Decoding Buffett's Investment Philosophy: Crypto Market Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Decoding Buffett's Investment Philosophy: Crypto Market Implications

Warren Buffett, the Oracle of Omaha, and the cryptocurrency market – two seemingly disparate worlds. Yet, understanding Buffett's core investment principles offers a fascinating lens through which to analyze the volatile and often perplexing crypto landscape. While Buffett famously remains skeptical of cryptocurrencies, his investment philosophy provides valuable insights for navigating this emerging asset class.

This article delves into the key tenets of Buffett's approach and explores their implications for cryptocurrency investors. We will examine how his emphasis on value investing, long-term vision, and aversion to speculation translate into a framework for evaluating crypto assets.

Buffett's Core Principles: A Foundation for Investment Decisions

Buffett's investment strategy is built on several pillars:

-

Value Investing: Buffett focuses on identifying undervalued companies with strong fundamentals and long-term growth potential. He seeks to buy assets below their intrinsic value, ensuring a margin of safety. This contrasts sharply with the often speculative nature of the crypto market, where price movements are driven by hype and sentiment as much as fundamentals.

-

Long-Term Perspective: Buffett is known for his "buy-and-hold" strategy, emphasizing patience and a long-term outlook. He avoids short-term trading and focuses on companies with sustainable competitive advantages. This contrasts with the short-term trading prevalent in the crypto market, where rapid price fluctuations are common.

-

Understanding the Business: Buffett meticulously researches the businesses he invests in, focusing on their financial health, management quality, and competitive landscape. This contrasts with many crypto investments, which are often based on speculation and technological promise rather than a deep understanding of the underlying project.

-

Risk Aversion: Buffett prioritizes risk management, emphasizing the importance of protecting capital. He avoids highly speculative investments and prefers businesses with predictable cash flows. This cautious approach stands in contrast to the high-risk, high-reward nature of many crypto investments.

Crypto Market Implications: Navigating the Volatility

Buffett's philosophy, while not explicitly designed for cryptocurrencies, offers valuable lessons for navigating this volatile market:

-

Due Diligence is Crucial: Applying Buffett's emphasis on thorough research is paramount. Investors should carefully analyze the underlying technology, team, and potential use cases of any cryptocurrency before investing. Understanding the tokenomics and the project's whitepaper is essential.

-

Long-Term Vision vs. Short-Term Gains: While short-term gains might be tempting, a long-term perspective is crucial. Investors should focus on projects with sustainable value and avoid chasing fleeting trends.

-

Risk Management is Paramount: Crypto investments are inherently risky. Investors should diversify their portfolios, avoid overexposure to any single asset, and only invest what they can afford to lose.

-

Focus on Underlying Value (Where Possible): While many cryptocurrencies lack the traditional business models Buffett favors, some projects offer real-world utility. Identifying these projects, which demonstrate tangible value beyond speculation, may align more closely with Buffett's principles.

Conclusion: A Cautious Approach

While Buffett's skepticism towards cryptocurrencies is well-documented, his core investment philosophy offers a valuable framework for navigating this complex market. By emphasizing due diligence, a long-term perspective, and prudent risk management, investors can increase their chances of success while mitigating the inherent volatility of the crypto space. Remember, the principles of value investing, even if applied differently, remain timeless and relevant, regardless of the asset class. Applying a Buffett-inspired approach doesn't necessarily mean avoiding crypto altogether, but it certainly advocates for a more measured and discerning engagement with this emerging asset class.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Decoding Buffett's Investment Philosophy: Crypto Market Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bbc Announces 2025 Christmas Animation A Julia Donaldson Adaptation

