Deadline Approaching: Secure Your $1,400 – U.S. Expat Tax Compliance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Deadline Approaching: Secure Your $1,400 – U.S. Expat Tax Compliance

Time is running out! American expats living abroad are urged to finalize their 2022 tax returns before the fast-approaching deadline. Failing to comply could mean missing out on a potential $1,400 refund – or worse, facing significant penalties. Understanding the Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credit (FTC) is crucial for maximizing your return and avoiding costly mistakes.

The looming deadline underscores the importance of proactive tax planning for U.S. citizens residing overseas. Many expats are unaware of the specific regulations and intricacies involved in filing their taxes as non-residents. This article will shed light on the key aspects of expat tax compliance, helping you navigate the process and potentially claim your rightful refund.

Understanding the Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credit (FTC)

For many American expats, the FEIE and FTC are essential for reducing their U.S. tax liability. The FEIE allows you to exclude a portion of your foreign-earned income from U.S. taxation. The FTC offsets U.S. taxes paid on your foreign income with the taxes you've already paid to your host country.

- FEIE: The amount you can exclude depends on your filing status and the applicable annual limit, which is adjusted annually. For 2022, the maximum exclusion was $112,000.

- FTC: This credit helps prevent double taxation. It allows you to deduct the foreign taxes you paid from your U.S. tax liability.

Crucially, claiming both the FEIE and FTC requires careful preparation and accurate record-keeping. You'll need to gather documentation such as your foreign tax returns, pay stubs, and bank statements to support your claims.

Common Mistakes to Avoid

Many expats fall victim to common tax filing errors, resulting in delays, penalties, and lost refunds. Here are some crucial points to remember:

- Missing the Deadline: Failing to file by the deadline incurs penalties, significantly impacting your potential refund.

- Incorrect Form Usage: Using the wrong forms (like Form 2555 for the FEIE and Form 1116 for the FTC) can lead to processing delays.

- Inaccurate Documentation: Incomplete or inaccurate documentation can lead to audits and delays.

- Ignoring Foreign Banking Information: Failing to report foreign bank accounts and assets can result in significant penalties.

Don't Miss Out on Your $1,400! Take Action Now!

The potential $1,400 refund highlights the importance of proactive tax planning. Given the complexity of expat taxes, seeking professional advice from a tax advisor specializing in international taxation is highly recommended. They can help you navigate the intricacies of the FEIE, FTC, and other relevant regulations, ensuring you maximize your return and avoid costly mistakes.

Act now to avoid penalties and secure your rightful refund. Contact a qualified tax professional today!

Keywords: U.S. expat taxes, Foreign Earned Income Exclusion (FEIE), Foreign Tax Credit (FTC), expat tax compliance, 2022 tax return, tax deadline, American expats, international taxation, tax refund, tax penalties, Form 2555, Form 1116.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Deadline Approaching: Secure Your $1,400 – U.S. Expat Tax Compliance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Utahs Gobert Draymond Greens All Time Great Status Undisputed Ahead Of Playoffs

