Does Warren Buffett's Approach To Risk Apply To Cryptocurrency Investing?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Does Warren Buffett's Approach to Risk Apply to Cryptocurrency Investing?

The Oracle of Omaha and the volatile world of crypto: a seemingly unlikely pairing. Warren Buffett, renowned for his value investing philosophy and risk-averse strategy, has famously dismissed Bitcoin and other cryptocurrencies. But does his cautious approach to risk truly translate to the unique challenges and opportunities presented by the cryptocurrency market? The answer, as with most things in finance, is nuanced.

Buffett's investment philosophy centers on understanding a company's intrinsic value, its long-term earning potential, and its management team. He favors established businesses with proven track records, shunning speculative ventures. His aversion to risk manifests in his preference for predictable, tangible assets over volatile, less understood investments. This is where the chasm between Buffett's approach and the cryptocurrency landscape becomes apparent.

The Fundamental Differences: Buffett vs. Crypto

Cryptocurrencies, unlike stocks, lack the fundamental backing of a company's assets and earnings. Their value is largely driven by speculation, market sentiment, and technological advancements. This volatility, a core characteristic of the crypto market, directly contradicts Buffett's preference for stability and predictable returns.

-

Tangible Assets vs. Digital Assets: Buffett's portfolio is heavily weighted towards tangible assets with proven value. Cryptocurrencies, on the other hand, are entirely digital, lacking the physical presence of traditional assets. This lack of tangibility contributes to the inherent risk.

-

Intrinsic Value vs. Speculative Value: Buffett meticulously assesses the intrinsic value of a company before investing. Determining the intrinsic value of a cryptocurrency is far more challenging, if not impossible, given the lack of traditional financial metrics. Its value is primarily driven by speculative forces.

-

Long-Term Investing vs. Short-Term Volatility: Buffett is a long-term investor, preferring to hold assets for years, even decades. The cryptocurrency market is known for its extreme short-term volatility, making long-term holding strategies fraught with considerable risk. While some argue for long-term cryptocurrency investment strategies, the historical price swings make this a high-risk proposition.

Where Buffett's Principles Could Apply

Despite the apparent incompatibility, some elements of Buffett's approach can still be relevant to navigating the crypto market:

-

Due Diligence: While the metrics differ, thorough research and understanding of the technology, the team behind a particular cryptocurrency, and the overall market trends remain crucial. Just like Buffett meticulously analyzes companies, crypto investors should carefully assess projects before investing.

-

Diversification: Buffett advocates for diversification to mitigate risk. This principle applies to cryptocurrency investing as well. Diversifying across different cryptocurrencies can help reduce the impact of individual asset price fluctuations.

-

Risk Management: Understanding your risk tolerance is paramount, whether investing in stocks or cryptocurrencies. Never invest more than you can afford to lose. This core tenet of responsible investing transcends asset classes.

Conclusion: A Cautious Approach Remains Essential

While some aspects of Warren Buffett's investment philosophy, such as due diligence and risk management, remain relevant to cryptocurrency investing, his fundamental aversion to volatility and speculation remains a significant hurdle. The cryptocurrency market's inherent volatility and lack of traditional valuation metrics make it a stark contrast to Buffett's preferred investment strategies. Therefore, while learning from Buffett's emphasis on careful analysis is crucial, directly applying his approach wholesale to the crypto world would likely be a recipe for significant losses. Proceed with extreme caution and only invest what you can afford to lose. The crypto market rewards careful research and risk management, but it's a far cry from the predictable world favored by the Oracle of Omaha.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Does Warren Buffett's Approach To Risk Apply To Cryptocurrency Investing?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Young Adult Colon Cancer Risk Factors Prevention And Early Detection

