Does Warren Buffett's Investment Philosophy Translate To Crypto Markets?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Does Warren Buffett's Investment Philosophy Translate to Crypto Markets? A Contrarian View

Warren Buffett, the Oracle of Omaha, is known for his value investing approach, a strategy built on identifying undervalued companies with strong fundamentals and long-term growth potential. But can this tried-and-true method, which has yielded decades of incredible returns in traditional markets, be successfully applied to the volatile and often unpredictable world of cryptocurrencies? The short answer is complex, and likely, no.

While Buffett's principles of thorough due diligence, long-term perspective, and understanding intrinsic value remain crucial for any successful investment strategy, their direct application to crypto presents significant challenges.

The Fundamental Differences: Stocks vs. Crypto

The core difference lies in the underlying assets. Buffett's success hinges on analyzing tangible assets, revenue streams, and future earnings potential of established companies. Cryptocurrencies, on the other hand, lack these traditional metrics. While some crypto projects offer underlying utilities or functionalities (like decentralized finance, or DeFi), the vast majority operate with speculative value as their primary driver. This makes traditional valuation techniques, so vital to Buffett's approach, largely inapplicable.

- Lack of Intrinsic Value: Unlike stocks representing ownership in a company with tangible assets and earnings, many cryptocurrencies lack inherent value beyond their perceived market demand. This makes assessing intrinsic value incredibly difficult, if not impossible.

- Volatility and Speculation: The extreme price volatility in the crypto market is a stark contrast to the more stable (though still fluctuating) nature of the stock market. Buffett's long-term investment horizon struggles to find footing in this environment of rapid price swings driven largely by speculation and sentiment.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains largely undefined in many jurisdictions. This uncertainty introduces significant risk, a factor Buffett diligently avoids in his traditional investments.

Where Buffett's Principles Might Apply (with caveats)

While a direct translation of Buffett's philosophy is unlikely to succeed, some of his core principles can be adapted, albeit cautiously.

- Due Diligence: Understanding the technology, team, and overall utility of a cryptocurrency project is crucial. This requires extensive research beyond simply following price charts.

- Risk Management: Diversification within the crypto market is paramount. Investing only in a few, high-risk assets is akin to gambling, a strategy directly opposed to Buffett's risk-averse approach.

- Long-Term Perspective (with a major caveat): While Buffett advocates for a long-term perspective, the crypto market’s volatility necessitates a more dynamic approach. Holding for the long term in crypto requires significant risk tolerance and acceptance of potential substantial losses.

Conclusion: A Different Game

The crypto market is a vastly different landscape than the traditional equity markets Buffett dominates. While his emphasis on careful research and risk management remains relevant, applying his specific valuation techniques directly to cryptocurrencies is largely futile. Investors seeking to navigate the crypto space should develop a unique strategy that acknowledges the fundamental differences and inherent risks. Trying to force-fit Buffett's methods will likely lead to disappointing results, highlighting the need for a fundamentally different investment philosophy within this nascent asset class.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Does Warren Buffett's Investment Philosophy Translate To Crypto Markets?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Amy Schumers Strategic 45 Million Investment In Real Estate

May 23, 2025

Amy Schumers Strategic 45 Million Investment In Real Estate

May 23, 2025 -

Master Plan 4 Unveiled Teslas Ambitious Terawatt Target Explained

May 23, 2025

Master Plan 4 Unveiled Teslas Ambitious Terawatt Target Explained

May 23, 2025 -

Homeland Securitys Plan To Modernize The Us Coast Guard New Secretary And Operational Changes

May 23, 2025

Homeland Securitys Plan To Modernize The Us Coast Guard New Secretary And Operational Changes

May 23, 2025 -

Martin Place Homeless Kitchen Closure During Vivid Sydney

May 23, 2025

Martin Place Homeless Kitchen Closure During Vivid Sydney

May 23, 2025 -

Japanese And Asian Intellectual Property Rights Head To Web3 Via Animoca Brands And Astar Network

May 23, 2025

Japanese And Asian Intellectual Property Rights Head To Web3 Via Animoca Brands And Astar Network

