Dividend Investing: Jim Cramer Favors Realty Income (O)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dividend Investing: Jim Cramer Favors Realty Income (O) – A REIT Giant's Appeal

Realty Income Corporation (O), a real estate investment trust (REIT) specializing in single-tenant properties, has once again caught the eye of renowned financial commentator Jim Cramer. His recent endorsement highlights the enduring appeal of dividend investing, particularly within the stable and predictable realm of REITs like Realty Income. But what makes (O) such a compelling choice for income-seeking investors? Let's delve into the reasons behind Cramer's recommendation and explore why Realty Income continues to be a popular pick among dividend investors.

Cramer's Rationale: A Consistent Dividend Champion

Jim Cramer, known for his outspoken opinions on the markets, frequently emphasizes the importance of dividend income, especially during periods of economic uncertainty. He sees Realty Income as a bastion of stability, citing its impressive track record of consistent dividend growth. This consistency is a key attraction for investors prioritizing reliable income streams. The company boasts a long history of increasing its dividend payouts, making it a favorite amongst those building a passive income portfolio.

Realty Income (O): A Deeper Dive into the Investment

Realty Income's success is built on a diversified portfolio of properties leased to a wide range of tenants across various industries. This diversification mitigates risk, ensuring a steady stream of rental income even if one sector experiences a downturn. Key features of Realty Income that contribute to its attractiveness include:

- High Occupancy Rates: Realty Income consistently maintains high occupancy rates, demonstrating the strength and stability of its tenant base. This translates directly into predictable cash flows and reliable dividend payouts.

- Monthly Dividend Payments: Unlike many companies that pay dividends quarterly, Realty Income pays its dividend monthly, providing investors with a more frequent income stream. This is a significant advantage for those seeking regular cash flow.

- Strong Tenant Base: The company boasts a diverse portfolio of high-quality tenants with strong credit ratings, further reducing risk and ensuring consistent rental income.

- Long-Term Lease Agreements: The long-term nature of Realty Income's lease agreements provides a predictable income stream for years to come. This predictability is a cornerstone of its appeal to dividend investors.

Beyond Cramer: Why Realty Income Remains a Top Choice

While Jim Cramer's endorsement is influential, Realty Income's enduring appeal extends beyond individual opinions. Its solid fundamentals, consistent dividend growth, and robust financial performance make it an attractive investment for long-term investors seeking reliable income. The company's focus on essential retail properties, such as pharmacies and convenience stores, further strengthens its resilience against economic downturns.

Risks to Consider:

While Realty Income presents a compelling investment opportunity, it's crucial to acknowledge potential risks:

- Interest Rate Sensitivity: Like most REITs, Realty Income is sensitive to interest rate fluctuations. Rising interest rates can impact borrowing costs and potentially reduce profitability.

- Economic Downturn: While its diverse tenant base provides a buffer, a severe economic downturn could still impact rental income and occupancy rates.

- Inflationary Pressures: Rising inflation can increase operating costs, potentially squeezing profit margins.

Conclusion: A Solid Choice for Dividend Investors?

Realty Income (O) presents a strong case for investors prioritizing dividend income and stability. Jim Cramer's endorsement reinforces the company's appeal, but its consistent performance, diversified portfolio, and monthly dividend payments speak for themselves. However, potential investors should always conduct thorough due diligence and carefully consider the risks before making any investment decisions. Remember to consult with a financial advisor before making any significant investment choices. The information provided here is for educational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dividend Investing: Jim Cramer Favors Realty Income (O). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Matt Rempe Uprising One Man Against The System In Competitive Sport

