DBS Reports Q1 Profit Beat, Bolsters Reserves To Navigate Uncertain Global Landscape

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

DBS Reports Q1 Profit Beat, Bolsters Reserves to Navigate Uncertain Global Landscape

Singapore, [Date of Publication] – DBS Bank, Southeast Asia's largest lender, announced a stronger-than-expected first-quarter profit today, exceeding analyst forecasts and highlighting its robust financial health amidst a complex global economic backdrop. The results showcase the bank's resilience and proactive approach to managing potential risks.

The bank reported a net profit of [Insert Exact Figure] for the first quarter of 2024, representing a [Percentage Change]% increase compared to the same period last year. This impressive performance surpasses analyst predictions, demonstrating DBS's ability to thrive even in challenging market conditions. Key drivers of this success include strong growth across various business segments and effective cost management.

Strong Performance Across Key Business Units

DBS's success wasn't confined to a single sector. The bank witnessed significant growth across its core business units:

- Corporate Banking: Experienced robust loan growth driven by strong demand from [mention specific sectors, e.g., technology, infrastructure]. The segment benefited from [mention specific factors contributing to growth].

- Consumer Banking: Showed healthy growth in [mention specific areas like deposits, credit cards, etc.], reflecting increasing consumer confidence and activity. The bank's digital banking initiatives continue to drive efficiency and customer engagement.

- Wealth Management: Maintained strong momentum, benefiting from [mention factors contributing to growth, e.g., rising asset under management, increased client activity].

Strategic Reserve Buildup for Navigating Uncertainty

Despite the positive results, DBS is not overlooking the global economic headwinds. The bank announced a significant bolstering of its reserves, demonstrating a cautious yet proactive approach to navigating uncertainties stemming from factors including:

- Geopolitical tensions: The ongoing war in Ukraine and escalating tensions in other regions pose risks to global growth and financial stability.

- Inflationary pressures: Persistent inflationary pressures continue to impact consumer spending and business investment, creating challenges for economic growth.

- Interest rate hikes: While interest rate hikes help control inflation, they also impact borrowing costs and can potentially slow economic activity.

By increasing its reserves, DBS is strategically positioning itself to withstand potential shocks and continue delivering strong performance for its shareholders and customers. This prudent approach reflects the bank's commitment to long-term stability and sustainable growth.

Looking Ahead: A Cautiously Optimistic Outlook

While acknowledging the challenges ahead, DBS remains cautiously optimistic about its future prospects. The bank's strong capital position, coupled with its diversified business model and robust risk management framework, provides a solid foundation for navigating the uncertain global landscape.

The bank’s CEO, [CEO's Name], stated, "[Insert a concise and impactful quote from the CEO summarizing the results and outlook]". This underscores the bank's confidence in its ability to deliver sustained value to its stakeholders.

Keywords: DBS Bank, Q1 Profit, Southeast Asia, Banking, Financial Results, Global Economy, Economic Uncertainty, Reserves, Risk Management, Corporate Banking, Consumer Banking, Wealth Management, Stock Market, Singapore, [CEO's Name]

This article is for informational purposes only and does not constitute financial advice. Always consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on DBS Reports Q1 Profit Beat, Bolsters Reserves To Navigate Uncertain Global Landscape. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Haryana Discovery Of Body In Suitcase Prompts Murder Probe

May 09, 2025

Haryana Discovery Of Body In Suitcase Prompts Murder Probe

May 09, 2025 -

Pope Leo Xiv The Life And Election Of Robert Prevost Americas First Pontiff

May 09, 2025

Pope Leo Xiv The Life And Election Of Robert Prevost Americas First Pontiff

May 09, 2025 -

Pietrangelo Back In The Lineup Golden Knights Game 2 Vs Oilers

May 09, 2025

Pietrangelo Back In The Lineup Golden Knights Game 2 Vs Oilers

May 09, 2025 -

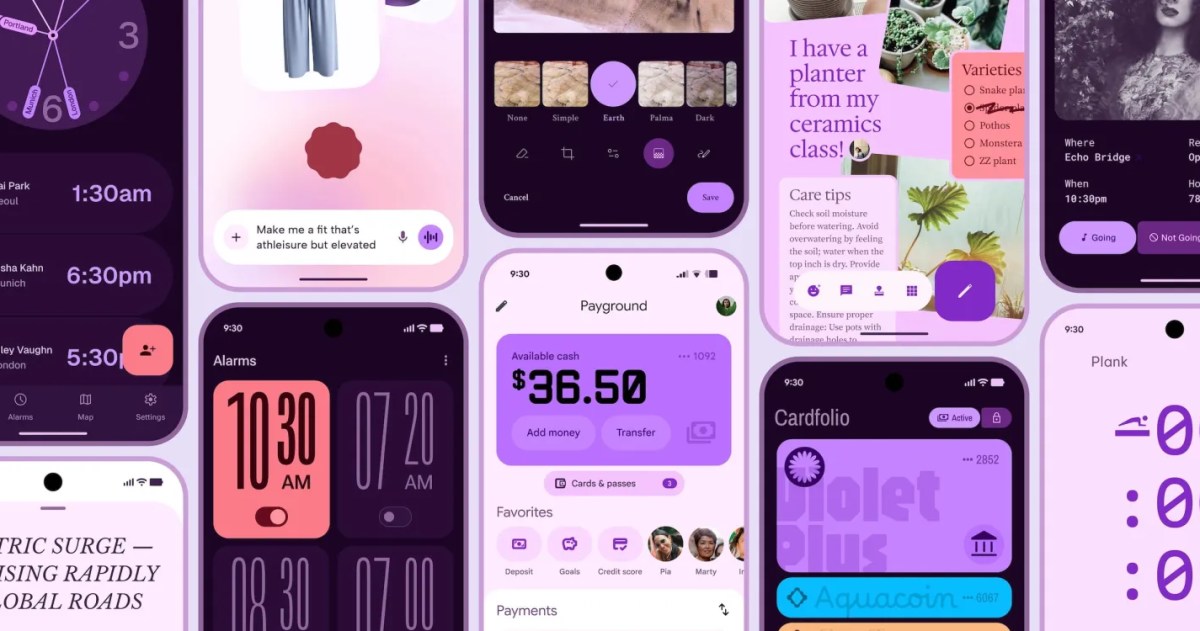

Gen Z Loyalty To I Phones Will Androids New Look Change That

May 09, 2025

Gen Z Loyalty To I Phones Will Androids New Look Change That

May 09, 2025 -

Monee Sea Moneys Rebranding And New Headquarters Unveiled

May 09, 2025

Monee Sea Moneys Rebranding And New Headquarters Unveiled

May 09, 2025