DPM Gan And Grace Fu Respond To WP's GST Proposals: Financial Implications For Singaporeans

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

DPM Gan and Grace Fu Respond to WP's GST Proposals: Financial Implications for Singaporeans

Singapore's political landscape heated up recently following the Workers' Party's (WP) alternative proposals regarding the Goods and Services Tax (GST). Deputy Prime Minister Lawrence Wong and Minister Grace Fu swiftly responded, outlining the potential financial implications for Singaporeans and defending the government's current approach. The debate highlights the crucial role of GST in Singapore's fiscal sustainability and the ongoing conversation about its impact on the nation's citizens.

WP's GST Proposals: A Summary

The WP's proposals centered around adjustments to the GST system, aiming to alleviate the tax burden on lower-income households. Specific suggestions included targeted rebates and adjustments to the GST rate itself, differing from the government’s gradual increase to 8%. While details varied, the core argument revolved around ensuring a fairer and more equitable distribution of the tax burden. The party emphasized the need for greater financial assistance for vulnerable segments of the population.

Government's Counterarguments: Maintaining Fiscal Responsibility

DPM Wong and Minister Fu countered the WP's proposals, emphasizing the importance of maintaining Singapore's fiscal prudence. They argued that the government's gradual GST increase, coupled with extensive assistance packages like the Assurance Package, provides a more sustainable and targeted approach to supporting lower-income families. The government’s position hinges on the need to fund essential public services like healthcare and infrastructure, which are crucial for Singapore's long-term prosperity.

Key Financial Implications Highlighted by the Government:

- Sustainability of Social Programs: The government highlighted that the current GST rate and planned increases are necessary to fund vital social programs benefiting all Singaporeans, including healthcare subsidies and eldercare. Significant deviations from the planned increase could jeopardize these initiatives.

- Impact on National Spending: Adjustments to the GST system proposed by the WP, particularly substantial rate reductions, could significantly impact national spending capabilities. This could lead to cuts in essential services or increased borrowing, impacting future generations.

- Targeted Assistance vs. Broad-Based Cuts: The government reiterated its commitment to providing targeted assistance to lower-income households through various schemes. They argued this approach is more efficient and effective than blanket GST reductions, which would benefit higher-income earners disproportionately.

The Assurance Package: A Key Component of the Government's Strategy

The government continues to emphasize the importance of the Assurance Package, a substantial financial assistance plan designed to mitigate the impact of the GST increase on lower- and middle-income households. This package includes significant payouts and tax rebates, acting as a crucial buffer against rising living costs. This underscores the government's commitment to ensuring a fair and just system despite the necessary GST increase.

Looking Ahead: The Ongoing Debate on Fiscal Policy

The exchange between the ruling party and the WP underscores the ongoing and crucial debate surrounding Singapore's fiscal policies. The GST, as a key component of the nation's revenue stream, continues to be a focal point of public discourse. This debate highlights the complex balancing act between maintaining fiscal responsibility, ensuring a strong social safety net, and promoting economic growth. Further discussions and clarifications are expected as the nation approaches the next general election. The government's commitment to transparency and engagement with the public on these important matters is paramount. The impact of the GST on everyday Singaporeans will undoubtedly remain a key issue in future political dialogues.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on DPM Gan And Grace Fu Respond To WP's GST Proposals: Financial Implications For Singaporeans. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Breaking News Additional Wwe Talent Releases Anticipated Soon

May 03, 2025

Breaking News Additional Wwe Talent Releases Anticipated Soon

May 03, 2025 -

Ubers New Rating System What Riders Need To Know

May 03, 2025

Ubers New Rating System What Riders Need To Know

May 03, 2025 -

From Crazy Rich Asians To Another Simple Favor Henry Golding On His Evolving On Screen Chemistry

May 03, 2025

From Crazy Rich Asians To Another Simple Favor Henry Golding On His Evolving On Screen Chemistry

