Dow Futures Continue Freefall Amidst Widespread Market Sell-Off

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dow Futures Continue Freefall Amidst Widespread Market Sell-Off

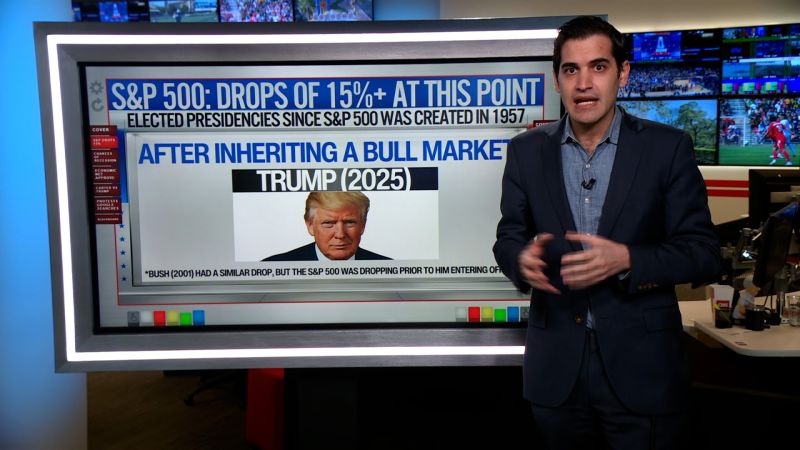

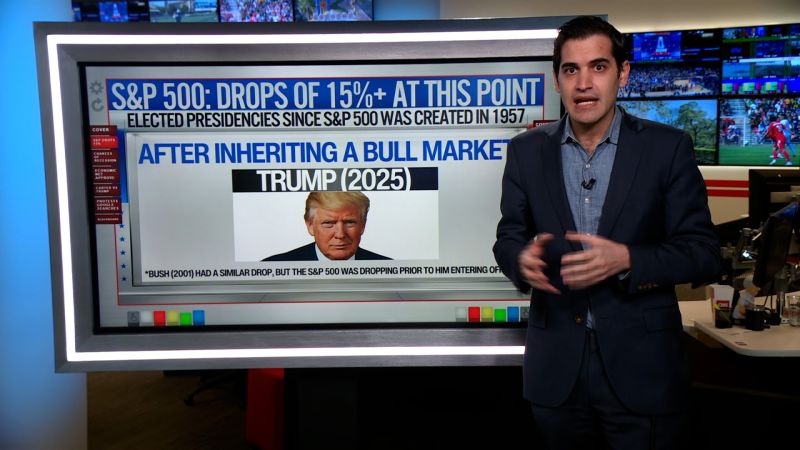

Fear grips Wall Street as a relentless market sell-off sends Dow futures plummeting. Concerns over rising interest rates, persistent inflation, and a potential recession are fueling the dramatic downturn, leaving investors scrambling for safety. The freefall continues, raising serious questions about the future trajectory of the US economy.

The dramatic drop in Dow futures signals a deepening crisis of confidence in the market. This isn't just a blip; it's a sustained sell-off impacting major indices globally. What's driving this widespread panic, and what can we expect next?

Rising Interest Rates: The Primary Culprit?

The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are widely considered the primary catalyst for this market turmoil. Higher rates increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate earnings. This uncertainty is prompting investors to pull back from riskier assets, leading to a significant sell-off across the board. The market is pricing in the possibility of further rate hikes, adding to the anxiety.

- Impact on Businesses: Higher borrowing costs make expansion and investment more expensive, impacting profitability and potentially leading to job cuts.

- Impact on Consumers: Higher interest rates translate to increased costs for mortgages, loans, and credit card debt, reducing consumer spending power.

Inflation Remains Stubbornly High

Despite the Fed's efforts, inflation remains stubbornly high, eroding purchasing power and further dampening consumer confidence. This persistent inflationary pressure is adding fuel to the fire, exacerbating the market's negative sentiment. Until inflation shows clear signs of cooling down, market volatility is likely to persist.

Recession Fears Loom Large

The combination of rising interest rates and persistent inflation has fueled growing concerns about a potential recession. Economists are closely monitoring key economic indicators, such as GDP growth and unemployment figures, to assess the risk of an economic downturn. The fear of a recession is acting as a significant bearish force, pushing investors to seek safer havens like government bonds.

What's Next for the Dow and the Broader Market?

Predicting the market's next move is always challenging, but several factors suggest that the volatility might continue for some time. The ongoing geopolitical uncertainty, coupled with the lingering effects of the pandemic, adds further complexity to the situation. Analysts are closely watching for signs of a potential market bottom, but for now, the outlook remains uncertain.

Key things to watch:

- Federal Reserve announcements: Future interest rate decisions will heavily influence market sentiment.

- Inflation data: Any significant changes in inflation rates will impact investor confidence.

- Economic indicators: GDP growth, unemployment figures, and consumer spending will be crucial indicators of the economic outlook.

For investors, this period of market volatility underscores the importance of diversification and a long-term investment strategy. Panicking and making rash decisions based on short-term market fluctuations can be detrimental. Consulting with a financial advisor is crucial during times like these to navigate the complexities of the market and develop a resilient investment plan. The current freefall in Dow futures serves as a stark reminder of the inherent risks involved in the stock market. Staying informed and making well-considered decisions is paramount to weathering this storm.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dow Futures Continue Freefall Amidst Widespread Market Sell-Off. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Budget Friendly Smart Display Showdown Amazons Echo Show Takes On Google

Apr 08, 2025

Budget Friendly Smart Display Showdown Amazons Echo Show Takes On Google

Apr 08, 2025 -

Global Recession Avoided Australias Economic Outlook And Challenges

Apr 08, 2025

Global Recession Avoided Australias Economic Outlook And Challenges

Apr 08, 2025 -

Crypto Exchange Okx Sanctioned 1 2 M Aml Fine In Malta Adds To Us Penalties

Apr 08, 2025

Crypto Exchange Okx Sanctioned 1 2 M Aml Fine In Malta Adds To Us Penalties

Apr 08, 2025 -

Filmmaker Reflects On The Challenging Death Scene In Unicorn

Apr 08, 2025

Filmmaker Reflects On The Challenging Death Scene In Unicorn

Apr 08, 2025 -

Norfolk Islands Isolated Businesses Confront Us Tariff Impact

Apr 08, 2025

Norfolk Islands Isolated Businesses Confront Us Tariff Impact

Apr 08, 2025