Donald Trump And Bitcoin: What His Reserve Plan Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Donald Trump and Bitcoin: What His Reserve Plan Means for Investors

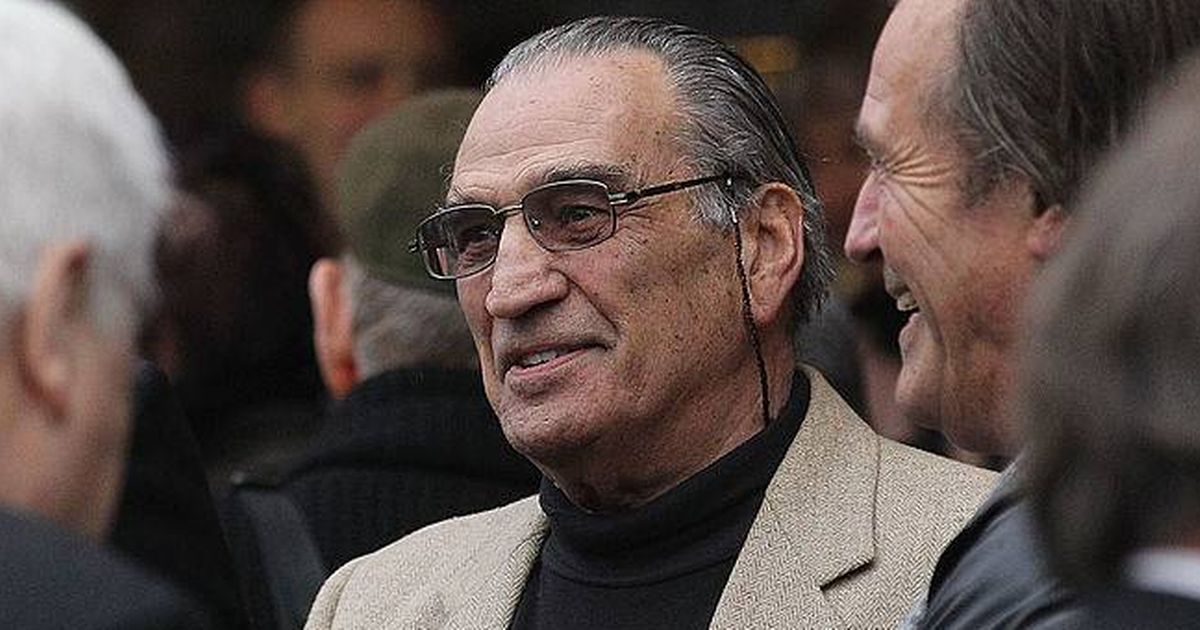

Donald Trump's recent pronouncements on a potential return to the White House have sent shockwaves through various sectors, and the cryptocurrency market is no exception. His previously expressed skepticism towards Bitcoin and cryptocurrencies, coupled with vague mentions of a "reserve plan" regarding the US dollar, has left investors wondering: what does a potential Trump presidency mean for their Bitcoin holdings?

The uncertainty surrounding Trump's economic policies, particularly his unpredictable approach to regulation, is a major concern. While he hasn't explicitly detailed his "reserve plan," the implications for Bitcoin and the broader crypto market are significant and require careful consideration.

Trump's Past Statements on Bitcoin:

Trump's past statements on Bitcoin have been far from supportive. He's frequently voiced concerns about cryptocurrencies, labeling them as "highly volatile" and potentially facilitating illicit activities. This rhetoric, while not directly impacting Bitcoin's functionality, has historically contributed to negative market sentiment. Such statements have often coincided with dips in Bitcoin's price. Understanding this history is crucial for investors attempting to gauge the potential impact of a second Trump term.

Decoding the "Reserve Plan": Potential Scenarios

The ambiguity surrounding Trump's "reserve plan" is a major source of anxiety for investors. Several interpretations are possible:

-

Strengthening the US Dollar: A core element of Trump's economic platform has always been a focus on strengthening the US dollar. If his "reserve plan" involves policies designed to bolster the dollar's global dominance, it could potentially put downward pressure on Bitcoin and other cryptocurrencies, as investors might shift their holdings back to more traditional assets.