May 08, 2025

Utahs Gobert Draymond Greens All Time Great Status Undisputed Ahead Of Playoffs

May 08, 2025 -

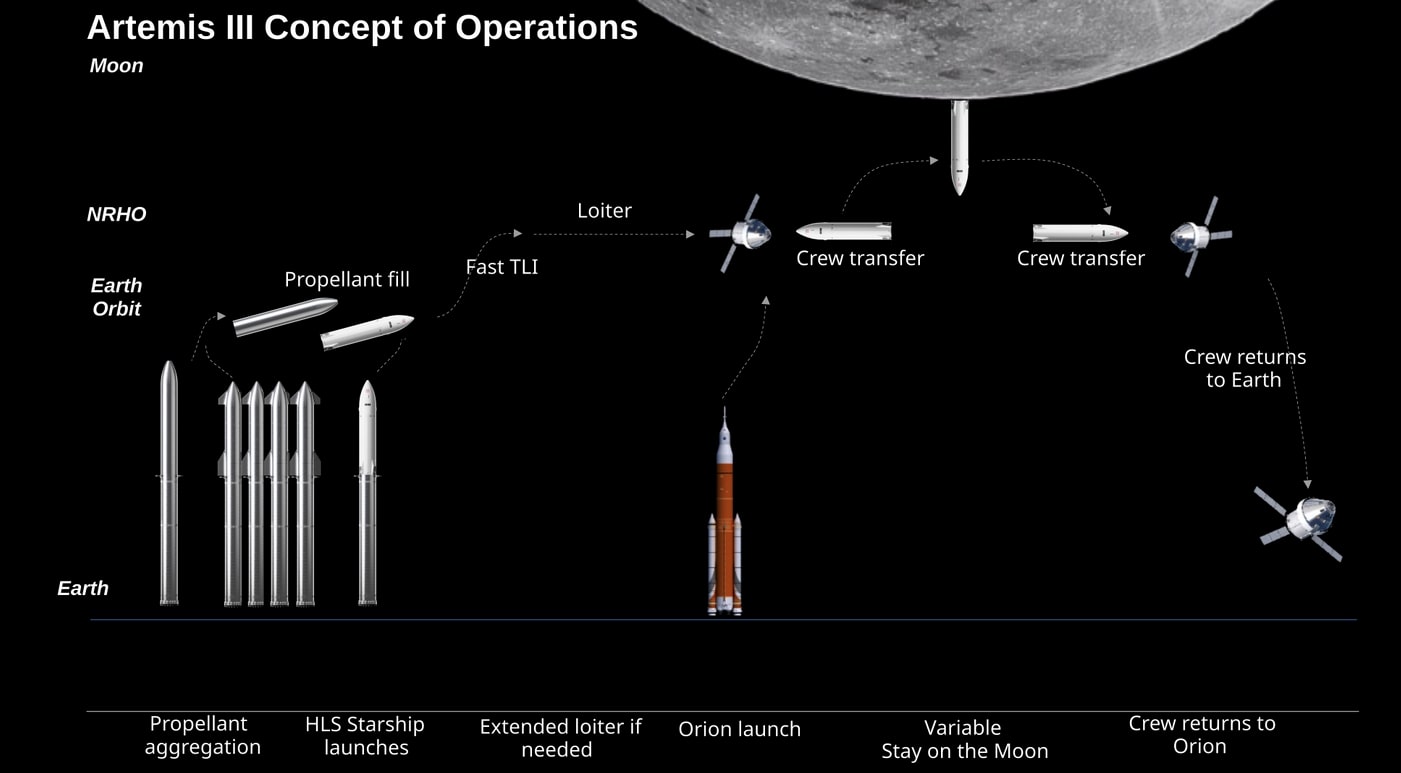

Nasa And The Government Uncovering The Truth Behind Budget Overruns

May 08, 2025

Nasa And The Government Uncovering The Truth Behind Budget Overruns

May 08, 2025 -

Dramatic 3 2 Victory For Al Ittihad Against Al Nassr

May 08, 2025

Dramatic 3 2 Victory For Al Ittihad Against Al Nassr

May 08, 2025 -

Skull Covered Poster Released For 28 Years Later

May 08, 2025

Skull Covered Poster Released For 28 Years Later

May 08, 2025 -

Playoff Upset Alert Denver And New York Steal Game 1 Wins

May 08, 2025

Playoff Upset Alert Denver And New York Steal Game 1 Wins

May 08, 2025

Latest Posts

-

Nba Live Score Nuggets Vs Thunder May 7 2025 Full Game Summary

May 09, 2025

Nba Live Score Nuggets Vs Thunder May 7 2025 Full Game Summary

May 09, 2025 -

Smaller Cheaper Echo Show Amazons New Smart Display Targets Budget Buyers

May 09, 2025

Smaller Cheaper Echo Show Amazons New Smart Display Targets Budget Buyers

May 09, 2025 -

Knicks Vs Celtics Final Box Score From May 7 2025

May 09, 2025

Knicks Vs Celtics Final Box Score From May 7 2025

May 09, 2025 -

Nikola Jokic Responds To Free Throw Merchant Taunts From Oklahoma City Fans

May 09, 2025

Nikola Jokic Responds To Free Throw Merchant Taunts From Oklahoma City Fans

May 09, 2025 -

Pakistan Media Trip To Azad Kashmir Aims To Debunk Indian Propaganda On Militant Camps

May 09, 2025

Pakistan Media Trip To Azad Kashmir Aims To Debunk Indian Propaganda On Militant Camps

May 09, 2025