May 03, 2025 -

Aaron Judges 2023 Successes Setbacks And Statistical Breakdown

May 03, 2025

Aaron Judges 2023 Successes Setbacks And Statistical Breakdown

May 03, 2025 -

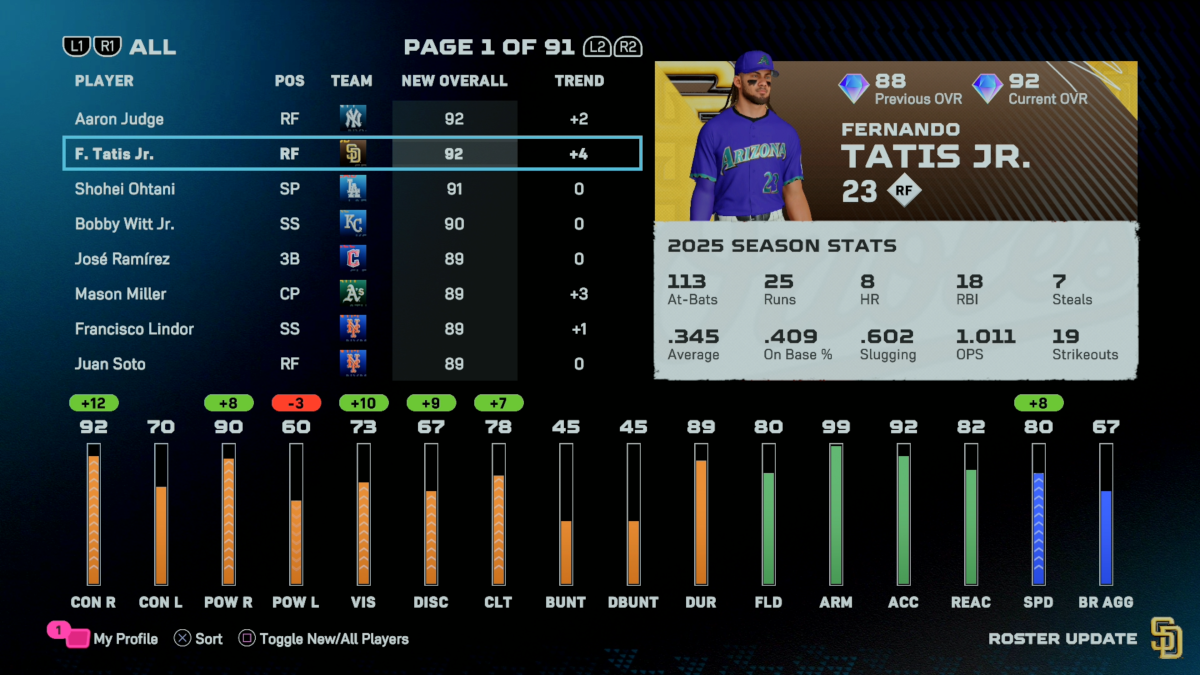

Tatis Jr S Diamond Dynasty Rating Explodes In Mlb The Show 25 Update

May 03, 2025

Tatis Jr S Diamond Dynasty Rating Explodes In Mlb The Show 25 Update

May 03, 2025

Latest Posts

-

Has Miesha Tate Reached Her Peak A Look At Her Improved Skills

May 04, 2025

Has Miesha Tate Reached Her Peak A Look At Her Improved Skills

May 04, 2025 -

Inter Miami Vs Ny Red Bulls Messis Lineup And Predicted Starting Xi

May 04, 2025

Inter Miami Vs Ny Red Bulls Messis Lineup And Predicted Starting Xi

May 04, 2025 -

Zelle Down Current Outage Affecting Money Transfers Between Friends

May 04, 2025

Zelle Down Current Outage Affecting Money Transfers Between Friends

May 04, 2025 -

Saturdays Ufc Fight Night Your Guide To Odds Predictions And Best Bets May 3

May 04, 2025

Saturdays Ufc Fight Night Your Guide To Odds Predictions And Best Bets May 3

May 04, 2025 -

May 3rd Ufc Fight Night Expert Betting Predictions

May 04, 2025

May 3rd Ufc Fight Night Expert Betting Predictions

May 04, 2025