Deloitte's Economic Forecast: Implications Of A Potential Canadian Recession

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Deloitte Predicts Increased Recession Risk: What it Means for the Canadian Economy

Deloitte's latest economic forecast paints a concerning picture for Canada, suggesting a heightened risk of recession in 2024. The report, released [Insert Date of Release], highlights several key factors contributing to this increased vulnerability, prompting anxieties amongst businesses and consumers alike. Understanding the potential implications is crucial for navigating the uncertain economic landscape ahead.

Key Factors Driving the Recessionary Risk:

Deloitte's analysis points to a confluence of factors increasing the likelihood of a Canadian recession. These include:

- Persistent Inflation: High inflation continues to erode consumer purchasing power and squeeze corporate profit margins. The Bank of Canada's aggressive interest rate hikes, while aimed at curbing inflation, also risk triggering a significant economic slowdown.

- Global Economic Uncertainty: The global economic outlook remains fragile, with ongoing geopolitical instability and persistent supply chain disruptions adding to the challenges faced by the Canadian economy. Weakness in major trading partners directly impacts Canadian exports and overall economic growth.

- Housing Market Correction: The Canadian housing market, which experienced a significant boom in recent years, is showing signs of a correction. Falling home prices and reduced construction activity contribute to a slowdown in overall economic activity.

- High Interest Rates: The Bank of Canada's efforts to combat inflation through higher interest rates are impacting borrowing costs for businesses and consumers, potentially dampening investment and spending. This tightening of monetary policy increases the risk of a sharper economic contraction.

Potential Implications of a Canadian Recession:

A Canadian recession would have significant repercussions across various sectors:

- Job Losses: A downturn typically leads to job losses and increased unemployment, impacting household incomes and consumer confidence. Specific sectors like manufacturing and construction could be particularly vulnerable.

- Reduced Consumer Spending: Falling incomes and economic uncertainty will likely reduce consumer spending, further depressing economic growth and impacting businesses reliant on consumer demand.

- Increased Government Debt: The government might need to increase spending on social programs and economic stimulus measures to mitigate the impact of a recession, leading to a rise in government debt.

- Business Failures: Many businesses, particularly small and medium-sized enterprises (SMEs), may struggle to survive in a recessionary environment, leading to increased business failures.

Mitigating the Risk:

While a recession isn't inevitable, proactive measures are essential to mitigate the potential damage. Deloitte suggests the following:

- Targeted Government Support: Government intervention, focused on supporting vulnerable sectors and individuals, can help cushion the blow of a potential recession.

- Business Resilience Strategies: Businesses need to develop robust strategies to adapt to changing economic conditions, including diversification, cost management, and investment in innovation.

- Consumer Prudence: Consumers should carefully manage their finances, prioritize debt reduction, and build up emergency savings to prepare for potential economic hardship.

Looking Ahead:

Deloitte's forecast highlights the significant challenges facing the Canadian economy. While the possibility of a recession is real, it's not a predetermined outcome. Proactive policy responses, coupled with strategic planning by businesses and responsible financial management by consumers, can help minimize the impact and navigate this period of economic uncertainty. Continued monitoring of key economic indicators and government policy decisions will be crucial in the coming months. Stay tuned for further updates and analyses as the economic situation unfolds.

Keywords: Canadian recession, Deloitte economic forecast, Canadian economy, inflation, interest rates, housing market, job losses, economic uncertainty, Bank of Canada, recession risk, economic outlook, business resilience, government support.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Deloitte's Economic Forecast: Implications Of A Potential Canadian Recession. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Madrid Open Sabalenka Vs Stearns Live Stream Info Predictions And Betting Odds

May 01, 2025

Madrid Open Sabalenka Vs Stearns Live Stream Info Predictions And Betting Odds

May 01, 2025 -

El Barca Y La Presion A Flick Influira En El Partido Contra El Inter

May 01, 2025

El Barca Y La Presion A Flick Influira En El Partido Contra El Inter

May 01, 2025 -

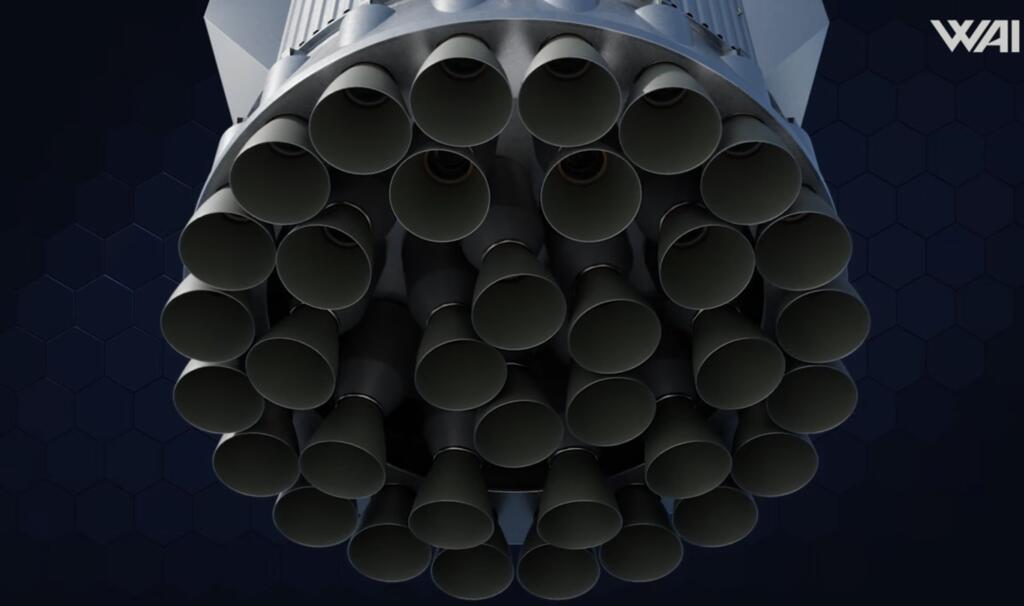

Next Gen Space X Starship 35 Raptor 3 Engines Boost Power And Capabilities

May 01, 2025

Next Gen Space X Starship 35 Raptor 3 Engines Boost Power And Capabilities

May 01, 2025 -

Obras Camp Nou El Cambio Radical Del Estadio Del Fc Barcelona

May 01, 2025

Obras Camp Nou El Cambio Radical Del Estadio Del Fc Barcelona

May 01, 2025 -

Ucl Clash Barcelona Veterans History Against Inter Milan Boosts Confidence

May 01, 2025

Ucl Clash Barcelona Veterans History Against Inter Milan Boosts Confidence

May 01, 2025