Deciphering Bitcoin's Future: Chart Analysis Points To Potential Cycle Conclusion

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Deciphering Bitcoin's Future: Chart Analysis Points to Potential Cycle Conclusion

Bitcoin, the world's leading cryptocurrency, has captivated investors and tech enthusiasts alike since its inception. But with its notoriously volatile nature, predicting its future trajectory remains a significant challenge. Recent chart analysis, however, suggests we may be nearing the end of a significant cycle, prompting crucial questions about what lies ahead for BTC. This article delves into the key indicators and potential scenarios shaping Bitcoin's future.

The Case for a Cycle Conclusion:

Several technical indicators are pointing towards a potential conclusion to Bitcoin's current bull/bear cycle. These include:

-

On-Chain Metrics: Data analyzing on-chain activity, such as the exchange flow and miner behavior, reveals a potential exhaustion of buying pressure. Decreased network activity and a flattening of certain key metrics suggest a period of consolidation or even a bearish correction could be imminent. This data, while complex, offers valuable insights for seasoned crypto traders.

-

Price Action & Chart Patterns: Experienced Bitcoin chart analysts are observing several bearish patterns forming on various timeframes. These include head and shoulders patterns and potential descending triangles, both classically indicating a potential price reversal downwards. However, it's crucial to remember that chart patterns are not foolproof predictors.

-

Macroeconomic Factors: The global economic landscape plays a significant role in Bitcoin's price. Current inflationary pressures and potential interest rate hikes by central banks globally can negatively impact risk-on assets, including cryptocurrencies. This external pressure adds another layer of complexity to forecasting Bitcoin's price.

Potential Scenarios:

While a definitive prediction remains elusive, several scenarios are plausible based on current analysis:

-

Extended Consolidation: Bitcoin could enter a prolonged period of sideways trading, consolidating its gains before potentially embarking on another bull run. This consolidation phase could last for months or even years, allowing the market to absorb recent price movements.

-

Bearish Correction: A significant price drop is a possibility, particularly if the bearish chart patterns mentioned above materialize. The extent of this correction is difficult to predict, but it could potentially retrace a significant portion of Bitcoin's recent gains.

-

Unexpected Bull Run: While less likely based on current indicators, unforeseen positive news, regulatory clarity, or widespread institutional adoption could trigger another unexpected bull run. However, this scenario would likely require a significant catalyst.

What This Means for Investors:

The potential conclusion of a Bitcoin cycle warrants careful consideration for investors. It's crucial to:

-

Diversify Your Portfolio: Reduce risk by diversifying across various asset classes, including traditional investments and altcoins. Never invest more than you can afford to lose.

-

Risk Management: Implement robust risk management strategies, including stop-loss orders and position sizing, to protect your investments during periods of volatility.

-

Stay Informed: Continuously monitor market trends, on-chain data, and macroeconomic factors to make informed investment decisions.

Conclusion:

While the future of Bitcoin remains uncertain, careful analysis of chart patterns, on-chain metrics, and macroeconomic conditions suggests we may be nearing the conclusion of a significant cycle. Investors should approach the market with caution, employing robust risk management strategies and staying informed about the evolving landscape. The information presented here is for educational purposes only and should not be construed as financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Deciphering Bitcoin's Future: Chart Analysis Points To Potential Cycle Conclusion. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

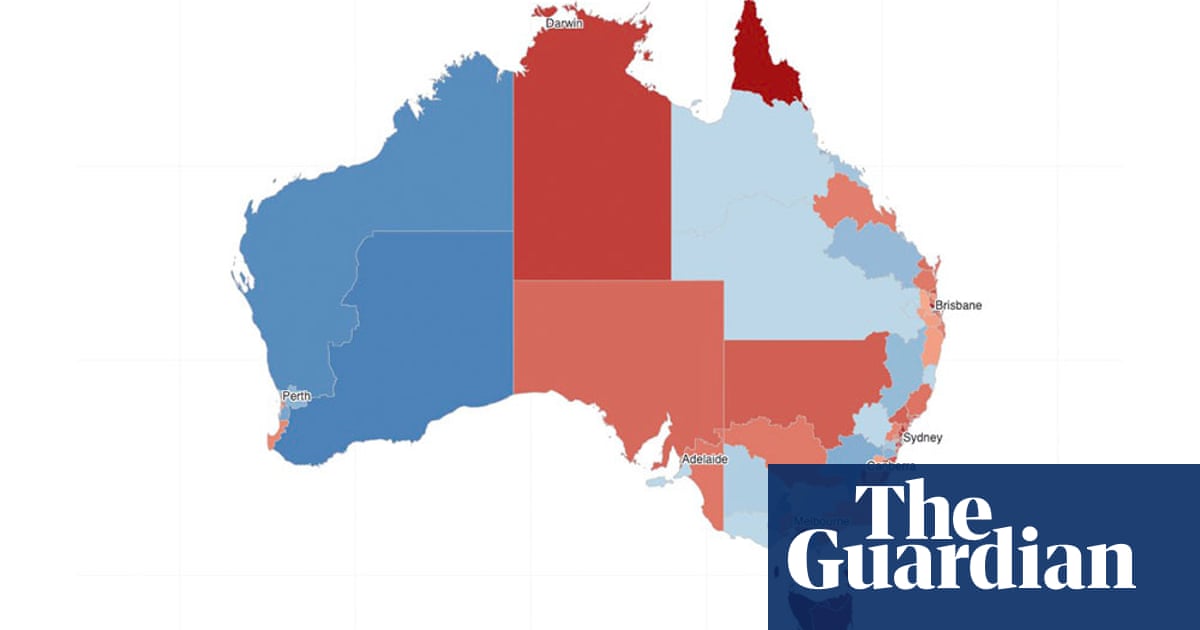

Australian Election 2023 Labors House Advantage And Senate Race

May 05, 2025

Australian Election 2023 Labors House Advantage And Senate Race

May 05, 2025 -

Victoria Apretada Del Espanyol Ante El Betis 1 0

May 05, 2025

Victoria Apretada Del Espanyol Ante El Betis 1 0

May 05, 2025 -

High Performance Storage 128 Tb Ssd With 14 G Bps Read Speeds From Innodisk

May 05, 2025

High Performance Storage 128 Tb Ssd With 14 G Bps Read Speeds From Innodisk

May 05, 2025 -

The Olympic Influence A Key To Understanding Green And Pops Success

May 05, 2025

The Olympic Influence A Key To Understanding Green And Pops Success

May 05, 2025 -

Com A Saida De Pedro Gabigol E Vitor Pereira Unidos No Flamengo Desafio Contra O Cruzeiro

May 05, 2025

Com A Saida De Pedro Gabigol E Vitor Pereira Unidos No Flamengo Desafio Contra O Cruzeiro

May 05, 2025