May 25, 2025

Young Adult Colon Cancer Risk Factors Prevention And Early Detection

May 25, 2025 -

Lewis Hamilton Third As Charles Leclerc Tops Monaco Gp Practice Two

May 25, 2025

Lewis Hamilton Third As Charles Leclerc Tops Monaco Gp Practice Two

May 25, 2025 -

Sabalenkas Bold Claim Ready For Roland Garros Challenge Quote Of The Day

May 25, 2025

Sabalenkas Bold Claim Ready For Roland Garros Challenge Quote Of The Day

May 25, 2025 -

Sirens Julianne Moore Milly Alcock Lead Netflixs Scathing Wealth Critique

May 25, 2025

Sirens Julianne Moore Milly Alcock Lead Netflixs Scathing Wealth Critique

May 25, 2025 -

Mickey 17 Streaming Now Where To Watch Bong Joon Hos Latest Film

May 25, 2025

Mickey 17 Streaming Now Where To Watch Bong Joon Hos Latest Film

May 25, 2025

Latest Posts

-

Teslas Pricing Strategy And Its Effect On Electric Vehicle Market Share

May 26, 2025

Teslas Pricing Strategy And Its Effect On Electric Vehicle Market Share

May 26, 2025 -

Nyt Strands Answers Sunday May 25 Solutions

May 26, 2025

Nyt Strands Answers Sunday May 25 Solutions

May 26, 2025 -

Progress Report Funding And Development Of The 2 6 Megajoule Laser At Llnl

May 26, 2025

Progress Report Funding And Development Of The 2 6 Megajoule Laser At Llnl

May 26, 2025 -

Roland Garros Sabalenkas Efficient First Round Performance

May 26, 2025

Roland Garros Sabalenkas Efficient First Round Performance

May 26, 2025 -

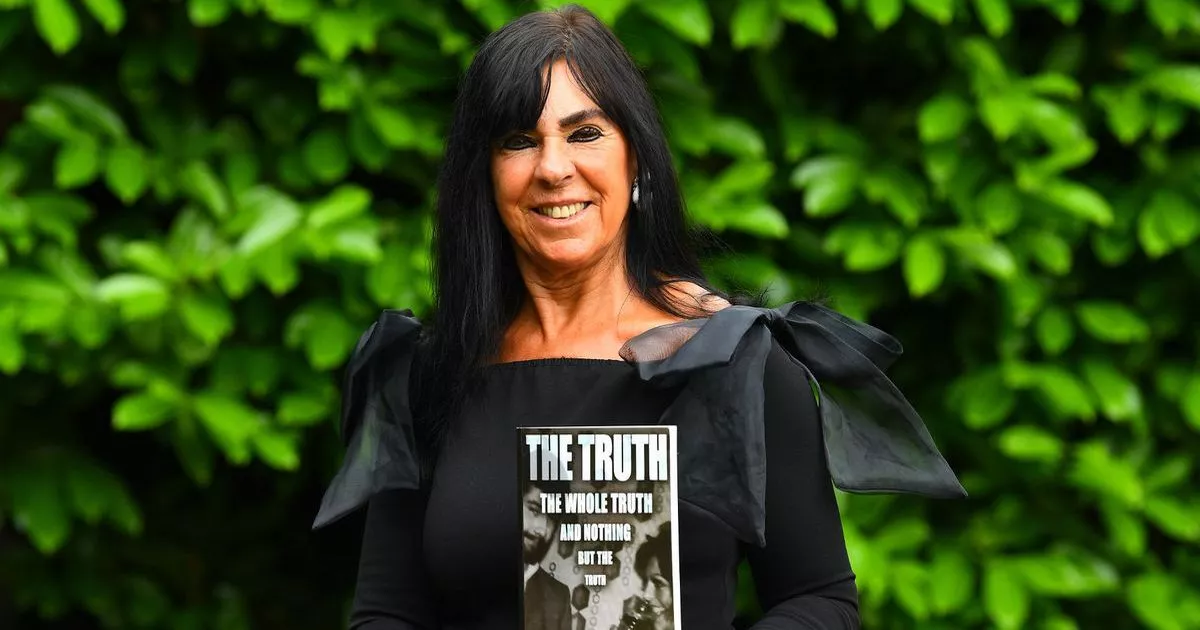

The Challenges And Realities Of Being Married To A Famous Uk Convict

May 26, 2025

The Challenges And Realities Of Being Married To A Famous Uk Convict

May 26, 2025