Deciphering Bitcoin's (BTC) Future: A Chart-Based Market Cycle Assessment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Deciphering Bitcoin's (BTC) Future: A Chart-Based Market Cycle Assessment

Bitcoin (BTC), the world's largest cryptocurrency by market capitalization, continues to captivate investors and analysts alike. Its volatile nature, however, makes predicting its future trajectory a complex challenge. This article delves into a chart-based assessment of Bitcoin's market cycles, offering insights into potential future price movements and market sentiment. Understanding these historical patterns can help investors navigate the often turbulent waters of the BTC market.

Bitcoin's Historical Market Cycles: A Pattern Recognition Approach

Bitcoin's price history reveals a series of distinct bull and bear markets, characterized by periods of explosive growth followed by significant corrections. Examining these cycles is crucial for identifying potential turning points and assessing risk. While past performance doesn't guarantee future results, recognizing recurring patterns can provide valuable context for informed decision-making.

- Bull Markets: Characterized by rapid price appreciation, fueled by increased adoption, technological advancements, and positive market sentiment. These periods are often accompanied by hype and significant media attention.

- Bear Markets: Marked by significant price declines, driven by factors such as regulatory uncertainty, market corrections, and waning investor enthusiasm. These periods can be characterized by fear and uncertainty.

Analyzing historical BTC price charts, specifically focusing on key indicators like moving averages, relative strength index (RSI), and volume, provides a framework for identifying potential market cycle phases. For example, prolonged periods of low RSI could signal a potential bottom, while sustained high RSI could indicate an overbought market, susceptible to a correction.

Key Chart Indicators for Bitcoin Price Prediction

Several technical analysis indicators help decipher Bitcoin's future price movements:

- Moving Averages (MA): Analyzing the 50-day, 100-day, and 200-day MAs can reveal potential support and resistance levels. A "golden cross" (50-day MA crossing above the 200-day MA) is often interpreted as a bullish signal, while a "death cross" (50-day MA crossing below the 200-day MA) can be a bearish indicator.

- Relative Strength Index (RSI): This momentum indicator helps determine whether Bitcoin is overbought (RSI above 70) or oversold (RSI below 30). These levels can signal potential reversals.

- Volume: Analyzing trading volume alongside price movements provides critical context. High volume during price increases strengthens bullish signals, while high volume during price decreases can signal a stronger bearish trend.

- Support and Resistance Levels: Identifying historical price levels where Bitcoin has bounced back (support) or reversed (resistance) is crucial for assessing potential future price action. Breakouts above resistance levels often signal further upward momentum.

Challenges in Predicting Bitcoin's Future

Despite the usefulness of chart-based analysis, several factors complicate accurate prediction:

- External Factors: Macroeconomic events, regulatory changes, and technological developments can significantly impact Bitcoin's price, making precise predictions difficult.

- Market Sentiment: Investor psychology plays a critical role in Bitcoin's price volatility. Fear, greed, and hype can significantly influence market trends.

- Regulatory Uncertainty: The evolving regulatory landscape surrounding cryptocurrencies adds another layer of uncertainty to price predictions.

Conclusion: Navigating the Bitcoin Market

While chart-based analysis provides valuable insights into potential market cycles, it's crucial to remember that Bitcoin's price is influenced by numerous factors beyond technical indicators. A holistic approach, incorporating fundamental analysis, understanding market sentiment, and acknowledging inherent risks, is essential for navigating the complex and dynamic Bitcoin market. Always conduct thorough research and consider consulting a financial advisor before making any investment decisions. The information provided here is for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Deciphering Bitcoin's (BTC) Future: A Chart-Based Market Cycle Assessment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fxs Alien Earth Series What We Know About The Cast Story And Premiere

