresas Para Investir Esta Semana

May 08, 2025