Donald Trump And Bitcoin: Is A Presidential Reserve Plan Likely?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Donald Trump and Bitcoin: Is a Presidential Reserve Plan Likely?

The possibility of a President Trump embracing Bitcoin as a national reserve asset has sparked intense debate among financial experts and cryptocurrency enthusiasts. While seemingly improbable given Trump's past pronouncements on cryptocurrencies, the current economic landscape and evolving political strategies might make this scenario more plausible than previously thought. This article delves into the likelihood of such a bold move and explores the potential implications.

Trump's Past Statements on Cryptocurrency: A Skeptical View

Donald Trump's public stance on Bitcoin and cryptocurrencies has, to date, been largely negative. He has voiced concerns about their volatility and potential for illicit activities. Statements like his criticism of Bitcoin as a "scam" in 2019, and his preference for a dollar-centric approach, have solidified the perception of him as a cryptocurrency skeptic. This historical context makes the idea of a Trump administration actively incorporating Bitcoin into a national reserve plan appear highly unlikely at first glance.

Shifting Economic Winds: A Catalyst for Change?

However, the current economic climate presents a drastically different context. The escalating national debt, inflationary pressures, and the growing influence of China's digital yuan are all factors that could force a reconsideration of traditional monetary policy. A Trump administration, facing these pressures, might see Bitcoin as a potential hedge against the weakening dollar, a tool to challenge Chinese economic influence, or even a way to attract younger voters more familiar with digital assets.

Potential Benefits of a Bitcoin Reserve:

- Reduced reliance on the dollar: Diversifying the national reserve away from the US dollar could mitigate risks associated with its fluctuating value and potential geopolitical instability.

- Technological advantage: Bitcoin's decentralized nature and inherent security features could be appealing in a world increasingly reliant on digital transactions.

- Attracting investment: A presidential endorsement of Bitcoin could attract significant foreign investment and boost the cryptocurrency market.

Challenges and Risks:

- Volatility: Bitcoin's price volatility remains a major concern, making it a risky asset for a national reserve.

- Regulation: The lack of clear regulatory frameworks surrounding Bitcoin could pose challenges for its integration into a national reserve.

- Security: Despite its security features, Bitcoin remains susceptible to hacking and theft, demanding robust security protocols at the national level.

The Likelihood: A Calculated Gamble?

While a full-scale adoption of Bitcoin as a primary reserve asset under a Trump presidency remains highly speculative, a more measured approach cannot be entirely dismissed. A gradual introduction of Bitcoin into the national reserves, perhaps as a small percentage alongside traditional assets, might be a more realistic strategy. This would allow the administration to explore the benefits while mitigating the inherent risks associated with such a bold move.

Conclusion: A Future Worth Watching

The prospect of Donald Trump and Bitcoin working together in a national reserve plan is a fascinating scenario with significant implications. While the probability may currently seem low, the ever-changing global economic and political landscape necessitates continuous observation. The possibility of such a surprising strategic shift under a Trump administration shouldn't be completely dismissed. Only time will tell if this unconventional strategy finds its place in the future of American economic policy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Donald Trump And Bitcoin: Is A Presidential Reserve Plan Likely?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Serie A Preview Udinese Vs Bologna Form Team News And Prediction