May 23, 2025

Bbc Announces 2025 Christmas Animation A Julia Donaldson Adaptation

May 23, 2025 -

Is Netflixs New Revenge Thriller Worth The Hype Top 10 Ranking Explained

May 23, 2025

Is Netflixs New Revenge Thriller Worth The Hype Top 10 Ranking Explained

May 23, 2025 -

Acer Partners New Ryzen 9 Laptop With Rtx 5070 Ti A Creators Dream

May 23, 2025

Acer Partners New Ryzen 9 Laptop With Rtx 5070 Ti A Creators Dream

May 23, 2025 -

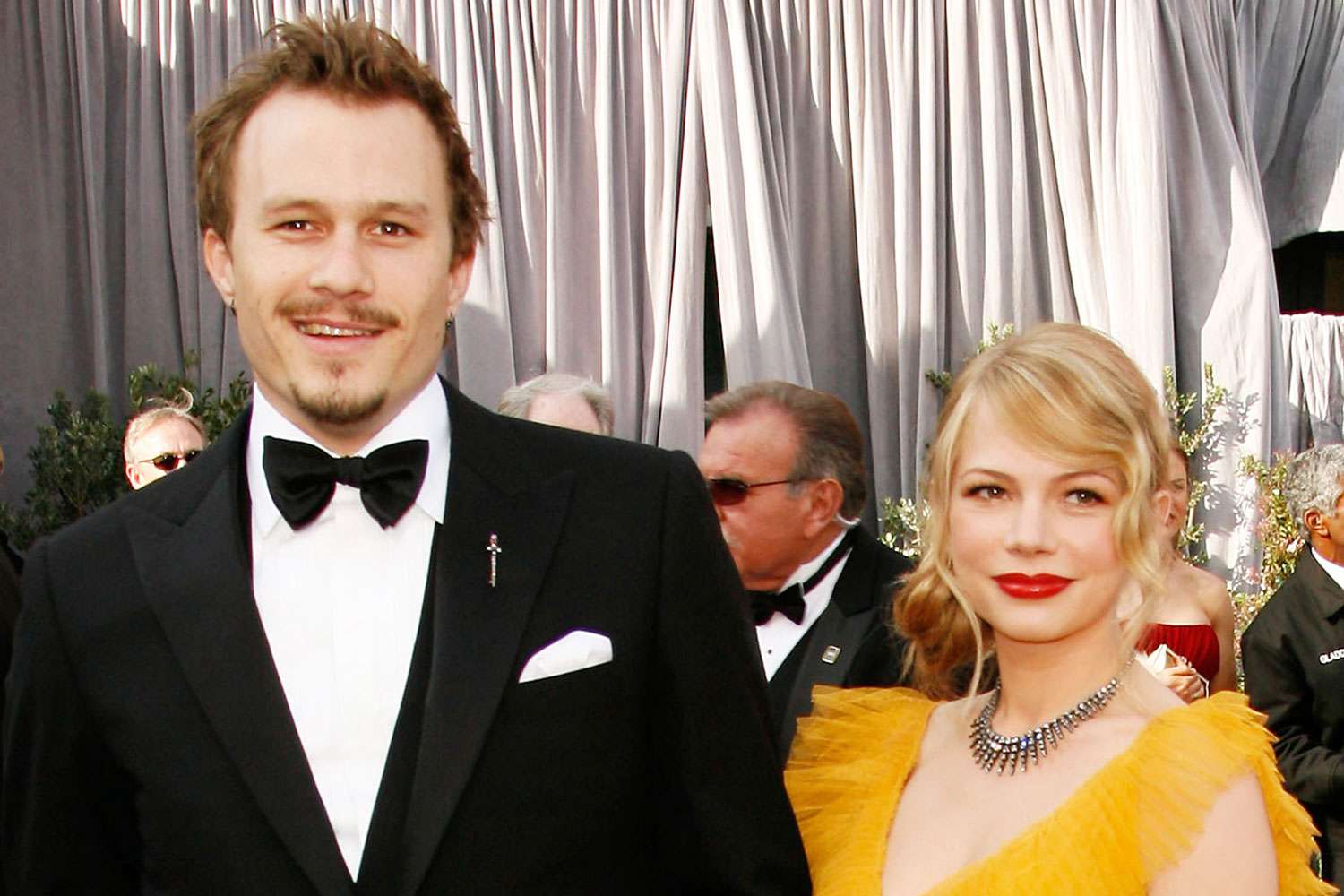

Michelle Williams Heartfelt Tribute Matilda And The Enduring Legacy Of Heath Ledger

May 23, 2025

Michelle Williams Heartfelt Tribute Matilda And The Enduring Legacy Of Heath Ledger

May 23, 2025 -

Can The Thunder Win It All Stephen A Smith Discusses Okcs Potential

May 23, 2025

Can The Thunder Win It All Stephen A Smith Discusses Okcs Potential

May 23, 2025

Latest Posts

-

Gillian Anderson A Transatlantic Life Britain Or America

May 23, 2025

Gillian Anderson A Transatlantic Life Britain Or America

May 23, 2025 -

Teslas Fully Autonomous Robotaxi Rollout Timeline And Challenges

May 23, 2025

Teslas Fully Autonomous Robotaxi Rollout Timeline And Challenges

May 23, 2025 -

Galvins Future Uncertain 750 000 Offers From Parramatta And Bulldogs On The Table

May 23, 2025

Galvins Future Uncertain 750 000 Offers From Parramatta And Bulldogs On The Table

May 23, 2025 -

Vivid Sydney 2025 Must See Events And Installations

May 23, 2025

Vivid Sydney 2025 Must See Events And Installations

May 23, 2025 -

Bangkok Y Egipto Aventuras Y Ciencia Ficcion En La Gran Pantalla

May 23, 2025

Bangkok Y Egipto Aventuras Y Ciencia Ficcion En La Gran Pantalla

May 23, 2025