Dow Plunges 800 Points: Market Crash Fears Rise Amid Treasury Yield Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dow Plunges 800 Points: Market Crash Fears Rise Amid Treasury Yield Surge

The Dow Jones Industrial Average suffered a dramatic 800-point plunge today, fueling widespread concerns of a potential market crash. This significant downturn follows a sharp surge in Treasury yields, sending shockwaves through Wall Street and leaving investors on edge. The volatility underscores growing anxieties about inflation, interest rate hikes, and the overall health of the global economy.

Treasury Yields: The Catalyst for Chaos?

The escalating yields on US Treasury bonds are widely considered the primary driver behind today's market turmoil. Higher yields generally indicate increased investor confidence in the economy, but in this instance, the rapid ascent is interpreted as a sign of looming inflation and the Federal Reserve's aggressive monetary tightening policies. This surge makes bonds more attractive than stocks, prompting investors to shift their portfolios, leading to a sell-off in the equity markets.

What Drove the Dow's Dramatic Fall?

Several factors contributed to the Dow's steep decline beyond the Treasury yield surge:

- Inflationary Pressures: Persistent inflation continues to erode purchasing power and dampens consumer spending, impacting corporate earnings and investor sentiment. The fear of sustained high inflation is a significant market headwind.

- Interest Rate Hikes: The Federal Reserve's ongoing efforts to combat inflation through interest rate increases are adding to market uncertainty. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth.

- Geopolitical Instability: Ongoing geopolitical tensions, including the war in Ukraine and rising global uncertainties, further contribute to market volatility and investor apprehension. These factors create a climate of risk aversion.

- Tech Stock Slump: Technology stocks, a significant component of the Dow, experienced particularly sharp declines, exacerbating the overall market downturn. This sector is particularly sensitive to interest rate changes.

Market Crash Fears Intensify

The magnitude of today's drop has reignited fears of a potential market crash. While a crash isn't inevitable, the current market conditions are certainly cause for concern. Many analysts are closely monitoring key economic indicators and the Federal Reserve's next moves for clues about the market's future trajectory.

What Happens Next?

The coming days and weeks will be crucial in determining the market's direction. Investors are anxiously awaiting further economic data and pronouncements from the Federal Reserve to gauge the potential severity and duration of this downturn. Strategies for navigating this volatile period include:

- Diversification: Maintaining a diversified investment portfolio can help mitigate risk.

- Risk Management: Employing sound risk management strategies is crucial in times of market uncertainty.

- Long-Term Perspective: Maintaining a long-term investment perspective is essential to weathering short-term market fluctuations.

Conclusion:

Today's market plunge serves as a stark reminder of the inherent risks involved in investing. While the immediate future remains uncertain, understanding the underlying factors driving market volatility is crucial for investors to make informed decisions and navigate the challenging landscape ahead. The situation warrants close monitoring and a carefully considered investment strategy. Experts advise staying informed about economic developments and consulting with financial advisors to create a robust plan for navigating this turbulent market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dow Plunges 800 Points: Market Crash Fears Rise Amid Treasury Yield Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

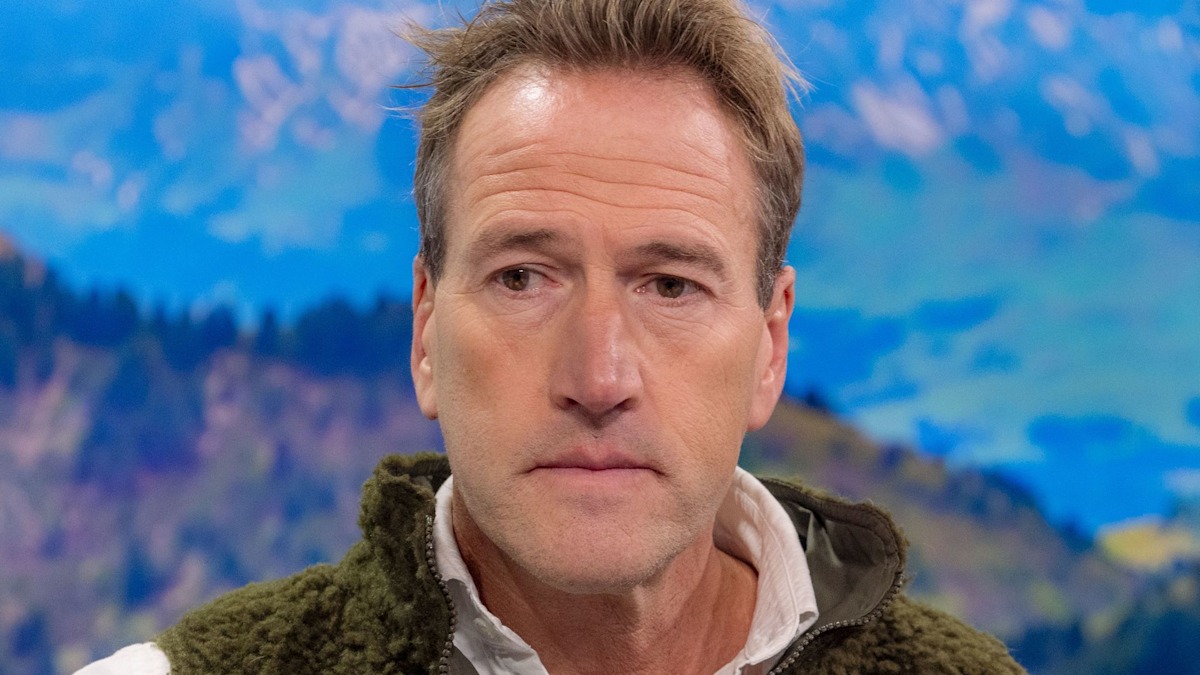

Ben Fogle On The Heartbreak Of Potential Separation From His Teens

May 22, 2025

Ben Fogle On The Heartbreak Of Potential Separation From His Teens

May 22, 2025 -

Bitcoin Surges Past 106 000 Institutional Investment Fuels Rally

May 22, 2025

Bitcoin Surges Past 106 000 Institutional Investment Fuels Rally

May 22, 2025 -

Dhonis Csk Strengthened Key Player To Feature In Ipl 2025

May 22, 2025

Dhonis Csk Strengthened Key Player To Feature In Ipl 2025

May 22, 2025 -

Follow The Action Edmonton Oilers Vs Dallas Stars Live Score And Play By Play

May 22, 2025

Follow The Action Edmonton Oilers Vs Dallas Stars Live Score And Play By Play

May 22, 2025 -

Top Stories From Dell Technologies World 2025 Day Two

May 22, 2025

Top Stories From Dell Technologies World 2025 Day Two

May 22, 2025