Dow Futures Tank Amidst Continued Market Sell-Off

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dow Futures Tank Amidst Continued Market Sell-Off: Investors Brace for Further Volatility

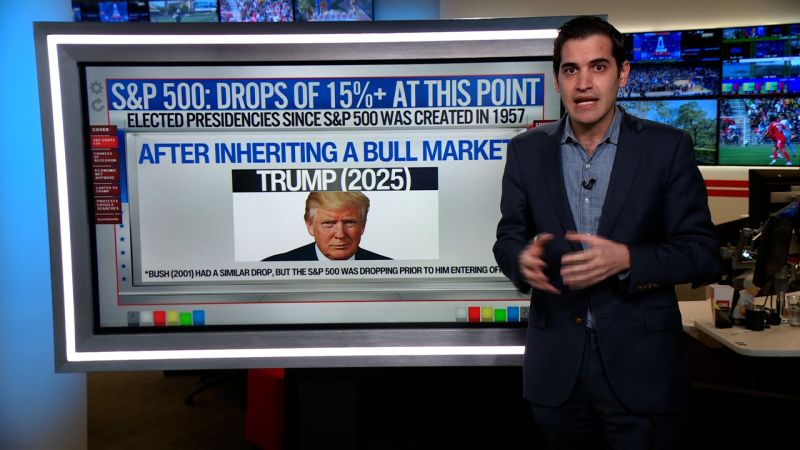

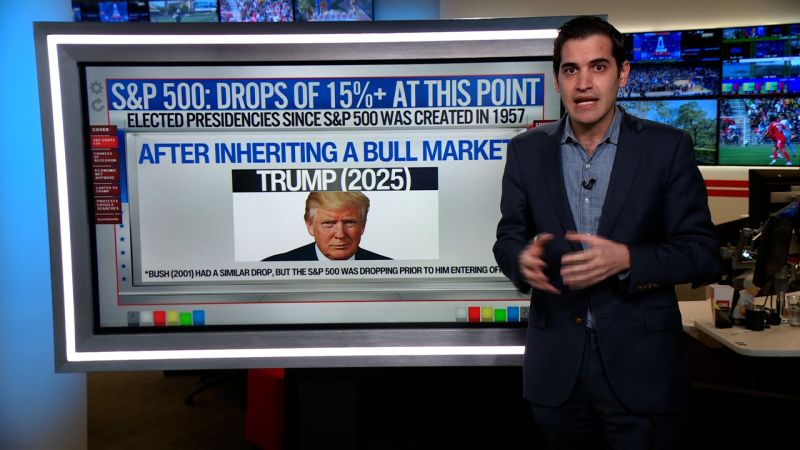

Wall Street is bracing for another day of turmoil as Dow futures plummet, signaling a continuation of the recent market sell-off. Concerns about inflation, rising interest rates, and a potential recession are fueling the downward trend, leaving investors on edge. The pre-market slump suggests a challenging trading session ahead for major indices.

The dramatic drop in Dow futures follows a week of significant losses across global markets. This persistent sell-off reflects a growing pessimism among investors regarding the economic outlook. Several factors contribute to this unease, creating a perfect storm for market volatility.

Inflationary Pressures and the Fed's Response

One of the primary drivers behind the market downturn is persistent inflation. Despite recent efforts by the Federal Reserve to curb inflation through interest rate hikes, price increases remain stubbornly high. This persistent inflation erodes purchasing power and increases the cost of borrowing, impacting both businesses and consumers. The market is anxiously awaiting the next Fed announcement, hoping for clarity on the future course of monetary policy.

- Key concerns: The speed and effectiveness of the Fed's actions in taming inflation.

- Market reaction: Investors are pricing in the risk of further rate hikes, leading to decreased valuations across the board.

Recessionary Fears Grip Investors

The possibility of a looming recession is further exacerbating market anxiety. High inflation, coupled with rising interest rates, creates a challenging environment for economic growth. Leading economic indicators are flashing warning signs, fueling speculation of a potential economic slowdown or even a full-blown recession. This uncertainty is prompting investors to move towards safer assets, triggering a sell-off in riskier investments.

- Economic indicators: Weakening consumer spending, declining manufacturing output, and a tightening credit market are all contributing to recessionary fears.

- Investor behavior: Flight to safety is evident, with investors shifting capital towards government bonds and other low-risk assets.

Geopolitical Instability Adds to the Mix

Adding to the existing market pressures is the ongoing geopolitical instability around the globe. The war in Ukraine, coupled with rising tensions in other regions, creates uncertainty and adds to investor apprehension. Geopolitical risks often trigger market volatility, as investors seek to protect their assets from unexpected global events.

- Global uncertainty: The war in Ukraine continues to disrupt supply chains and fuel inflationary pressures.

- Market impact: Uncertainty surrounding geopolitical events contributes to risk aversion and market declines.

What's Next for the Markets?

The current market sell-off presents a challenging environment for investors. While the short-term outlook remains uncertain, analysts are closely monitoring key economic indicators and the Federal Reserve's actions for clues about the future direction of the markets. The ongoing volatility highlights the importance of a well-diversified investment strategy and a long-term perspective.

Investors should carefully consider their risk tolerance and consult with financial advisors before making any significant investment decisions. The situation remains fluid, and further market fluctuations are expected in the coming days and weeks. Staying informed and adapting to the changing market dynamics will be crucial for navigating this period of uncertainty. Keep an eye on updates from leading financial news sources for the latest developments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dow Futures Tank Amidst Continued Market Sell-Off. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Secure Ideas Meets Stringent Security Standards Crest And Cmmc Certified

Apr 08, 2025

Secure Ideas Meets Stringent Security Standards Crest And Cmmc Certified

Apr 08, 2025 -

Izak Rankines Fitness Battle A Crucial Test For Adelaide Crows Ahead Of Gather Round

Apr 08, 2025

Izak Rankines Fitness Battle A Crucial Test For Adelaide Crows Ahead Of Gather Round

Apr 08, 2025 -

2025 Update Monetary Authority Of Singapore Investigates Eight Cases Of Finfluencer Misconduct

Apr 08, 2025

2025 Update Monetary Authority Of Singapore Investigates Eight Cases Of Finfluencer Misconduct

Apr 08, 2025 -

Global Recession Avoided Australias Economic Outlook And Challenges

Apr 08, 2025

Global Recession Avoided Australias Economic Outlook And Challenges

Apr 08, 2025 -

Icc Mens Player Of The Month Nominees Unveiled For March 2025

Apr 08, 2025

Icc Mens Player Of The Month Nominees Unveiled For March 2025

Apr 08, 2025