Decoding Warren Buffett's Strategy: Is It Applicable To Cryptocurrency Investments?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Decoding Warren Buffett's Strategy: Is It Applicable to Cryptocurrency Investments?

Warren Buffett, the Oracle of Omaha, is renowned for his value investing approach, a strategy built on patience, fundamental analysis, and a long-term perspective. But can this tried-and-true method, so successful in traditional markets, be applied to the volatile and often unpredictable world of cryptocurrency investments? The answer, as with most things in finance, is nuanced.

Buffett's Core Principles: A Foundation in Value

Buffett's success stems from several key principles:

- Understanding the Underlying Business: He meticulously researches companies, focusing on their profitability, management, and competitive advantage before investing. He looks for businesses he understands and believes will generate consistent cash flow for years to come.

- Long-Term Perspective: He's famously patient, holding investments for decades rather than chasing short-term gains. This allows him to weather market fluctuations and capitalize on long-term growth.

- Margin of Safety: Buffett aims to buy assets below their intrinsic value, creating a buffer against potential losses. This "margin of safety" is crucial to his risk management strategy.

- Intrinsic Value Focus: He doesn't chase trends or hype; he focuses on the fundamental value of an asset, independent of market sentiment.

The Cryptocurrency Conundrum: Applying Buffett's Wisdom

Applying these principles directly to cryptocurrencies presents significant challenges:

- Lack of Intrinsic Value (for most): Unlike established companies with tangible assets and predictable earnings, many cryptocurrencies lack demonstrable intrinsic value. Their worth is often driven by speculation and market sentiment, making fundamental analysis difficult. While some projects offer utility through blockchain technology, valuing this utility remains a complex task.

- Volatility and Speculation: The cryptocurrency market is notoriously volatile, experiencing dramatic price swings in short periods. This high volatility clashes with Buffett's long-term, patient approach. The inherent speculation in the market also contradicts his focus on fundamental analysis.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, creating uncertainty and potential risks that Buffett's traditional investment strategy may not fully account for. Regulatory changes can significantly impact cryptocurrency prices.

- Technological Risk: The underlying technology of cryptocurrencies is constantly evolving. New technologies, upgrades, and forks can significantly impact the value of a particular cryptocurrency. This technological risk is difficult to assess using traditional valuation methods.

Finding Common Ground: A Modified Approach?

While a direct application of Buffett's strategy might be unsuitable for most cryptocurrencies, some elements could still be relevant:

- Diversification: Just like in traditional markets, diversification within the cryptocurrency space can mitigate risk. Investing across different cryptocurrencies with varying use cases and levels of market capitalization can reduce exposure to the volatility of individual assets.

- Due Diligence: Thorough research into the underlying technology, team, and use case of a cryptocurrency is crucial, mirroring Buffett's emphasis on understanding the business. Focus on projects with strong fundamentals and a clear path to long-term adoption.

- Risk Management: Implementing strict risk management strategies, such as setting stop-loss orders and only investing what you can afford to lose, is crucial in the volatile cryptocurrency market.

Conclusion: Proceed with Caution

While some aspects of Warren Buffett's investment philosophy can inform cryptocurrency investing, a direct application is unrealistic. The inherent volatility, lack of intrinsic value in many cases, and regulatory uncertainty require a more cautious and adaptable approach. Investors should proceed with extreme caution, focusing on thorough due diligence, diversification, and robust risk management strategies. The cryptocurrency market remains highly speculative, and significant losses are possible.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Decoding Warren Buffett's Strategy: Is It Applicable To Cryptocurrency Investments?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Toronto Blue Jays Mediocrity Or A Hidden Potential

May 21, 2025

Toronto Blue Jays Mediocrity Or A Hidden Potential

May 21, 2025 -

Former Actress Accuses Harvey Weinstein Of Rape Following Alleged Erectile Dysfunction Treatment

May 21, 2025

Former Actress Accuses Harvey Weinstein Of Rape Following Alleged Erectile Dysfunction Treatment

May 21, 2025 -

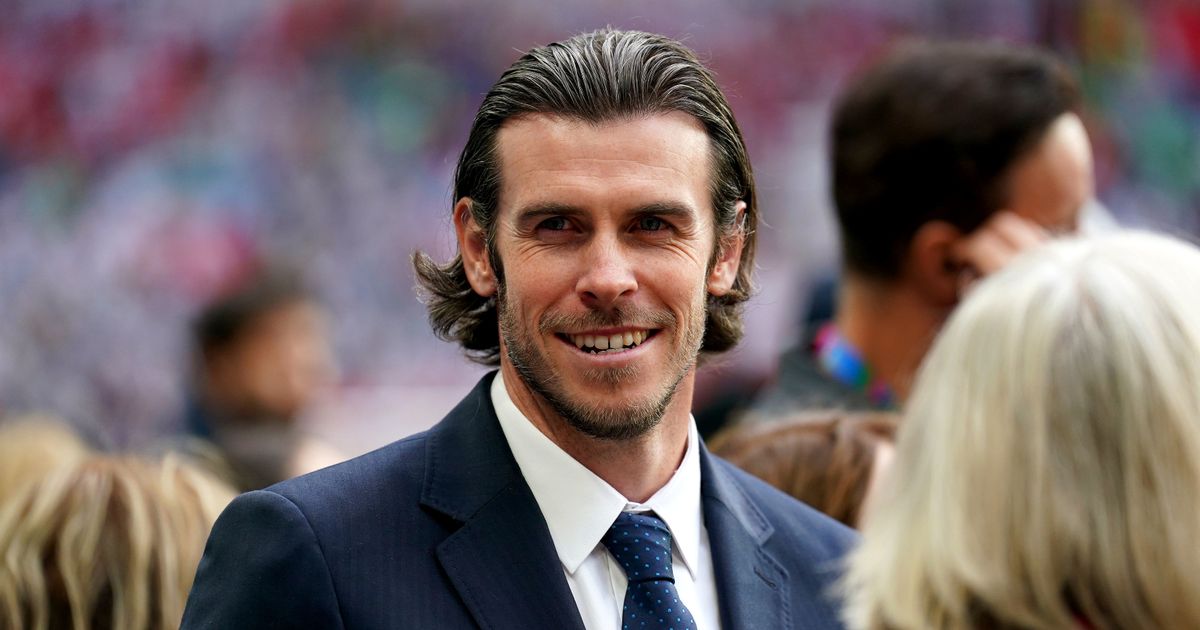

Tottenham Appoints Gareth Bale Ahead Of Crucial Europa League Final

May 21, 2025

Tottenham Appoints Gareth Bale Ahead Of Crucial Europa League Final

May 21, 2025 -

Follow Crystal Palace Vs Wolves Premier League Match News And Results

May 21, 2025

Follow Crystal Palace Vs Wolves Premier League Match News And Results

May 21, 2025 -

Significant Progress Made Anakie Fire Emergency Level Lowered

May 21, 2025

Significant Progress Made Anakie Fire Emergency Level Lowered

May 21, 2025