May 23, 2025

Latest Posts

-

Web3 Expansion Animoca Brands And Astar Network Secure Major Asian Ip Rights

May 23, 2025

Web3 Expansion Animoca Brands And Astar Network Secure Major Asian Ip Rights

May 23, 2025 -

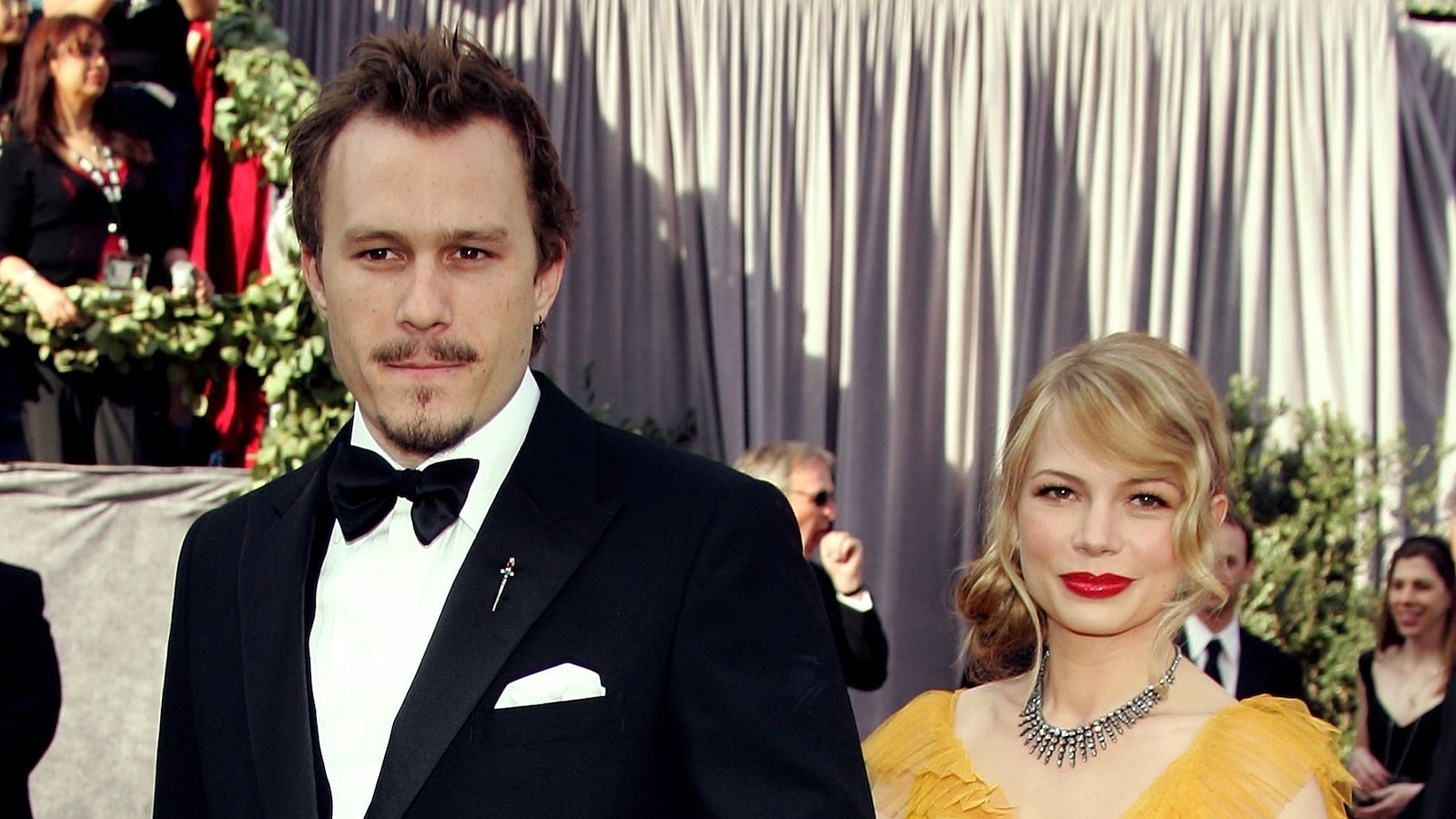

Daughter Matildas Influence Michelle Williams On Life After Heath Ledger

May 23, 2025

Daughter Matildas Influence Michelle Williams On Life After Heath Ledger

May 23, 2025 -

Euphoria Season 3 All Your Burning Questions Answered

May 23, 2025

Euphoria Season 3 All Your Burning Questions Answered

May 23, 2025 -

Is Netflixs Manga Adaptation Bet Worth Watching A Honest Tv Review

May 23, 2025

Is Netflixs Manga Adaptation Bet Worth Watching A Honest Tv Review

May 23, 2025 -

Bitcoins New All Time High What Investors Need To Know Now

May 23, 2025

Bitcoins New All Time High What Investors Need To Know Now

May 23, 2025