Decoding Buffett's Strategy: Applying Fear And Greed To Cryptocurrency Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Decoding Buffett's Strategy: Applying Fear and Greed to Cryptocurrency Investments

Warren Buffett, the Oracle of Omaha, is famously known for his contrarian investment strategies, built on a foundation of understanding and exploiting market psychology – specifically, the emotions of fear and greed. While Buffett remains skeptical of cryptocurrencies, his core principles offer valuable insights for navigating the volatile world of digital assets. This article explores how investors can apply Buffett's wisdom to make informed decisions in the cryptocurrency market.

Buffett's Contrarian Approach: A Foundation in Value Investing

Buffett's success stems from his value investing philosophy. He seeks undervalued assets with strong fundamentals, patiently waiting for the market to recognize their true worth. This contrasts sharply with the often speculative nature of the cryptocurrency market, driven by hype and rapid price fluctuations. However, understanding his principles can help us identify opportunities even within this volatile landscape.

Harnessing Fear: Identifying Undervalued Cryptocurrencies

The cryptocurrency market is prone to dramatic crashes fueled by fear. During these periods of intense negativity, opportunities for savvy investors can emerge. Buffett’s approach would suggest looking for fundamentally strong projects whose value has been temporarily depressed by market panic. This requires careful due diligence:

- Fundamental Analysis: Examine the underlying technology, team, adoption rate, and overall utility of the cryptocurrency. Is the project solving a real-world problem? Does it have a strong development team and community support?

- Technical Analysis (with caution): While Buffett isn't a fan of short-term market timing, understanding chart patterns can help identify potential support levels where buying might be strategically advantageous during a market downturn. However, rely on this analysis cautiously, supplementing it with strong fundamental research.

- Risk Assessment: Cryptocurrencies are inherently risky. Diversification is crucial to mitigate losses. Don't put all your eggs in one basket.

Capitalizing on Greed: Recognizing Overvalued Assets and Avoiding the Hype Cycle

The cryptocurrency market is also susceptible to periods of intense greed, often driven by hype and FOMO (fear of missing out). Buffett would caution against succumbing to this emotional pressure. Identifying overvalued assets requires critical thinking and a healthy dose of skepticism:

- Identifying Hype: Be wary of projects with extravagant promises and little to show for it. Focus on projects with tangible progress and a clear roadmap.

- Market Sentiment Analysis: Pay attention to news cycles and social media trends. Excessive hype often precedes a price correction.

- Understanding Intrinsic Value: What is the actual value of the cryptocurrency? Is the current price justified by its fundamentals? If not, it might be overvalued.

Applying Buffett's Patience: Long-Term Perspective is Key

Buffett's investment strategy is characterized by patience and a long-term perspective. This is even more critical in the cryptocurrency market, where short-term volatility is the norm. Investors should:

- Avoid impulsive decisions: Don't let emotions dictate your investment choices. Stick to your research and your strategy.

- Focus on the long-term potential: Identify projects with long-term growth potential, even if the short-term outlook is uncertain.

- Have a clear exit strategy: Knowing when to sell is just as important as knowing when to buy.

Conclusion: A Measured Approach to Crypto Investing

While Warren Buffett may not be a cryptocurrency enthusiast, his core principles of value investing, patience, and understanding market psychology remain invaluable for navigating the volatile world of digital assets. By applying his contrarian approach and focusing on fundamental analysis, investors can potentially mitigate risks and capitalize on opportunities within the cryptocurrency market. Remember, thorough research, risk management, and a long-term perspective are key to success.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Decoding Buffett's Strategy: Applying Fear And Greed To Cryptocurrency Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Competitive Pricing Of Electric Vehicles Teslas Position And Market Share

