Dow Futures Extend Losses Amidst Broad Market Sell-Off

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

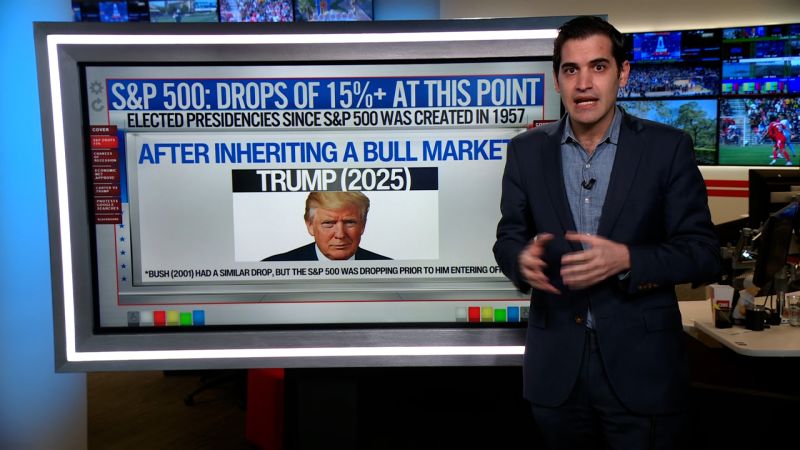

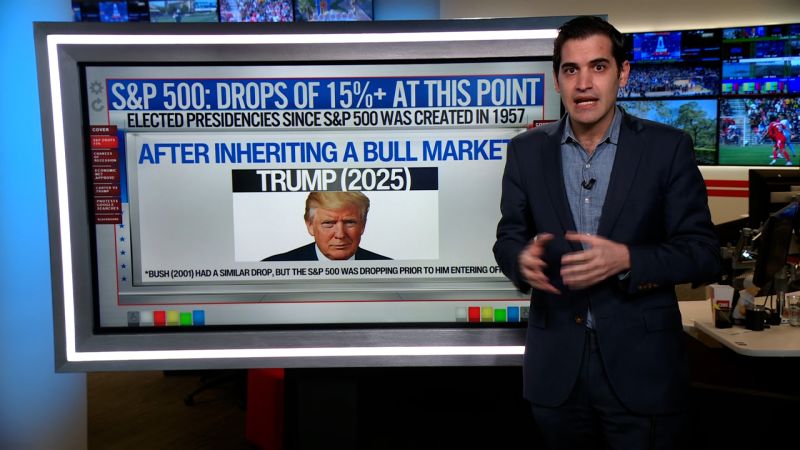

Dow Futures Extend Losses Amidst Broad Market Sell-Off: Fears of Recession Deepen

Wall Street experienced a significant downturn today, with Dow futures extending their losses amidst a broader market sell-off. Concerns over rising interest rates, persistent inflation, and a potential recession are fueling investor anxieties, leading to widespread selling across major indices. The sell-off underscores growing uncertainty about the economic outlook and the Federal Reserve's ability to engineer a "soft landing."

This morning's decline follows a week of volatile trading, leaving investors on edge. The persistent negative sentiment suggests a deeper underlying concern than just short-term market fluctuations. Let's delve into the key factors contributing to this market turmoil:

Rising Interest Rates and Inflationary Pressures

The Federal Reserve's ongoing efforts to combat inflation through interest rate hikes are a primary driver of the current market sell-off. While higher rates aim to cool the economy and curb inflation, they also increase borrowing costs for businesses and consumers, potentially slowing economic growth and increasing the risk of a recession. The market is grappling with the delicate balancing act the Fed faces: taming inflation without triggering a significant economic downturn.

- Higher borrowing costs: Increased interest rates make it more expensive for businesses to invest and expand, impacting job growth and overall economic activity.

- Reduced consumer spending: Higher rates also lead to increased borrowing costs for consumers, potentially reducing spending and impacting economic growth.

- Inflationary concerns: While interest rate hikes aim to curb inflation, there are concerns that the current measures may not be sufficient to bring inflation down to the Fed's target level.

Recession Fears Loom Large

The combination of rising interest rates and persistent inflation is fueling growing fears of a recession. Economic indicators are sending mixed signals, adding to the uncertainty. Concerns about corporate earnings and potential future profit reductions are also contributing to the sell-off.

- Inverted yield curve: The persistent inversion of the yield curve – where short-term Treasury yields exceed long-term yields – is a historically reliable recession predictor.

- Weakening economic data: Some recent economic data points, such as slowing consumer spending and manufacturing output, have further fueled recession anxieties.

- Geopolitical uncertainty: Global geopolitical instability, including the ongoing war in Ukraine and tensions in other regions, adds to the overall economic uncertainty.

What This Means for Investors

The current market sell-off highlights the importance of a diversified investment strategy and a long-term perspective. Investors should carefully assess their risk tolerance and consider adjusting their portfolios based on their individual circumstances and financial goals. Seeking professional financial advice is highly recommended during periods of market volatility.

Key Takeaways:

- Dow futures extend losses amidst a broader market sell-off.

- Rising interest rates and persistent inflation are major contributing factors.

- Growing fears of a recession are adding to investor anxieties.

- Investors should consider diversifying their portfolios and seeking professional advice.

This situation is rapidly evolving, and we will continue to monitor the markets closely and provide updates as they become available. Stay tuned for further analysis and insights as the situation unfolds. Remember to consult with a financial advisor before making any significant investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dow Futures Extend Losses Amidst Broad Market Sell-Off. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jacques Villeneuve Observes Uncharacteristic Change In F1 Drivers Behavior

Apr 07, 2025

Jacques Villeneuve Observes Uncharacteristic Change In F1 Drivers Behavior

Apr 07, 2025 -

Cara Klaim Saldo Dana Gratis Rp250 000 Yang Resmi And Aman

Apr 07, 2025

Cara Klaim Saldo Dana Gratis Rp250 000 Yang Resmi And Aman

Apr 07, 2025 -

Fake Ideas Contest Hobart Stadiums Agonocratic Spectacle

Apr 07, 2025

Fake Ideas Contest Hobart Stadiums Agonocratic Spectacle

Apr 07, 2025 -

Wiliames New Role Leading The Bulldogs Nrlw

Apr 07, 2025

Wiliames New Role Leading The Bulldogs Nrlw

Apr 07, 2025 -

Roblox And Google A Strategic Partnership Redefining Immersive Advertising

Apr 07, 2025

Roblox And Google A Strategic Partnership Redefining Immersive Advertising

Apr 07, 2025