Downturn Ahead? US Stock Market And Dollar Weaken Post-Trump Remarks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Downturn Ahead? US Stock Market and Dollar Weaken Post-Trump Remarks

The US stock market experienced a noticeable dip and the dollar weakened following controversial remarks made by former President Donald Trump, sparking concerns about potential economic instability. This unexpected market reaction highlights the ongoing influence of political rhetoric on financial markets and raises questions about the future trajectory of the US economy.

The immediate aftermath of Trump's comments saw a significant sell-off in major indices, including the Dow Jones Industrial Average and the S&P 500. The Nasdaq, heavily weighted with technology stocks, also felt the pressure. This volatility underscores the market's sensitivity to political uncertainty, particularly given the current geopolitical landscape and existing concerns about inflation and potential interest rate hikes.

H2: Unpacking the Market Reaction:

Several factors contributed to the market's negative response:

- Increased Political Uncertainty: Trump's remarks, while not explicitly detailing specific policy proposals, introduced an element of unpredictability that investors find unsettling. Any hint of future political instability can trigger risk-aversion among investors, leading to capital flight.

- Dollar Weakness: The decline in the value of the US dollar is likely linked to the overall market downturn and a flight to safety. Investors often seek refuge in assets perceived as less risky during periods of uncertainty, potentially impacting the demand for the dollar.

- Inflationary Pressures: Existing concerns about inflation and the Federal Reserve's monetary policy response likely exacerbated the market's reaction. Trump's comments added another layer of uncertainty to an already complex economic picture.

H2: Expert Opinions and Market Analysis:

Financial analysts offered mixed perspectives on the long-term implications of the market downturn. Some believe the dip is a temporary correction, arguing that the underlying fundamentals of the US economy remain strong. Others express more caution, highlighting the potential for sustained volatility depending on future political developments and economic data. The consensus seems to be that the situation warrants close monitoring.

"The market's reaction is a clear indication of investor sentiment," notes leading economist Dr. Emily Carter. "Uncertainty breeds volatility, and Trump's comments injected a significant dose of uncertainty into the mix."

H2: What to Watch For:

Investors are keenly watching several key indicators in the coming weeks:

- Economic Data Releases: Upcoming reports on inflation, employment, and consumer spending will be crucial in shaping market sentiment and guiding investor decisions.

- Federal Reserve Actions: The Federal Reserve's next monetary policy announcement will be closely scrutinized, as any shift in interest rates could significantly impact market performance.

- Political Developments: Further pronouncements from political figures and the ongoing political climate will undoubtedly continue to influence market dynamics.

H3: Navigating Market Volatility:

For individual investors, navigating this period of uncertainty requires a balanced approach. Diversification, a long-term investment strategy, and careful risk assessment are vital. Seeking professional financial advice can provide valuable insights and guidance during times of market volatility.

H2: Conclusion:

The recent market dip following Trump's remarks serves as a stark reminder of the interconnectedness of politics and finance. While the long-term consequences remain unclear, the immediate impact highlights the market's inherent sensitivity to uncertainty and the importance of staying informed about both economic and political developments. The coming weeks will be crucial in determining whether this represents a temporary setback or the prelude to a more significant economic shift. Continued monitoring of economic indicators and political developments is essential for informed decision-making in the current market climate.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Downturn Ahead? US Stock Market And Dollar Weaken Post-Trump Remarks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Blue Origins Failures Eclipse Katy Perrys Success A Deeper Look At Bezos Space Program

Apr 22, 2025

Blue Origins Failures Eclipse Katy Perrys Success A Deeper Look At Bezos Space Program

