Dow Futures Fall Sharply: What's Driving The Market Decline?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

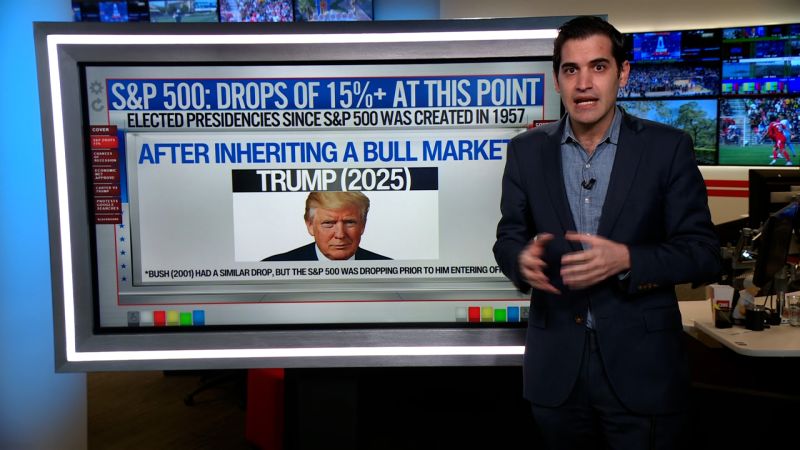

Dow Futures Fall Sharply: What's Driving the Market Decline?

Wall Street opened with a significant downturn, sending shockwaves through the financial markets. Dow futures plummeted sharply, signaling a potential day of heavy losses for investors. This unexpected dip leaves many questioning the underlying causes of this market decline. While pinpointing a single culprit is difficult, several factors are contributing to the current volatility.

Understanding the Dow Futures Drop:

The dramatic fall in Dow futures reflects a broader sense of unease within the market. These futures contracts, which represent an agreement to buy or sell the Dow Jones Industrial Average at a future date, are often used as a predictor of the stock market's overall direction. Their sharp decline suggests a significant correction may be underway.

Key Factors Fueling the Market Decline:

Several intertwined factors are contributing to the current market uncertainty:

-

Inflationary Pressures: Persistent inflation remains a major concern. Higher-than-expected inflation figures could prompt the Federal Reserve to maintain or even increase interest rates, potentially slowing economic growth and impacting corporate earnings. This uncertainty is prompting investors to take a more cautious approach.

-

Geopolitical Instability: Ongoing geopolitical tensions, particularly the war in Ukraine, continue to create market volatility. The conflict's impact on energy prices and global supply chains adds to the existing economic pressures. Uncertainty about the future trajectory of the conflict makes investors hesitant.

-

Earnings Season Concerns: The upcoming earnings season is adding to the anxiety. Concerns about slowing corporate earnings growth, particularly in certain sectors, are impacting investor sentiment. Disappointing results from major companies could trigger further market declines.

-

Rising Interest Rates: The Federal Reserve's efforts to combat inflation through interest rate hikes have created a challenging environment for businesses and consumers alike. Higher borrowing costs can stifle economic activity and impact corporate profitability. The anticipation of further rate increases is weighing heavily on the market.

-

Potential Recession Fears: The combination of inflation, rising interest rates, and geopolitical instability has fueled concerns about a potential recession. This fear is driving investors to seek safer assets, leading to a sell-off in riskier stocks.

What Investors Should Do:

The current market volatility underscores the importance of a well-diversified investment portfolio and a long-term investment strategy. Investors should avoid panic selling and instead focus on their overall financial goals. Consulting with a financial advisor can provide personalized guidance during periods of market uncertainty.

Looking Ahead:

The coming days will be crucial in determining the trajectory of the market. Further economic data releases, corporate earnings announcements, and any developments on the geopolitical front will significantly influence investor sentiment. It is imperative to stay informed and monitor market trends closely. The situation remains fluid, and experts are closely analyzing the situation to predict future market movements.

Keywords: Dow Futures, Market Decline, Stock Market Crash, Stock Market Volatility, Inflation, Interest Rates, Recession, Geopolitical Instability, Earnings Season, Investment Strategy, Financial Advice, Market Trends.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dow Futures Fall Sharply: What's Driving The Market Decline?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Angels Offensive Explosion Crushes Guardians

Apr 08, 2025

Angels Offensive Explosion Crushes Guardians

Apr 08, 2025 -

End Of An Era Dan Biggars Retirement From International Rugby

Apr 08, 2025

End Of An Era Dan Biggars Retirement From International Rugby

Apr 08, 2025 -

Elon Musk Doge And A Free Federal Building Jd Vance Offers Clarity On Recent Events

Apr 08, 2025

Elon Musk Doge And A Free Federal Building Jd Vance Offers Clarity On Recent Events

Apr 08, 2025 -

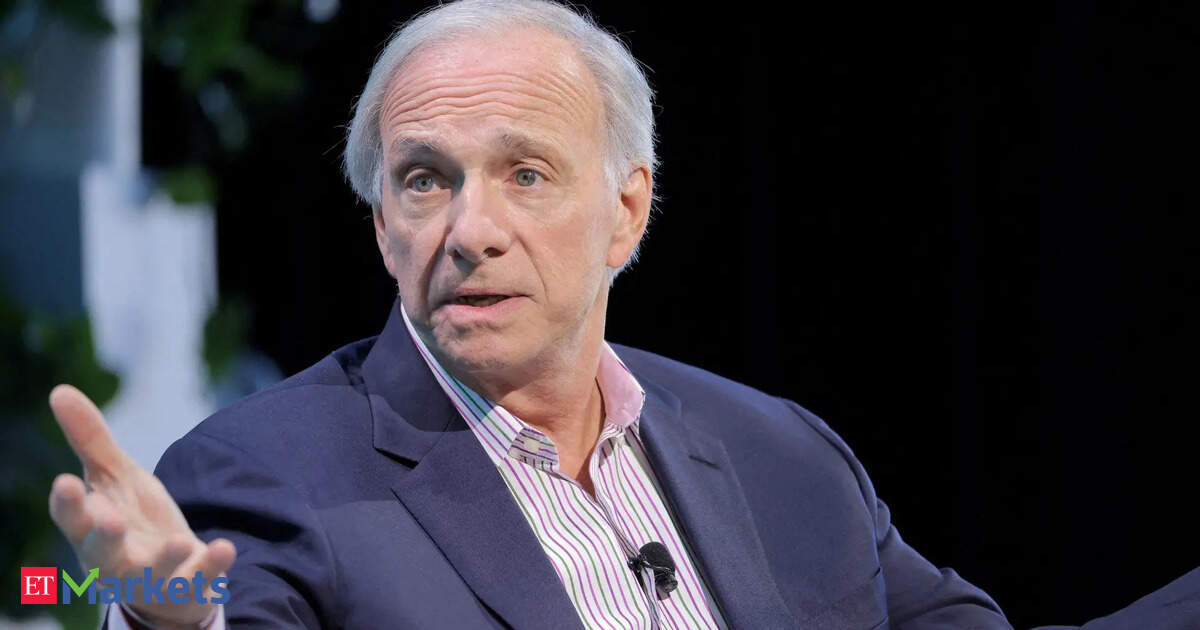

Ray Dalio On Global Shift Us Economic Weakness And Chinas Rise

Apr 08, 2025

Ray Dalio On Global Shift Us Economic Weakness And Chinas Rise

Apr 08, 2025 -

Retractable Touchpad Unique Feature On New Dual Screen Laptop

Apr 08, 2025

Retractable Touchpad Unique Feature On New Dual Screen Laptop

Apr 08, 2025