Dow, S&P 500, Nasdaq In Turmoil: Bond Yields And US-China Trade Relations Drive Market Uncertainty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dow, S&P 500, Nasdaq in Turmoil: Bond Yields and US-China Trade Relations Drive Market Uncertainty

The US stock market experienced significant turbulence this week, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all experiencing sharp declines. Investors are grappling with rising bond yields and escalating concerns surrounding US-China trade relations, creating a climate of uncertainty that's sending shockwaves through Wall Street. This volatile market environment has left many wondering what the future holds for their investments.

Rising Bond Yields: A Major Catalyst for Market Volatility

The recent surge in US Treasury bond yields is a primary driver of the current market downturn. Higher yields, often seen as a reflection of increased investor confidence in the economy, can simultaneously detract from the attractiveness of equities. Money flows towards bonds, offering a safer, albeit less potentially lucrative, return. This shift in investor sentiment is directly impacting stock prices across the board. The 10-year Treasury yield, a key benchmark, has climbed significantly in recent weeks, adding to the pressure on already jittery markets.

US-China Trade Relations: A Looming Shadow

Adding fuel to the fire are renewed tensions in US-China trade relations. While a comprehensive trade deal remains elusive, ongoing disagreements and the potential for further tariffs continue to weigh heavily on investor confidence. The uncertainty surrounding future trade policies creates significant risk for multinational corporations, impacting their profitability and, consequently, their stock valuations. This uncertainty is particularly detrimental to technology companies, many of which rely heavily on the Chinese market.

Nasdaq Takes the Biggest Hit: Tech Sector Vulnerability

The technology-heavy Nasdaq Composite has been particularly hard hit, reflecting the sector's sensitivity to both rising interest rates and trade tensions. Many tech companies are heavily reliant on debt financing, making them vulnerable to rising borrowing costs. Furthermore, the sector's significant international exposure exacerbates the impact of trade disputes. This confluence of factors has led to substantial losses in the tech sector, dragging down the overall market.

What's Next for Investors?

The current market volatility underscores the importance of diversification and a long-term investment strategy. While short-term fluctuations are inevitable, focusing on a well-diversified portfolio and a long-term perspective can help mitigate the impact of market downturns. Investors are urged to:

- Monitor economic indicators closely: Keep abreast of developments regarding bond yields, inflation, and trade relations.

- Re-evaluate investment strategies: Consider adjusting your portfolio allocation based on your risk tolerance and financial goals.

- Seek professional advice: Consulting a financial advisor can provide valuable guidance during periods of market uncertainty.

The Road Ahead: Navigating Uncertainty

The interplay of rising bond yields and US-China trade tensions presents a complex challenge for investors. The market's reaction highlights the interconnectedness of global economic forces and the significant impact these factors can have on individual investment portfolios. While the short-term outlook remains uncertain, maintaining a balanced and informed approach is crucial for navigating these turbulent times. The coming weeks will be critical in determining the market's trajectory, and investors will need to remain vigilant and adaptable. The situation remains fluid, requiring continuous monitoring and strategic adjustments to investment portfolios.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dow, S&P 500, Nasdaq In Turmoil: Bond Yields And US-China Trade Relations Drive Market Uncertainty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Speed Showdown Micro Sd Vs Micro Sd Express Performance

Apr 11, 2025

Speed Showdown Micro Sd Vs Micro Sd Express Performance

Apr 11, 2025 -

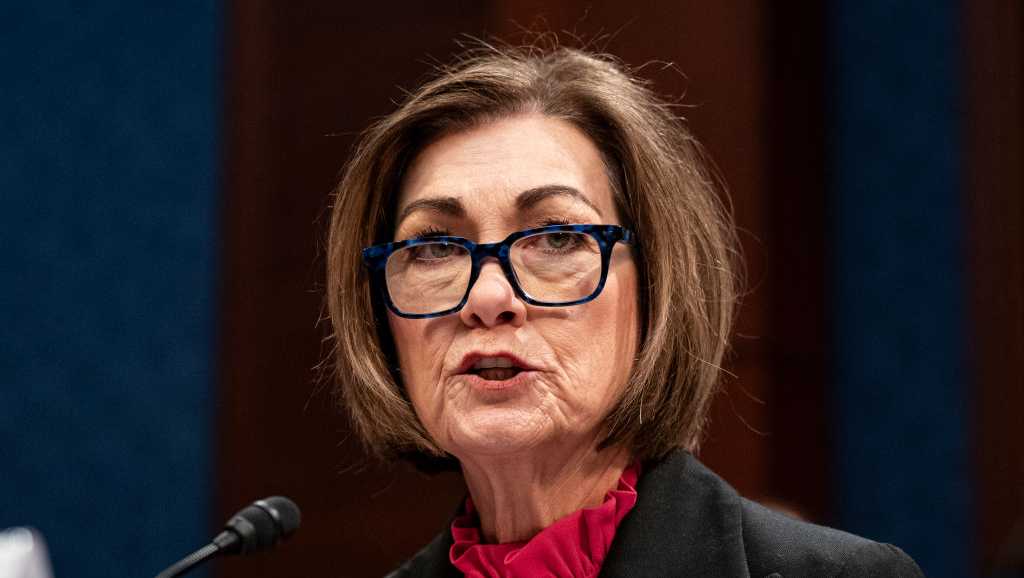

After Much Deliberation Iowa Governor Forgoes Third Term

Apr 11, 2025

After Much Deliberation Iowa Governor Forgoes Third Term

Apr 11, 2025 -

Navigating The New Tariffs A Guide For Small Creators

Apr 11, 2025

Navigating The New Tariffs A Guide For Small Creators

Apr 11, 2025 -

Boca Raton Plane Crash Fireball Engulfs Small Aircraft

Apr 11, 2025

Boca Raton Plane Crash Fireball Engulfs Small Aircraft

Apr 11, 2025 -

Napiecie Przed Legia Chelsea Fani Groza Pilkarzom

Apr 11, 2025

Napiecie Przed Legia Chelsea Fani Groza Pilkarzom

Apr 11, 2025