Apr 22, 2025 -

Twin Headwinds Force Macquaries 2 8 Billion Withdrawal

Apr 22, 2025

Twin Headwinds Force Macquaries 2 8 Billion Withdrawal

Apr 22, 2025 -

The Growing Influence Of Indian Technology On The World Stage

Apr 22, 2025

The Growing Influence Of Indian Technology On The World Stage

Apr 22, 2025 -

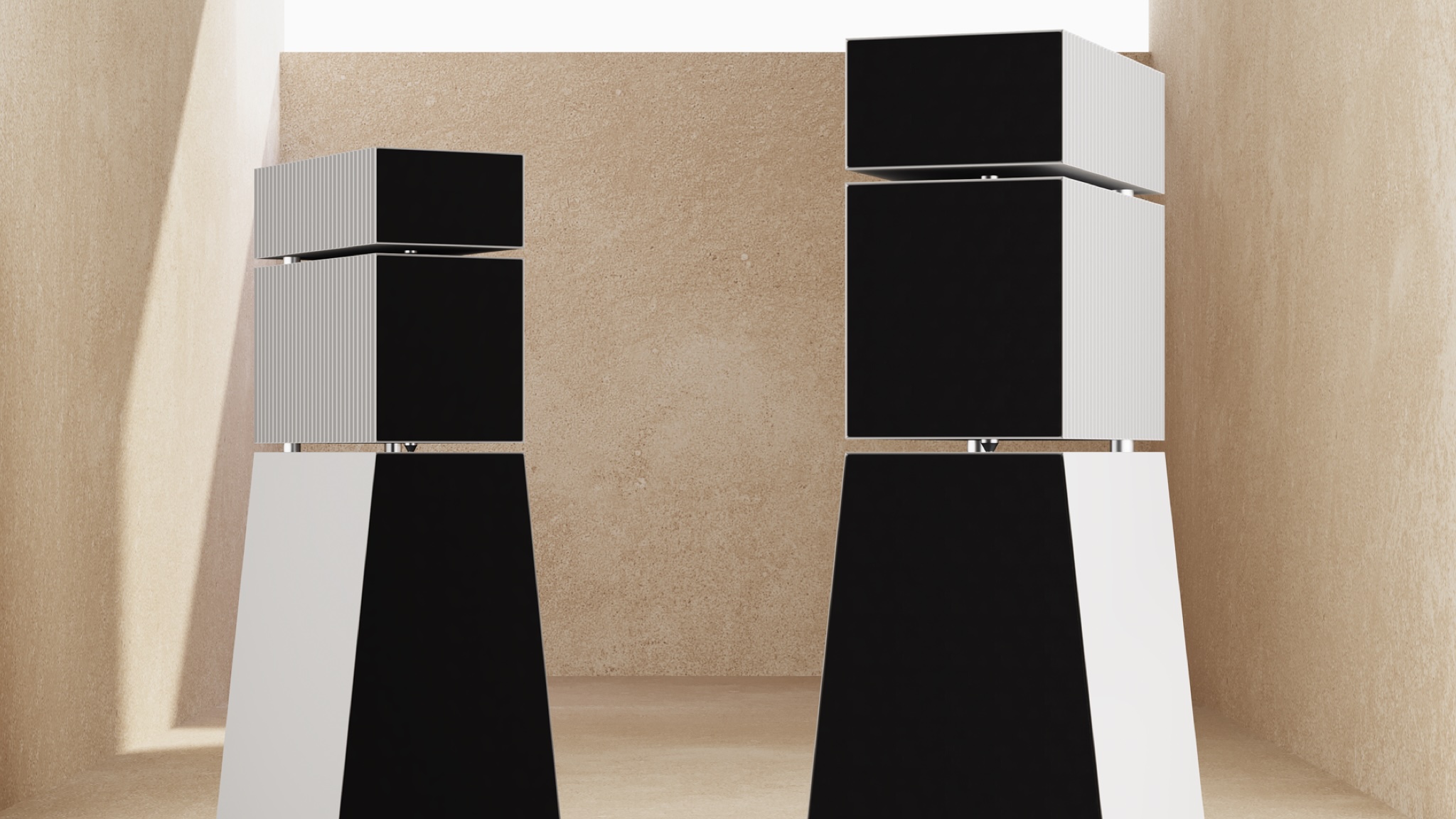

Out Of This World Sound Heavyweight Speakers With A Sci Fi Twist

Apr 22, 2025

Out Of This World Sound Heavyweight Speakers With A Sci Fi Twist

Apr 22, 2025 -

New York Entrepreneurs Francais Eco Responsables Celebrent Le Jour De La Terre

Apr 22, 2025

New York Entrepreneurs Francais Eco Responsables Celebrent Le Jour De La Terre

Apr 22, 2025