May 06, 2025

Fxs Alien Earth Series What We Know About The Cast Story And Premiere

May 06, 2025 -

Opinion Did Mark Carneys Washington Trip Achieve Its Goals

May 06, 2025

Opinion Did Mark Carneys Washington Trip Achieve Its Goals

May 06, 2025 -

Web3 Gaming Gets A Boost Stablecoin Launch On Sui Network

May 06, 2025

Web3 Gaming Gets A Boost Stablecoin Launch On Sui Network

May 06, 2025 -

Examining Liberal Policy A Critical Assessment

May 06, 2025

Examining Liberal Policy A Critical Assessment

May 06, 2025 -

Met Gala 2025 A Live Look At The Nights Biggest Fashion Moments

May 06, 2025

Met Gala 2025 A Live Look At The Nights Biggest Fashion Moments

May 06, 2025

Latest Posts

-

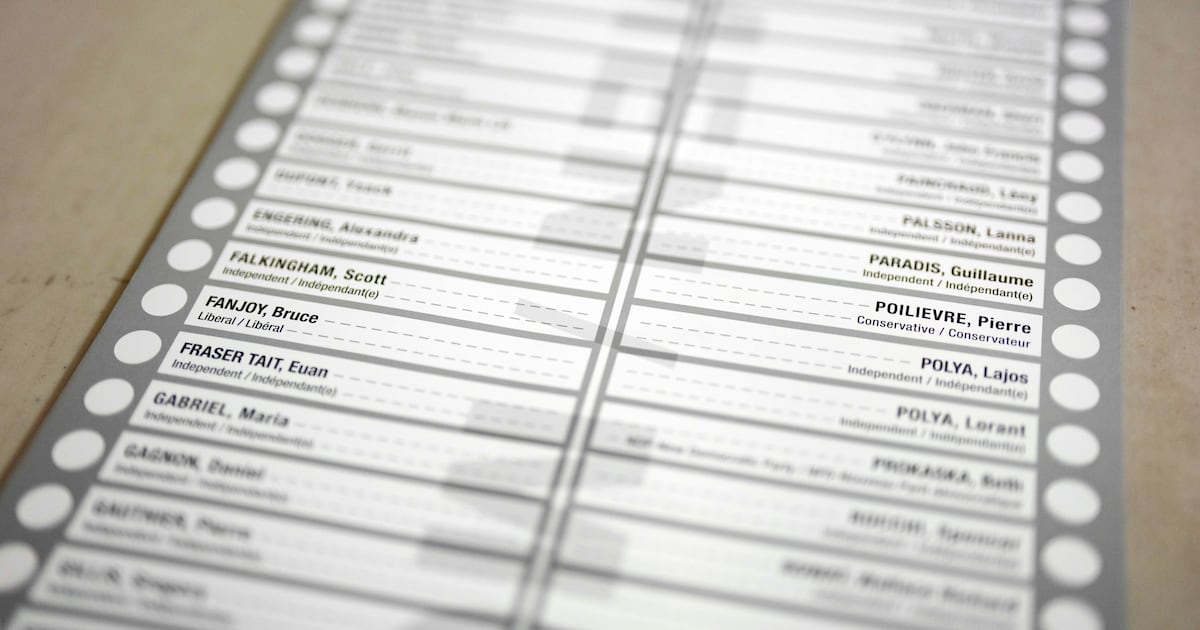

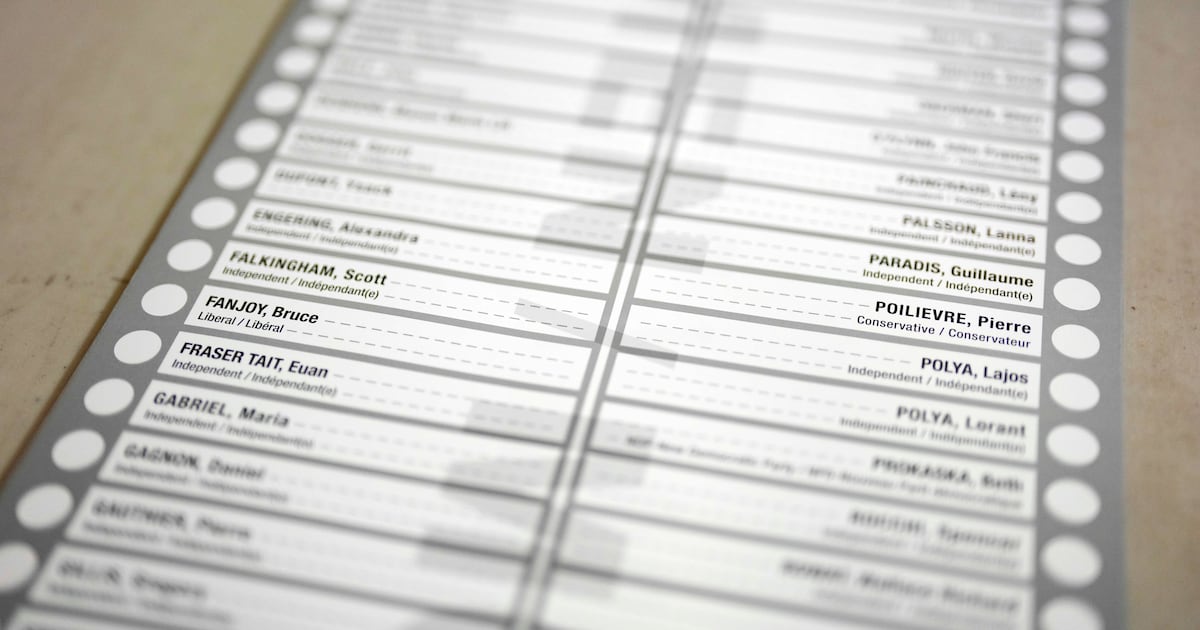

Poilievre Faces Byelection Ballot Challenge Protest Group Adds Hundreds Of Names

May 06, 2025

Poilievre Faces Byelection Ballot Challenge Protest Group Adds Hundreds Of Names

May 06, 2025 -

Hundreds Of Names Added To Pierre Poilievres Alberta Byelection Ballot A Protest

May 06, 2025

Hundreds Of Names Added To Pierre Poilievres Alberta Byelection Ballot A Protest

May 06, 2025 -

Positive Update On Fan Injured In Pnc Park Field Fall

May 06, 2025

Positive Update On Fan Injured In Pnc Park Field Fall

May 06, 2025 -

A Timely Commencement Tale Grant Hills Journey To Success

May 06, 2025

A Timely Commencement Tale Grant Hills Journey To Success

May 06, 2025 -

Re Purposed Stones The Potential Significance Of Recycled Megaliths In Stonehenge Construction

May 06, 2025

Re Purposed Stones The Potential Significance Of Recycled Megaliths In Stonehenge Construction

May 06, 2025