DOGE's Disruptive Potential: How It Undermines Traditional Banking Practices

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

DOGE's Disruptive Potential: How it Undermines Traditional Banking Practices

Dogecoin (DOGE), initially conceived as a lighthearted meme-based cryptocurrency, is increasingly demonstrating disruptive potential within the financial landscape. While its inherent volatility and lack of sophisticated underlying technology remain concerns, its growing adoption challenges established banking practices in several key ways. This article explores how DOGE's unique characteristics are impacting the traditional financial system.

H2: The Rise of Peer-to-Peer Transactions

One of the most significant ways DOGE undermines traditional banking is through its facilitation of peer-to-peer (P2P) transactions. Unlike traditional bank transfers, which often involve intermediaries, high fees, and processing delays, DOGE transactions are directly between parties, significantly reducing costs and processing times. This empowers individuals and businesses to bypass traditional banking systems, particularly advantageous in regions with limited access to financial services or high transaction fees. This is a key driver of DOGE's adoption in developing countries.

H2: Challenging the Monopoly on Money Transfer

International money transfers are notoriously expensive and slow through traditional banking channels. DOGE offers a compelling alternative, enabling faster and cheaper cross-border payments. This is particularly appealing to migrant workers sending remittances home, who often face exorbitant fees from traditional providers. The lower transaction costs associated with DOGE represent a substantial benefit, potentially disrupting the multi-billion dollar remittance market dominated by traditional financial institutions.

H3: Transparency and Decentralization

Unlike traditional banking, which operates on a centralized system, DOGE transactions are recorded on a public, decentralized blockchain. This transparency enhances accountability and reduces the risk of fraud and manipulation. While this transparency can be a double-edged sword regarding user privacy, it fosters trust and confidence among users wary of centralized systems.

H2: Accessibility and Inclusivity

Traditional banking often excludes individuals and businesses lacking access to formal financial services (the "unbanked" and "underbanked"). DOGE's accessibility, requiring only a digital wallet and internet access, offers a lifeline for those marginalized by traditional financial systems. This inclusivity is a crucial aspect of DOGE's disruptive potential, fostering financial empowerment in underserved communities globally.

H2: The Limitations and Risks

It’s crucial to acknowledge DOGE's limitations. Its volatility poses significant risks to users, as its value can fluctuate dramatically in short periods. Furthermore, the lack of robust regulatory frameworks surrounding cryptocurrencies creates uncertainties and potential vulnerabilities. The Dogecoin network also faces scalability challenges compared to more established cryptocurrencies.

H2: The Future of DOGE and its Disruptive Potential

Despite these challenges, DOGE's disruptive potential remains undeniable. Its ability to facilitate cheaper, faster, and more accessible transactions is reshaping the financial landscape, particularly impacting the unbanked and challenging traditional banking practices. As the cryptocurrency market matures and regulatory clarity emerges, DOGE's role in the future of finance warrants continued observation. The ongoing evolution of DOGE and similar cryptocurrencies will undoubtedly continue to pressure traditional banking systems to innovate and adapt to remain competitive. The question isn’t if DOGE will continue to disrupt, but how.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on DOGE's Disruptive Potential: How It Undermines Traditional Banking Practices. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Revolutions Offensive Boost Campanas Return And Chancalays Impact

Apr 12, 2025

Revolutions Offensive Boost Campanas Return And Chancalays Impact

Apr 12, 2025 -

Search Intensifies For Missing Boa Constrictor Latest Developments

Apr 12, 2025

Search Intensifies For Missing Boa Constrictor Latest Developments

Apr 12, 2025 -

Lunar Dust Electrostatics Implications For Propellantless Space Drive

Apr 12, 2025

Lunar Dust Electrostatics Implications For Propellantless Space Drive

Apr 12, 2025 -

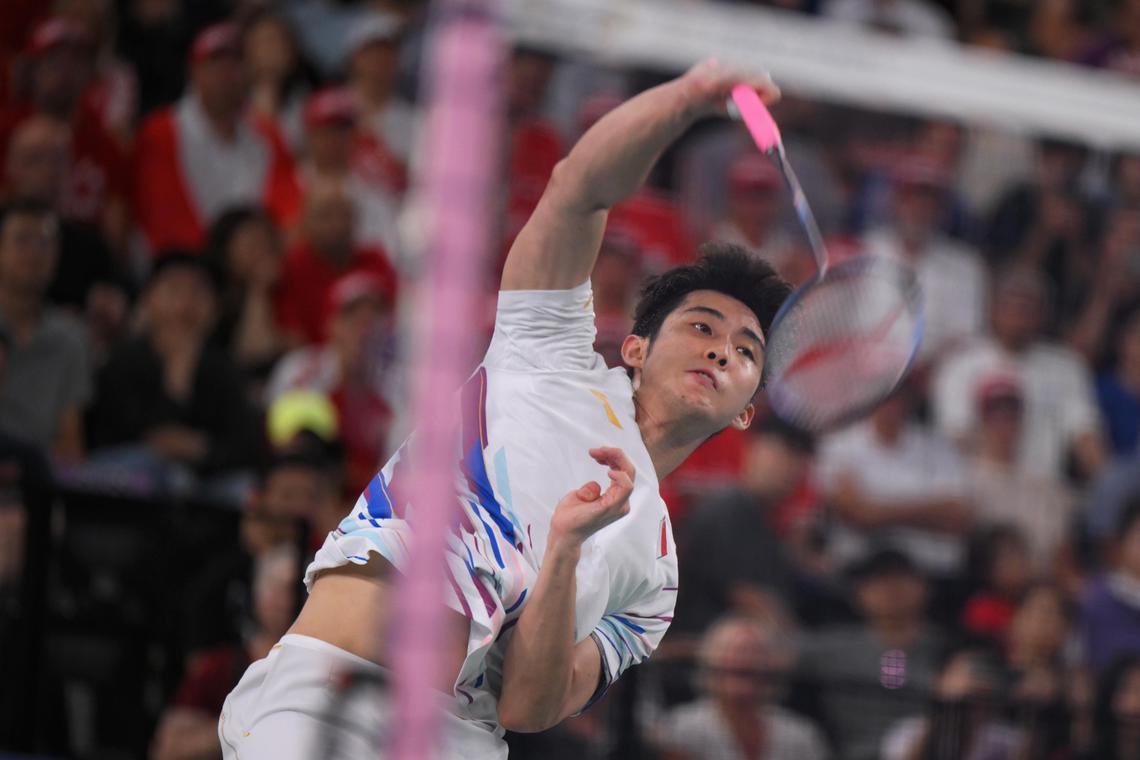

Loh Kean Yew Wins Through To Badminton Asia Championships Last Eight

Apr 12, 2025

Loh Kean Yew Wins Through To Badminton Asia Championships Last Eight

Apr 12, 2025 -

What Happened To Tiffany Smith And Piper Rockelle Recent News

Apr 12, 2025

What Happened To Tiffany Smith And Piper Rockelle Recent News

Apr 12, 2025