Dow Futures Plunge: Market Sell-Off Deepens

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

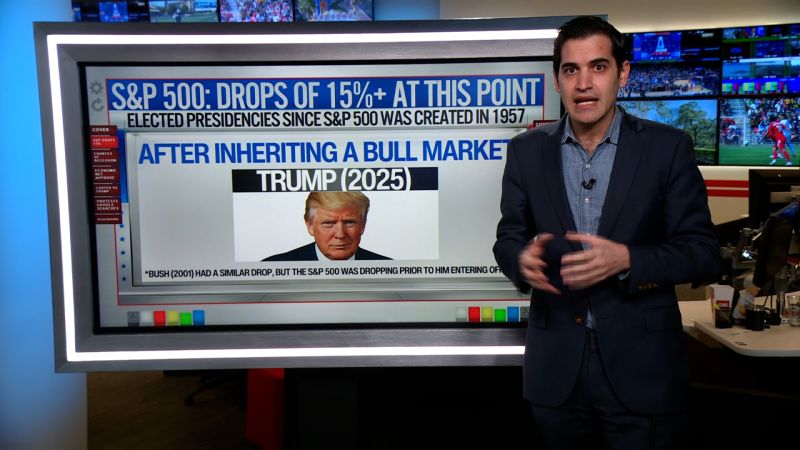

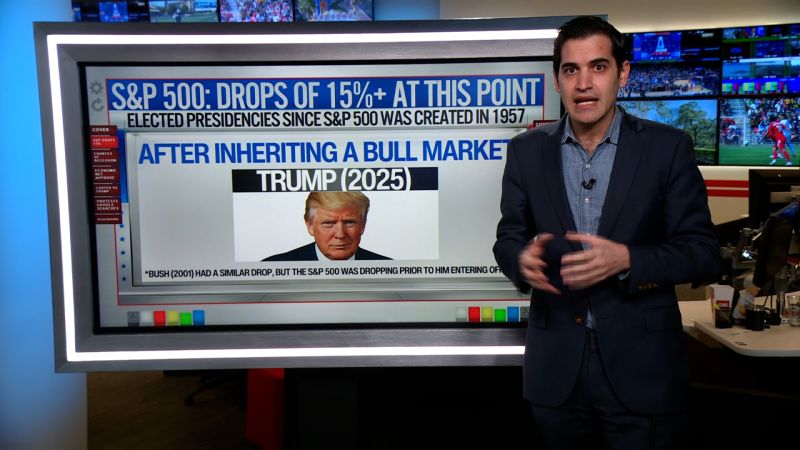

Dow Futures Plunge: Market Sell-Off Deepens Amidst Rising Interest Rate Fears

Investors brace for another turbulent day as Dow futures plummet, signaling a deepening market sell-off fueled by persistent concerns over rising interest rates and persistent inflation.

The global markets are experiencing a significant downturn, with Dow futures plunging sharply overnight, pointing towards a potentially volatile trading session on Wall Street. This steep decline follows a week of considerable losses, deepening anxieties among investors already grappling with economic uncertainty. The primary driver behind this sell-off appears to be the ongoing debate surrounding interest rate hikes by major central banks, particularly the Federal Reserve.

<h3>Rising Interest Rates: The Primary Culprit</h3>

The Federal Reserve's aggressive approach to combating inflation through interest rate increases continues to cast a long shadow over the market. While higher rates aim to curb inflation, they also increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate earnings. This creates a challenging environment for investors who are now grappling with the potential for a recession. Analysts predict further rate hikes in the coming months, adding to the pressure on already vulnerable markets.

<h3>Inflation Remains Stubbornly High</h3>

Adding fuel to the fire is the persistent inflation plaguing the global economy. Recent economic data has shown inflation remaining stubbornly high, defying predictions of a significant slowdown. This persistent inflation necessitates further intervention from central banks, reinforcing the expectation of continued interest rate hikes, further fueling market anxieties.

<h3>What This Means for Investors</h3>

The current market volatility presents significant challenges for investors. The steep decline in Dow futures underscores the need for a cautious approach, with many experts recommending diversification and a long-term investment strategy. Short-term market fluctuations should be viewed within the context of broader economic trends and long-term investment goals.

- Diversification: Spreading investments across different asset classes can help mitigate risk during periods of market turmoil.

- Long-Term Perspective: Focusing on long-term investment goals rather than reacting to short-term market fluctuations is crucial.

- Risk Assessment: A thorough risk assessment is essential before making any investment decisions, especially in times of high market volatility.

<h3>Looking Ahead: Uncertainty Remains</h3>

The outlook remains uncertain, with market analysts offering varying predictions. Some suggest the sell-off may be short-lived, while others warn of a more prolonged period of volatility. The situation warrants close monitoring of economic indicators and central bank announcements. The coming weeks will be critical in determining the direction of the market, and investors are advised to stay informed and adapt their strategies accordingly. The interplay between inflation, interest rates, and economic growth will continue to be the key factors shaping market performance. This situation highlights the importance of informed decision-making and a well-defined investment strategy, particularly in times of economic uncertainty. The global markets remain susceptible to further shocks, emphasizing the need for vigilance and adaptability in investment strategies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dow Futures Plunge: Market Sell-Off Deepens. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chinese Markets Crumble Indices Close Over 7 Lower

Apr 07, 2025

Chinese Markets Crumble Indices Close Over 7 Lower

Apr 07, 2025 -

Dan Biggars Retirement A Look Back At The Welsh Fly Halfs Legacy

Apr 07, 2025

Dan Biggars Retirement A Look Back At The Welsh Fly Halfs Legacy

Apr 07, 2025 -

Antonellis Fight Back Overcoming Adversity At The Japanese Gp

Apr 07, 2025

Antonellis Fight Back Overcoming Adversity At The Japanese Gp

Apr 07, 2025 -

Dow Futures Dive 1000 Points Tariff Worries Deepen Market Crisis

Apr 07, 2025

Dow Futures Dive 1000 Points Tariff Worries Deepen Market Crisis

Apr 07, 2025 -

Australian F1 Fans Your Guide To The 2025 Japanese Gp Start Time

Apr 07, 2025

Australian F1 Fans Your Guide To The 2025 Japanese Gp Start Time

Apr 07, 2025