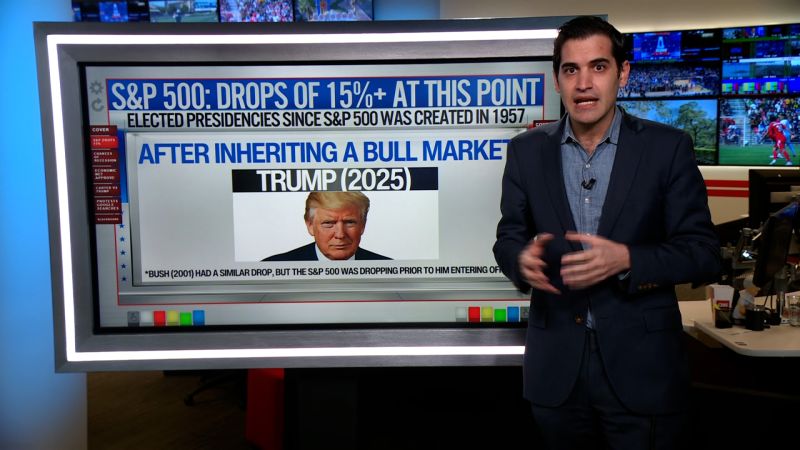

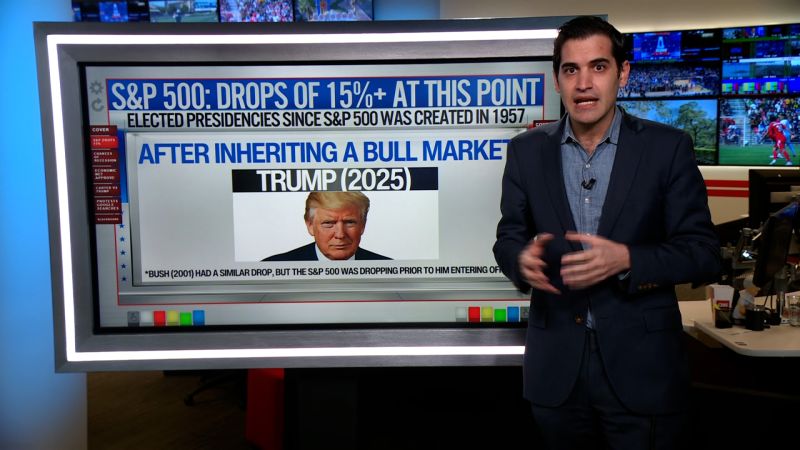

Dow Futures Tank: What's Driving The Continued Market Decline?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dow Futures Tank: What's Driving the Continued Market Decline?

The Dow futures are plummeting, signaling another potential day of significant losses for the US stock market. This continued decline raises serious concerns amongst investors, prompting urgent questions about the underlying causes. While pinpointing a single culprit is difficult, several interconnected factors are contributing to this downward trend. Understanding these dynamics is crucial for navigating the current market volatility.

Rising Interest Rates and Inflationary Pressures: The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are a major driving force behind the market downturn. Higher interest rates increase borrowing costs for businesses, dampening investment and economic growth. Persistent inflation, fueled by factors like supply chain disruptions and strong consumer demand, further exacerbates the situation. The market is anxiously awaiting signs that inflation is cooling down, but for now, the pressure remains intense.

Geopolitical Instability and Global Uncertainty: The ongoing war in Ukraine continues to disrupt global supply chains and energy markets, contributing to inflationary pressures. Geopolitical tensions in other regions also add to the overall uncertainty, making investors hesitant to commit to long-term investments. This uncertainty breeds volatility and fuels sell-offs, particularly in riskier assets.

Earnings Season Concerns: The current earnings season is providing a mixed bag of results. While some companies are exceeding expectations, others are falling short, highlighting the challenges businesses face in the current economic climate. Disappointing earnings reports often trigger immediate sell-offs, contributing to the overall market downturn. Investors are carefully scrutinizing corporate guidance for clues about future performance.

Tech Sector Weakness: The tech sector, a significant component of the Dow Jones Industrial Average, has been particularly hard hit recently. Concerns about slowing growth, rising interest rates impacting valuations, and a potential recession are driving down tech stock prices. This weakness is further dragging down the broader market.

What Does This Mean for Investors?

The continued decline in Dow futures presents significant challenges for investors. However, it's crucial to avoid panic selling. Instead, investors should:

- Diversify their portfolios: Spreading investments across different asset classes can help mitigate risk.

- Re-evaluate risk tolerance: Given the current market volatility, reassessing your investment strategy and risk tolerance is essential.

- Focus on long-term goals: Short-term market fluctuations are normal. Maintaining a long-term investment strategy is crucial.

- Seek professional advice: Consulting with a financial advisor can provide personalized guidance based on individual circumstances.

Looking Ahead:

The future direction of the market remains uncertain. While the factors contributing to the current decline are significant, it's important to remember that market cycles are inherently volatile. Closely monitoring economic indicators, geopolitical developments, and corporate earnings will be crucial in navigating the coming weeks and months. The market's reaction to upcoming economic data releases, particularly inflation figures, will be a key determinant of the market's trajectory. The ongoing battle between inflation and interest rate hikes will continue to shape the investment landscape. Stay informed, stay diversified, and stay patient.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dow Futures Tank: What's Driving The Continued Market Decline?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Get Ready Sabrina Carpenters Fortnite Festival Concert Date Revealed

Apr 08, 2025

Get Ready Sabrina Carpenters Fortnite Festival Concert Date Revealed

Apr 08, 2025 -

Insufficient Details Emerge In Kelloggs Data Breach Announcement

Apr 08, 2025

Insufficient Details Emerge In Kelloggs Data Breach Announcement

Apr 08, 2025 -

Tik Tok Ban Date Speculation What We Know So Far

Apr 08, 2025

Tik Tok Ban Date Speculation What We Know So Far

Apr 08, 2025 -

Apple Watch Series 11 Release Date Price And New Features

Apr 08, 2025

Apple Watch Series 11 Release Date Price And New Features

Apr 08, 2025 -

Death Of A Unicorn A Satirical Take On Corporate Greed Film Review

Apr 08, 2025

Death Of A Unicorn A Satirical Take On Corporate Greed Film Review

Apr 08, 2025