May 25, 2025

Competitive Pricing Of Electric Vehicles Teslas Position And Market Share

May 25, 2025 -

Memorial Day Weekend Forecast Expect Unsettled Conditions

May 25, 2025

Memorial Day Weekend Forecast Expect Unsettled Conditions

May 25, 2025 -

260 Million Hack Of Cetus Suis Leading De Fi Platform Hit Funds Largely Recovered

May 25, 2025

260 Million Hack Of Cetus Suis Leading De Fi Platform Hit Funds Largely Recovered

May 25, 2025 -

Family Ties In Pkr Anwar Ibrahim Responds To Nepotism Accusations

May 25, 2025

Family Ties In Pkr Anwar Ibrahim Responds To Nepotism Accusations

May 25, 2025 -

Budget Friendly Smart Display Amazons Smaller Echo Show Launches To Rival Google

May 25, 2025

Budget Friendly Smart Display Amazons Smaller Echo Show Launches To Rival Google

May 25, 2025

Latest Posts

-

Afl Dockers Adaptable Ruck Strategies For Every Match

May 25, 2025

Afl Dockers Adaptable Ruck Strategies For Every Match

May 25, 2025 -

18 Year Olds Zombie Apocalypse Renner And Elbas New Hulu Movie

May 25, 2025

18 Year Olds Zombie Apocalypse Renner And Elbas New Hulu Movie

May 25, 2025 -

Fremantle Vs Port Adelaide Free Live Stream Links And Afl Match Details

May 25, 2025

Fremantle Vs Port Adelaide Free Live Stream Links And Afl Match Details

May 25, 2025 -

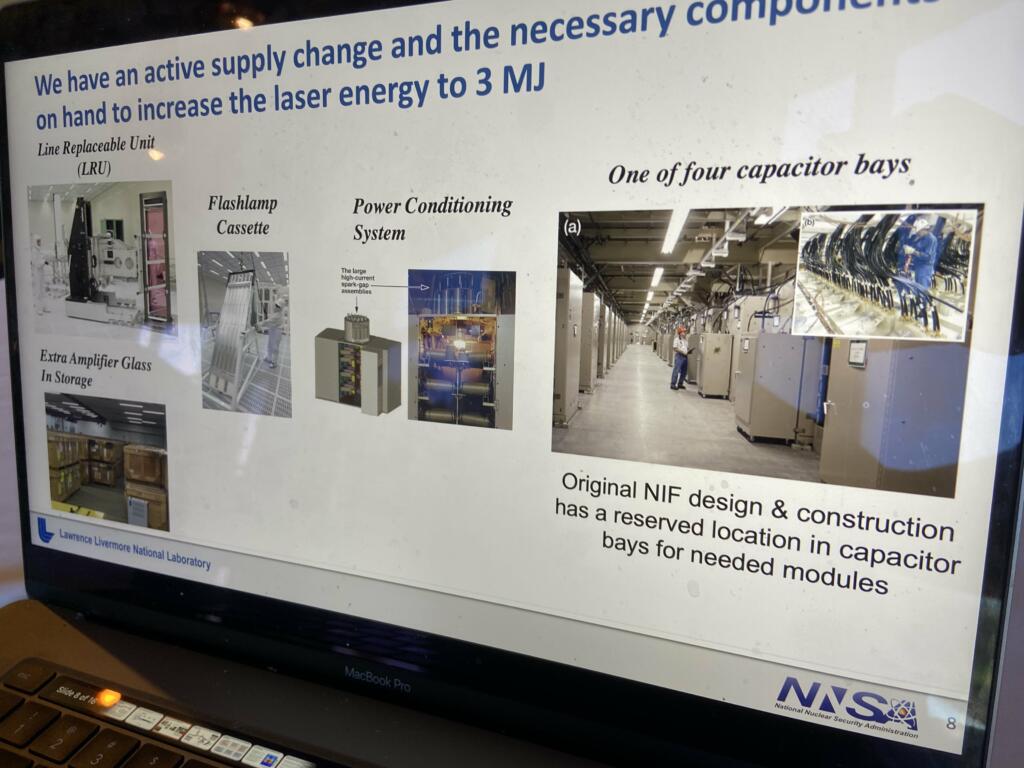

Laser Fusion Technology On The Path To Commercialization

May 25, 2025

Laser Fusion Technology On The Path To Commercialization

May 25, 2025 -

Is The Wheel Of Time Over Prime Video Confirms Cancellation After 3 Seasons

May 25, 2025

Is The Wheel Of Time Over Prime Video Confirms Cancellation After 3 Seasons

May 25, 2025