-

Increased Regulation: A Trump administration might prioritize increased regulation of the cryptocurrency market. This could range from stricter KYC/AML compliance measures to outright bans on certain crypto activities. While some argue that clearer regulations could bring stability to the market, increased regulatory scrutiny could also stifle innovation and limit adoption.

-

Technological Nationalism: Trump's "America First" ideology could translate into policies that favor domestic financial technologies over cryptocurrencies. This could lead to an uneven playing field, making it harder for cryptocurrencies to compete with US-based financial institutions.

What Investors Should Do:

The uncertainty surrounding a Trump presidency and its implications for Bitcoin necessitates a cautious approach for investors. Here's what you should consider:

-

Diversification: Maintain a diversified investment portfolio. Don't put all your eggs in one basket, whether it's Bitcoin or any other single asset.

-

Risk Tolerance: Evaluate your own risk tolerance. Bitcoin is inherently volatile, and a Trump presidency could exacerbate this volatility. Only invest what you can afford to lose.

-

Stay Informed: Stay updated on political and economic developments. Follow reputable news sources and financial analysts to understand the evolving landscape.

-

Long-Term Perspective: The cryptocurrency market has historically demonstrated resilience. If you believe in the long-term potential of Bitcoin, consider weathering short-term fluctuations caused by political uncertainty.

Conclusion:

Donald Trump's potential return to the White House and his vague "reserve plan" inject significant uncertainty into the Bitcoin market. While it's impossible to predict the future with certainty, understanding his past rhetoric and possible policy implications allows investors to make more informed decisions. A balanced approach combining diversification, risk management, and staying informed is crucial for navigating this period of uncertainty. The future of Bitcoin under a potential second Trump administration remains to be seen, but preparedness is key.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Donald Trump And Bitcoin: What His Reserve Plan Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unlock Screen Times Potential Helpful Strategies For I Phone Users

Apr 25, 2025

Unlock Screen Times Potential Helpful Strategies For I Phone Users

Apr 25, 2025 -

1 1 Billion Profit For Revolut Analyzing The London Fintechs Financial Growth

Apr 25, 2025

1 1 Billion Profit For Revolut Analyzing The London Fintechs Financial Growth

Apr 25, 2025 -

Remembering Gerard Kennedy Neighbours Star Passes Away At 93

Apr 25, 2025

Remembering Gerard Kennedy Neighbours Star Passes Away At 93

Apr 25, 2025 -

U And Alibi Review I Jack Wright A Blend Of Succession And Dallas

Apr 25, 2025

U And Alibi Review I Jack Wright A Blend Of Succession And Dallas

Apr 25, 2025 -

Could Mace Windu Return In A Future Star Wars Project Director Offers Clues

Apr 25, 2025

Could Mace Windu Return In A Future Star Wars Project Director Offers Clues

Apr 25, 2025

Latest Posts

-

Hegseths Decision To Eliminate Women Peace And Security Program Sparks Debate

Apr 30, 2025

Hegseths Decision To Eliminate Women Peace And Security Program Sparks Debate

Apr 30, 2025 -

The Contentious Creation Of Mars Maps A History Of Scientific Dispute

Apr 30, 2025

The Contentious Creation Of Mars Maps A History Of Scientific Dispute

Apr 30, 2025 -

Asus Rog Astral Gpu Sag Solution A Standard For All

Apr 30, 2025

Asus Rog Astral Gpu Sag Solution A Standard For All

Apr 30, 2025 -

Nothings Phone 2 Redefining Smartphone Design With Modularity

Apr 30, 2025

Nothings Phone 2 Redefining Smartphone Design With Modularity

Apr 30, 2025 -

Jeremy Renners Near Fatal Snowplow Accident A Fight For Life

Apr 30, 2025

Jeremy Renners Near Fatal Snowplow Accident A Fight For Life

Apr 30, 2025