Dow, S&P 500, Nasdaq Dive: Bond Yield Surge And Renewed US-China Trade War Fears Shake Markets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dow, S&P 500, Nasdaq Dive: Bond Yield Surge and Renewed US-China Trade War Fears Shake Markets

Wall Street experienced a sharp downturn today, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all plunging significantly. This dramatic market drop is largely attributed to a surge in US Treasury bond yields and resurfacing anxieties about a renewed trade war between the United States and China. Investors, already grappling with persistent inflation concerns, reacted swiftly to these developments, triggering widespread selling across major indices.

Rising Bond Yields: A Major Catalyst for the Market Sell-Off

The 10-year Treasury yield climbed to its highest level in over 14 years, exceeding 4.2%. This rise reflects growing expectations of further interest rate hikes by the Federal Reserve as it combats stubbornly high inflation. Higher bond yields make bonds more attractive relative to stocks, prompting investors to shift their portfolios, thus putting downward pressure on equity markets. This flight to safety significantly contributed to the market's volatility.

Renewed US-China Trade Tensions Add Fuel to the Fire

Adding to the market turmoil, renewed concerns about escalating trade tensions between the US and China emerged. Recent rhetoric and actions from both governments have reignited fears of a full-blown trade war, a scenario that could severely disrupt global supply chains and further destabilize already fragile markets. Uncertainty surrounding future trade policies has created a significant headwind for investor confidence.

Impact on Specific Sectors:

The market downturn wasn't uniform across all sectors. Technology stocks, particularly sensitive to interest rate changes and global economic uncertainty, bore the brunt of the sell-off. The Nasdaq Composite, heavily weighted with tech giants, experienced its most significant daily drop in several weeks. However, the decline wasn't limited to tech; other sectors also felt the pressure.

- Technology: Tech companies, often valued on future growth prospects, were disproportionately affected by rising bond yields.

- Consumer Discretionary: Companies reliant on consumer spending faced headwinds due to concerns about reduced consumer confidence amid inflation and potential economic slowdown.

- Energy: While the energy sector initially showed some resilience, it eventually succumbed to the broader market pressure.

What's Next for Investors?

The current market volatility underscores the challenges investors face in navigating a complex economic environment. The confluence of rising interest rates, persistent inflation, and geopolitical risks creates a challenging landscape for both short-term and long-term investment strategies. Many analysts are closely monitoring developments related to inflation, Federal Reserve policy, and US-China relations for clues about the market's near-term direction.

Key Takeaways:

- Bond yield surge: The increase in US Treasury yields is a significant factor driving the market downturn.

- US-China trade concerns: Renewed trade war fears are adding to investor anxieties.

- Sectoral impact: Technology stocks were particularly hard hit, but the decline was widespread.

- Investor uncertainty: The current environment creates significant uncertainty for investors.

Moving forward, investors should focus on diversification, risk management, and a long-term investment horizon. Seeking professional financial advice is crucial during periods of heightened market volatility. The situation remains fluid, and further updates will be provided as the market evolves. Stay tuned for further analysis and market updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dow, S&P 500, Nasdaq Dive: Bond Yield Surge And Renewed US-China Trade War Fears Shake Markets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ulasan Film The Outpost Sinopsis Dan Perjuangan Melawan Taliban

Apr 12, 2025

Ulasan Film The Outpost Sinopsis Dan Perjuangan Melawan Taliban

Apr 12, 2025 -

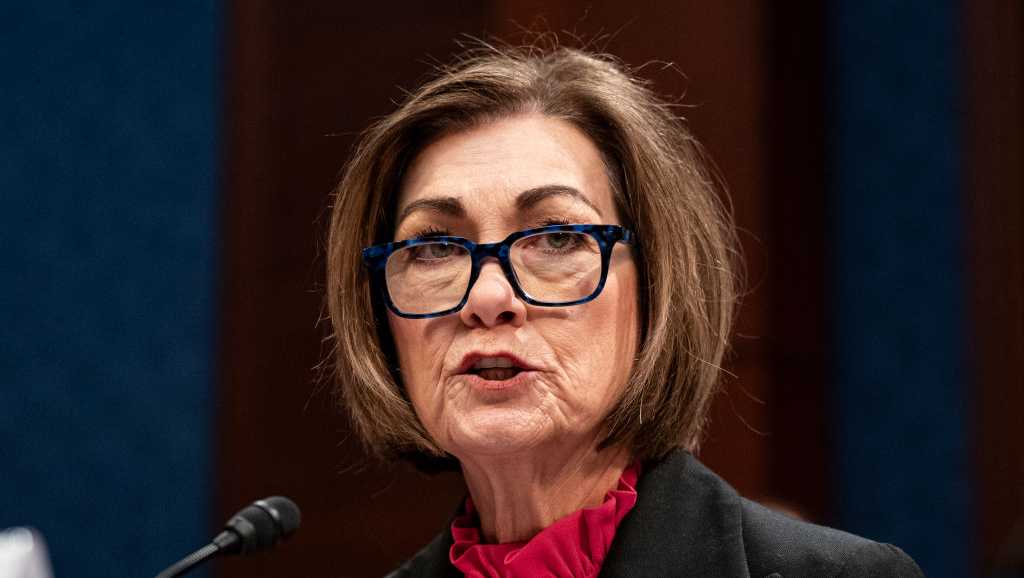

After Much Deliberation Iowa Governor Declines Third Term

Apr 12, 2025

After Much Deliberation Iowa Governor Declines Third Term

Apr 12, 2025 -

Juventus Vs Lecce Game Thread Lineups And Discussion

Apr 12, 2025

Juventus Vs Lecce Game Thread Lineups And Discussion

Apr 12, 2025 -

Anshul Kambojs Ipl 2025 Debut Csks New Player Faces Kkr At Chepauk

Apr 12, 2025

Anshul Kambojs Ipl 2025 Debut Csks New Player Faces Kkr At Chepauk

Apr 12, 2025 -

Aqeela Dan Harry Chemistry Baru Di Sinetron Asmara Gen Z

Apr 12, 2025

Aqeela Dan Harry Chemistry Baru Di Sinetron Asmara Gen Z

Apr 12, 2025