Dow Futures Tumble: What's Driving The Market's Sharp Decline?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dow Futures Tumble: What's Driving the Market's Sharp Decline?

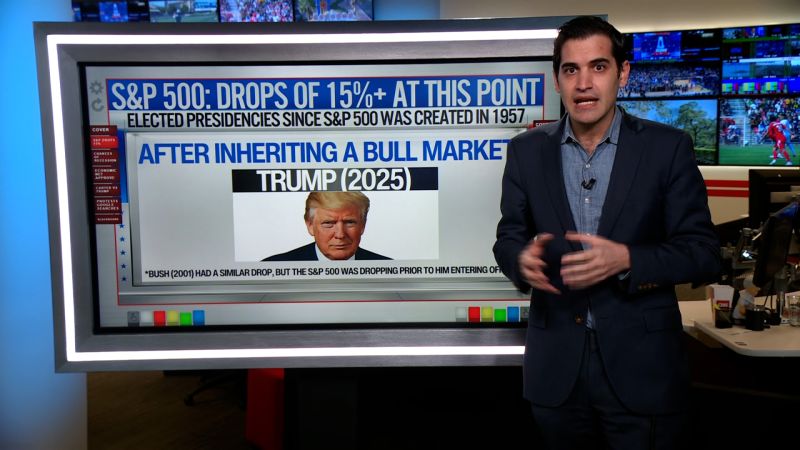

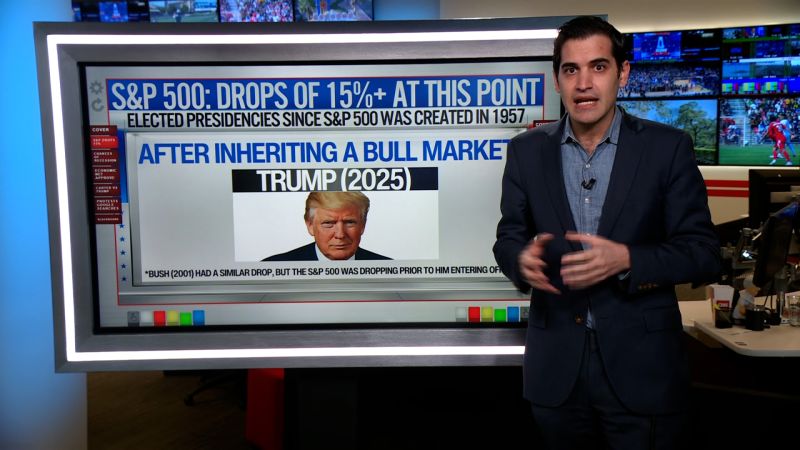

Wall Street opens in the red as investors grapple with a confluence of economic anxieties. The Dow Jones Industrial Average futures experienced a significant drop this morning, signaling a potential day of heavy losses for investors. This sharp decline isn't driven by a single factor, but rather a complex interplay of economic concerns that are leaving market participants jittery. Understanding these contributing factors is crucial for navigating the current volatility.

H2: Rising Interest Rates and Inflationary Pressures

One of the most significant drivers behind the market's downturn is the continued rise in interest rates. The Federal Reserve's ongoing efforts to combat inflation, while necessary to stabilize the economy, are impacting investor sentiment. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate profits. This uncertainty is leading to a sell-off in riskier assets. Furthermore, persistent inflationary pressures, with stubbornly high consumer prices, add to the concerns. The fear of a prolonged period of high inflation erodes purchasing power and dampens consumer confidence, impacting overall economic activity.

H2: Geopolitical Instability and Global Uncertainty

Geopolitical tensions continue to cast a long shadow over the global economy. The ongoing conflict in Ukraine, coupled with escalating tensions in other regions, introduces significant uncertainty into the market. These geopolitical risks disrupt supply chains, increase commodity prices, and create a climate of risk aversion among investors. This uncertainty is prompting investors to move towards safer assets, contributing to the decline in stock futures.

H2: Weak Earnings Reports and Corporate Guidance

Several major corporations have recently released disappointing earnings reports, further fueling the market's decline. Lower-than-expected profits and cautious corporate guidance for the coming quarters are adding to investor anxieties. This suggests that companies are facing headwinds from the current economic environment, impacting future growth prospects and investor confidence. Investors are reassessing their portfolios in light of this weaker-than-anticipated corporate performance.