Apr 29, 2025

Serie A Preview Udinese Vs Bologna Form Team News And Prediction

Apr 29, 2025 -

Update Dengue Fever Cases Rise In The Cook Islands Health Officials Respond

Apr 29, 2025

Update Dengue Fever Cases Rise In The Cook Islands Health Officials Respond

Apr 29, 2025 -

Chat Gpt Down Troubleshooting Guide Common Fixes And Solutions

Apr 29, 2025

Chat Gpt Down Troubleshooting Guide Common Fixes And Solutions

Apr 29, 2025 -

Firm Handshake Fierce Fight Punggol Grc In Ge 2025

Apr 29, 2025

Firm Handshake Fierce Fight Punggol Grc In Ge 2025

Apr 29, 2025 -

Partis Politiques Et Enjeux Ontariens Une Election A Haut Risque

Apr 29, 2025

Partis Politiques Et Enjeux Ontariens Une Election A Haut Risque

Apr 29, 2025

Latest Posts

-

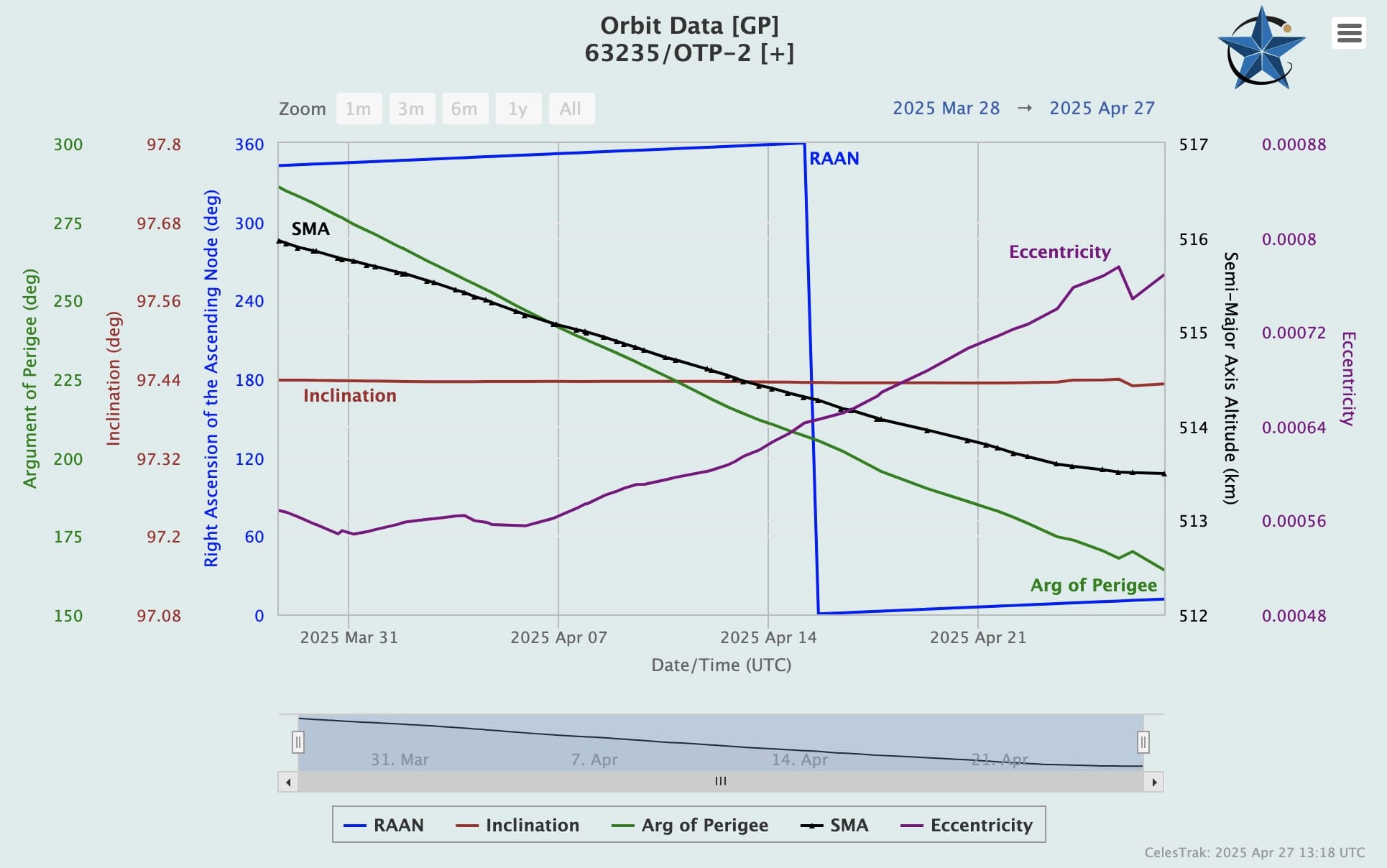

Otp 2 Propellantless Drive Satellite Orbital Decay Slows Promising Breakthrough

Apr 29, 2025

Otp 2 Propellantless Drive Satellite Orbital Decay Slows Promising Breakthrough

Apr 29, 2025 -

Ea Sports College Football 26 And Madden 26 Release Date And Bundle Details Revealed

Apr 29, 2025

Ea Sports College Football 26 And Madden 26 Release Date And Bundle Details Revealed

Apr 29, 2025 -

New Trailer Dwayne Johnsons Intense Portrayal Of Mark Kerr In The Smashing Machine

Apr 29, 2025

New Trailer Dwayne Johnsons Intense Portrayal Of Mark Kerr In The Smashing Machine

Apr 29, 2025 -

The Dangers Of Unrestricted Ai Access To Web3 Cryptographic Keys

Apr 29, 2025

The Dangers Of Unrestricted Ai Access To Web3 Cryptographic Keys

Apr 29, 2025 -

Wp Leader Pritam Singh Rejects Negative Politics Label Ahead Of Ge 2025

Apr 29, 2025

Wp Leader Pritam Singh Rejects Negative Politics Label Ahead Of Ge 2025

Apr 29, 2025