Dollar Decline Drives Record Crypto Investments From US Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dollar Decline Drives Record Crypto Investments from US Investors

The plummeting value of the US dollar is fueling a surge in cryptocurrency investments from American investors, reaching record levels according to recent market data. This flight to digital assets reflects growing concerns about inflation and the weakening greenback, offering a potential hedge against economic uncertainty. Experts predict this trend will continue as long as the dollar remains volatile.

A Weakening Dollar: The Catalyst for Crypto Adoption

The dollar's decline, driven by factors including persistent inflation and aggressive Federal Reserve interest rate hikes, has pushed investors to seek alternative assets. Cryptocurrencies, often perceived as a decentralized and inflation-resistant store of value, are increasingly attractive in this environment. This shift is particularly pronounced among US investors who are witnessing the erosion of their purchasing power.

Record Investments: Numbers Tell the Story

Data from leading cryptocurrency exchanges show a significant spike in US-based trading volume and investment in major cryptocurrencies like Bitcoin and Ethereum. While specific figures vary depending on the platform, analysts report increases exceeding previous records, indicating a substantial influx of capital fleeing the weakening dollar. This surge isn't limited to seasoned crypto traders; new users are also entering the market at an unprecedented rate.

Why Crypto? Diversification and Inflation Hedge

Several factors contribute to the rising popularity of crypto amongst US investors during this period of dollar decline:

- Diversification: Crypto offers a distinct asset class, allowing investors to diversify their portfolios beyond traditional stocks and bonds. This reduces overall risk and helps mitigate potential losses linked to the dollar's instability.

- Inflation Hedge: Many believe cryptocurrencies, particularly Bitcoin, could act as a hedge against inflation. Their limited supply and decentralized nature are perceived as qualities that protect against currency devaluation.

- Technological Innovation: The underlying blockchain technology behind cryptocurrencies continues to attract investment and innovation, further boosting confidence in the long-term potential of the sector.

- Accessibility: Increased accessibility through user-friendly exchanges and platforms has made cryptocurrency investment easier than ever before, drawing in a wider range of participants.

Risks Remain: Navigating the Crypto Market

Despite the apparent appeal, it's crucial to acknowledge the inherent risks associated with cryptocurrency investment. The market is highly volatile, and prices can fluctuate dramatically in short periods. Investors should proceed with caution, conducting thorough research and only investing what they can afford to lose. Understanding the technology and risks involved is paramount before committing capital.

The Future of Crypto and the Dollar:

The correlation between the dollar's decline and the rise in US crypto investment is undeniable. As the economic landscape continues to evolve, this trend is likely to persist, particularly if inflation remains a concern. However, the long-term impact on both the cryptocurrency market and the US dollar remains to be seen. Experts are closely monitoring the situation, anticipating further shifts in investor behavior and market dynamics. The interplay between fiat currency and digital assets will continue to be a significant focus for market analysts and financial experts globally.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dollar Decline Drives Record Crypto Investments From US Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Madrid Open Swiateks Calm Approach Leads To Quarterfinal Spot After Power Failure

Apr 30, 2025

Madrid Open Swiateks Calm Approach Leads To Quarterfinal Spot After Power Failure