H3: Key Sectors Feeling the Pinch

The technology sector, often a bellwether for market sentiment, is particularly vulnerable to rising interest rates. High-growth tech companies, many of which are still unprofitable, are disproportionately impacted by increased borrowing costs. This is contributing to the broader market decline. Additionally, the energy sector is experiencing volatility due to global supply chain disruptions and geopolitical factors.

H2: What to Expect in the Coming Days

The current market downturn reflects a complex and evolving economic situation. While a single trigger cannot be identified, the combination of rising interest rates, persistent inflation, geopolitical instability, and weak corporate earnings creates a challenging environment for investors. Market analysts are closely monitoring economic indicators and corporate performance to gauge the potential for a sustained recovery. In the short term, further volatility is expected, emphasizing the need for a cautious approach to investment strategies. Investors should consider diversifying their portfolios and carefully evaluating their risk tolerance. The coming days will be critical in determining the extent and duration of this market correction. Stay informed and consult with financial advisors before making any significant investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dow Futures Tumble: What's Driving The Market's Sharp Decline?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Open Ai Vs Meta The Ai Arms Race Heats Up With Llama 4 And A Powerful New Open Weight Model

Apr 08, 2025

Open Ai Vs Meta The Ai Arms Race Heats Up With Llama 4 And A Powerful New Open Weight Model

Apr 08, 2025 -

Updated Fha Rules What You Need To Know About New Residency Requirements

Apr 08, 2025

Updated Fha Rules What You Need To Know About New Residency Requirements

Apr 08, 2025 -

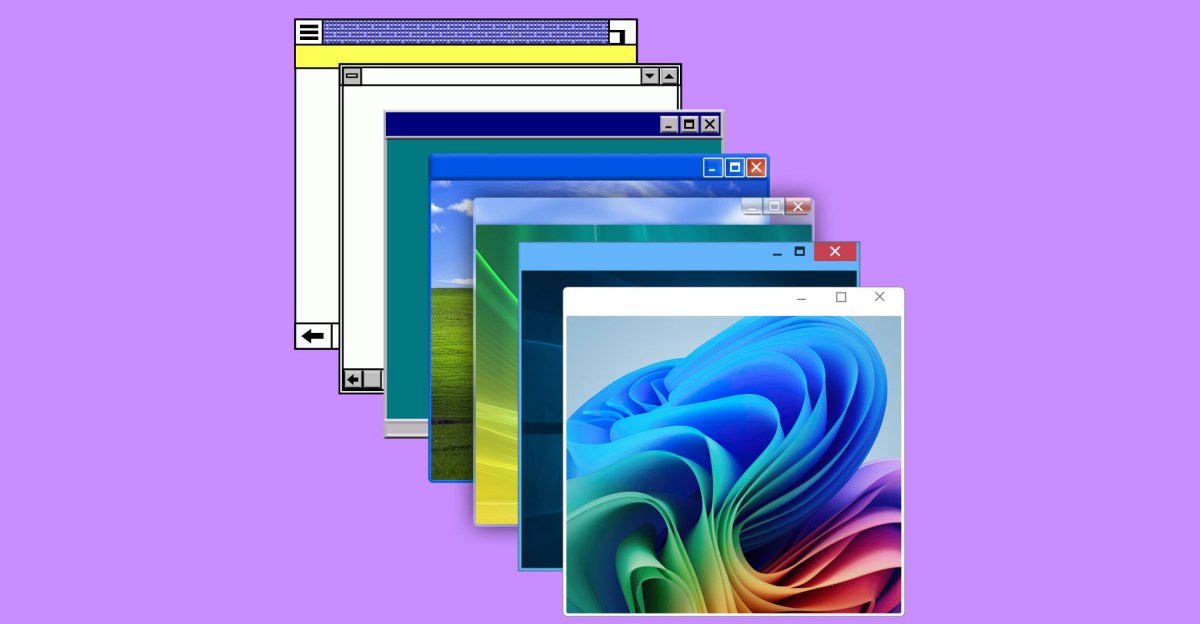

Microsoft At 50 A Retrospective On Leadership Technology And Market Domination

Apr 08, 2025

Microsoft At 50 A Retrospective On Leadership Technology And Market Domination

Apr 08, 2025 -

Assessing Metas Llama 4 Strengths And Weaknesses Compared To Leading Ai Models

Apr 08, 2025

Assessing Metas Llama 4 Strengths And Weaknesses Compared To Leading Ai Models

Apr 08, 2025 -

Caution This Key Bitcoin Metric May Soon Give A Faulty Buy Signal

Apr 08, 2025

Caution This Key Bitcoin Metric May Soon Give A Faulty Buy Signal

Apr 08, 2025