Mar 18, 2025

The Matt Rempe Uprising One Man Against The System In Competitive Sport

Mar 18, 2025 -

Village Roadshow Entertainment Group Bankruptcy Filing Details And Analysis

Mar 18, 2025

Village Roadshow Entertainment Group Bankruptcy Filing Details And Analysis

Mar 18, 2025 -

Mls News Messi Nets Goal As Miami Defeats Atlanta Nashville Upsets Philadelphia

Mar 18, 2025

Mls News Messi Nets Goal As Miami Defeats Atlanta Nashville Upsets Philadelphia

Mar 18, 2025 -

Play In Nightmare How A Single Play By A Former Sun Cost The Lakers

Mar 18, 2025

Play In Nightmare How A Single Play By A Former Sun Cost The Lakers

Mar 18, 2025 -

Pepe Token Price Deciphering The Indicators Is A Bottom In Sight After 75 Drop

Mar 18, 2025

Pepe Token Price Deciphering The Indicators Is A Bottom In Sight After 75 Drop

Mar 18, 2025

Latest Posts

-

Us Bans Nvidia H20 Exports Huaweis Speedy New Ai Chip Raises Eyebrows

Apr 30, 2025

Us Bans Nvidia H20 Exports Huaweis Speedy New Ai Chip Raises Eyebrows

Apr 30, 2025 -

Ancient Monumental Reuse The Potential Source Of Stonehenges Three Ton Stones

Apr 30, 2025

Ancient Monumental Reuse The Potential Source Of Stonehenges Three Ton Stones

Apr 30, 2025 -

Australian Navy Vessels Built In China Damaged In Tornado Full Statement From Defense

Apr 30, 2025

Australian Navy Vessels Built In China Damaged In Tornado Full Statement From Defense

Apr 30, 2025 -

Rcb Triumph Highlights Delhi Capitals Tactical Flaws Kumble Bangar React

Apr 30, 2025

Rcb Triumph Highlights Delhi Capitals Tactical Flaws Kumble Bangar React

Apr 30, 2025 -

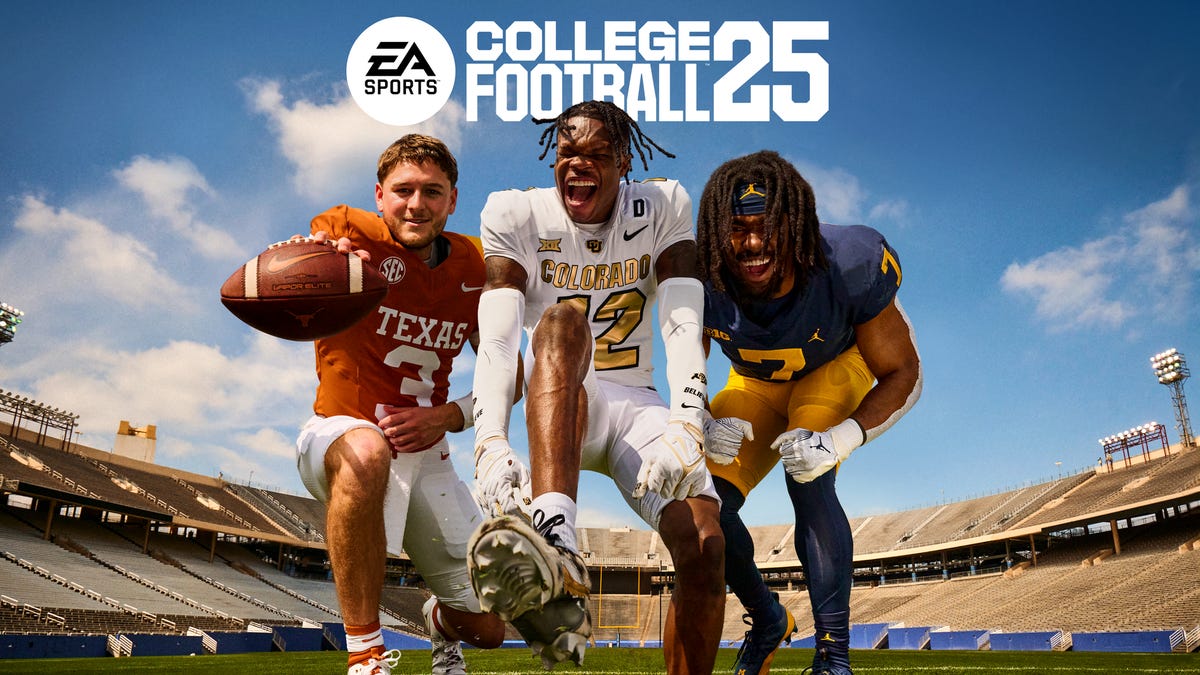

College Football 26 And Madden 26 Bundle Official Release Date Announcement

Apr 30, 2025

College Football 26 And Madden 26 Bundle Official Release Date Announcement

Apr 30, 2025