Apr 30, 2025 -

Viola Da Terra Research Pace Students Visit The Azores

Apr 30, 2025

Viola Da Terra Research Pace Students Visit The Azores

Apr 30, 2025 -

Australian Navy Tugboats China Construction Sparks 2025 Election Debate

Apr 30, 2025

Australian Navy Tugboats China Construction Sparks 2025 Election Debate

Apr 30, 2025 -

Cancelo Out Al Hilals Acl Semi Final Hopes Diminished

Apr 30, 2025

Cancelo Out Al Hilals Acl Semi Final Hopes Diminished

Apr 30, 2025 -

499 Overseas Flights Qantas Announces Massive Sale

Apr 30, 2025

499 Overseas Flights Qantas Announces Massive Sale

Apr 30, 2025

Latest Posts

-

Dte Energys 574 Million Rate Hike Proposal A Closer Look At The Details

Apr 30, 2025

Dte Energys 574 Million Rate Hike Proposal A Closer Look At The Details

Apr 30, 2025 -

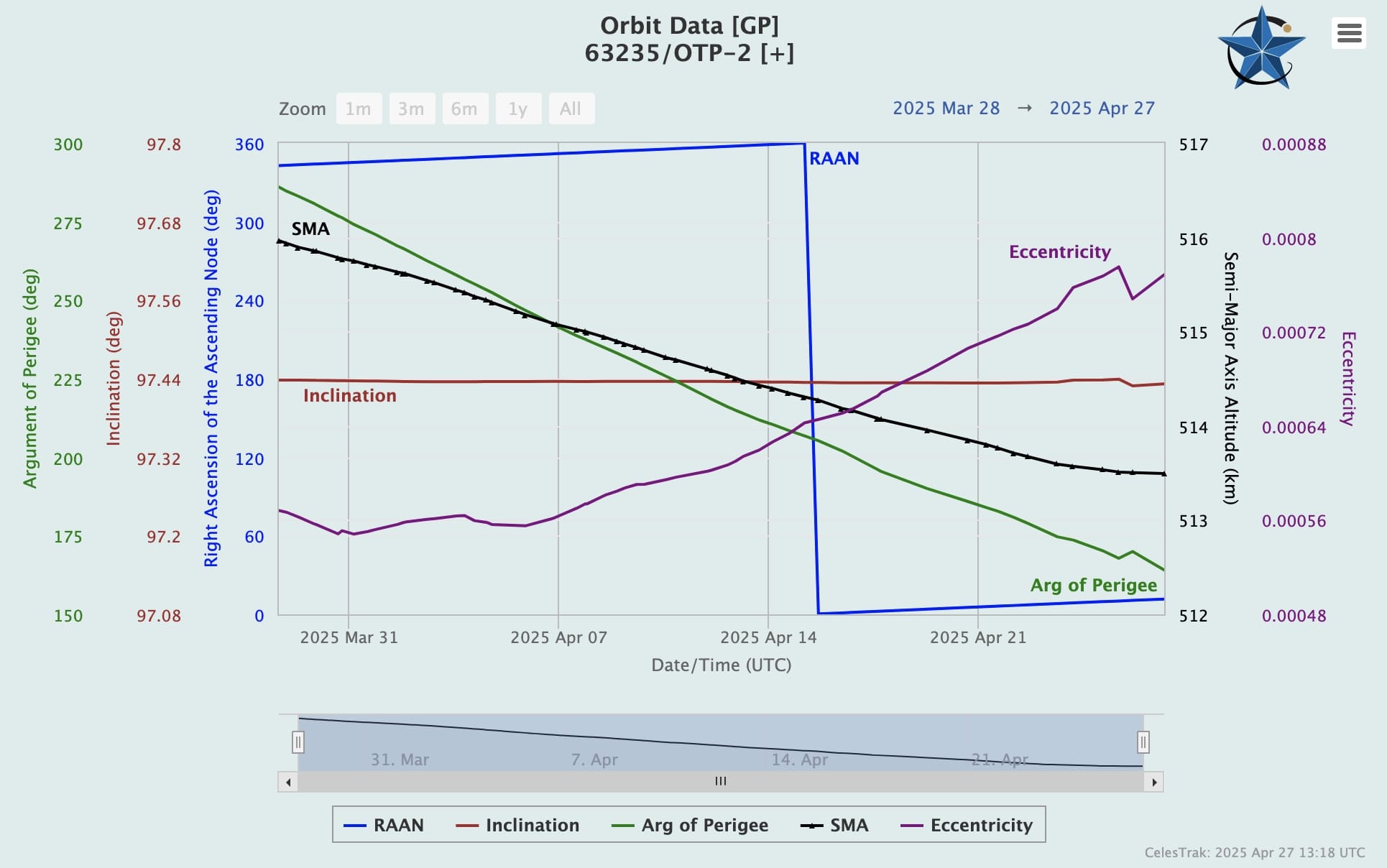

Propellantless Satellite Drive Otp 2 Latest Orbital Data Shows Decline Reduction

Apr 30, 2025

Propellantless Satellite Drive Otp 2 Latest Orbital Data Shows Decline Reduction

Apr 30, 2025 -

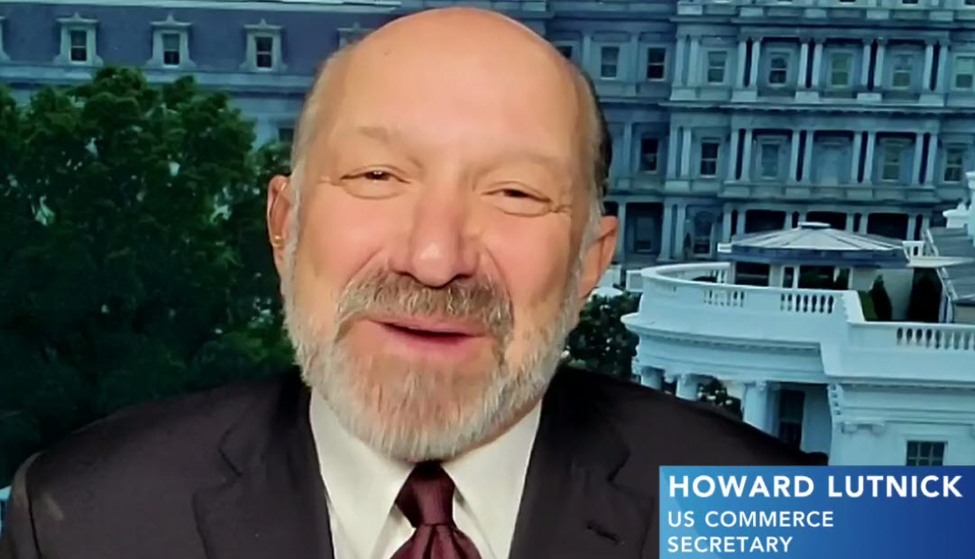

International Business Deal Lutnick Awaits Foreign Parliaments Approval

Apr 30, 2025

International Business Deal Lutnick Awaits Foreign Parliaments Approval

Apr 30, 2025 -

Ge 2025 Erosion Of Public Trust In Pap Government Warns Psps Hazel Poa

Apr 30, 2025

Ge 2025 Erosion Of Public Trust In Pap Government Warns Psps Hazel Poa

Apr 30, 2025 -

Dte Rate Hike Request Expect An 11 Increase On Your Electricity Bill

Apr 30, 2025

Dte Rate Hike Request Expect An 11 Increase On Your Electricity Bill

Apr 30, 2025