Due Diligence In Web3: Separating Verified Projects From Risky Ventures

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Due Diligence in Web3: Separating Verified Projects from Risky Ventures

The decentralized world of Web3 offers incredible opportunities, but it also harbors significant risks. Navigating this landscape requires a keen eye and a robust due diligence process. For investors, developers, and even casual users, understanding how to separate legitimate, verified projects from potentially risky ventures is crucial to avoid scams, rug pulls, and other pitfalls. This article will equip you with the knowledge and tools necessary to conduct thorough due diligence in the exciting yet volatile Web3 ecosystem.

What is Due Diligence in Web3?

Due diligence in Web3 expands beyond traditional financial analysis. It's a multifaceted process encompassing technical audits, community assessment, team verification, and tokenomics analysis. It aims to identify potential red flags and assess the overall viability and legitimacy of a project. Unlike traditional finance, where regulatory oversight is more prevalent, Web3 relies heavily on community scrutiny and independent verification.

Key Areas for Web3 Due Diligence:

-

1. Team Verification: Investigate the team behind the project. Look for their experience, backgrounds, and online presence. Are they doxxed (publicly revealed their identities)? Are their LinkedIn profiles and other online information consistent with their claims? A transparent and verifiable team is a strong positive indicator.

-

2. Smart Contract Audits: Smart contracts are the backbone of many Web3 projects. Independent audits by reputable firms are essential to identify vulnerabilities and potential security risks. Look for audits from well-known security companies and scrutinize the audit reports carefully. Beware of projects that lack audits or those whose audits reveal significant vulnerabilities.

-

3. Tokenomics Analysis: Analyze the project's tokenomics, including token supply, distribution, utility, and vesting schedules. A well-designed tokenomics model ensures fair distribution and long-term sustainability. Be wary of projects with unrealistic token promises or overly concentrated token distribution.

-

4. Whitepaper Review: A comprehensive and well-written whitepaper is a crucial component. It should clearly outline the project's goals, technology, roadmap, and tokenomics. Scrutinize the whitepaper for inconsistencies, unrealistic claims, or vague language.

-

5. Community Engagement: Analyze the project's community engagement on platforms like Discord, Telegram, and Twitter. A thriving and engaged community is a positive sign. Look for signs of genuine enthusiasm, constructive discussions, and active participation from the development team. Conversely, a silent or overly promotional community could be a red flag.

-

6. Roadmap Analysis: Evaluate the project's roadmap and assess its feasibility. Is the roadmap realistic and achievable? Are there clear milestones and deadlines? A vague or overly ambitious roadmap can be a warning sign.

-

7. Social Media Scrutiny: Analyze social media activity for any signs of negativity, controversies, or suspicious behavior. Look for inconsistencies between the project's public image and its reality.

Identifying Red Flags:

Several red flags should trigger immediate caution:

- Anonymous or pseudonymous teams.

- Lack of transparent smart contract audits.

- Unrealistic tokenomics or promises.

- Overly aggressive marketing tactics.

- Negative community sentiment or controversies.

- Vague or unrealistic roadmaps.

- Lack of a detailed whitepaper.

Conclusion:

Due diligence in Web3 is a crucial process that requires careful investigation and critical thinking. By diligently analyzing these key areas and remaining vigilant for red flags, you can significantly reduce your risk of encountering fraudulent or poorly developed projects. Remember, thorough due diligence is an investment in protecting your time, money, and reputation within the exciting and evolving world of Web3. Always conduct your own research and never invest more than you can afford to lose.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Due Diligence In Web3: Separating Verified Projects From Risky Ventures. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Defeat To Victory Bompastors Tactical Masterclass Against Barca

Apr 28, 2025

From Defeat To Victory Bompastors Tactical Masterclass Against Barca

Apr 28, 2025 -

Donald Trumps Approval Rating A New Low After 100 Days In Office

Apr 28, 2025

Donald Trumps Approval Rating A New Low After 100 Days In Office

Apr 28, 2025 -

Ipl 2023 Virat Kohli And Kl Rahuls Heated Exchange Dc Wicketkeepers Retort

Apr 28, 2025

Ipl 2023 Virat Kohli And Kl Rahuls Heated Exchange Dc Wicketkeepers Retort

Apr 28, 2025 -

Ge 2025 Rdus Opening Rally Highlights Pressing Economic Issues

Apr 28, 2025

Ge 2025 Rdus Opening Rally Highlights Pressing Economic Issues

Apr 28, 2025 -

Power Outage Crisis Spain And Portugal Face Widespread Blackouts Affecting Madrid Open

Apr 28, 2025

Power Outage Crisis Spain And Portugal Face Widespread Blackouts Affecting Madrid Open

Apr 28, 2025

Latest Posts

-

Ryanair Issues Travel Alert Uk Passengers Advised Of Potential Problems

Apr 29, 2025

Ryanair Issues Travel Alert Uk Passengers Advised Of Potential Problems

Apr 29, 2025 -

Crypto Whales May Strategy Accumulating These 3 Altcoins

Apr 29, 2025

Crypto Whales May Strategy Accumulating These 3 Altcoins

Apr 29, 2025 -

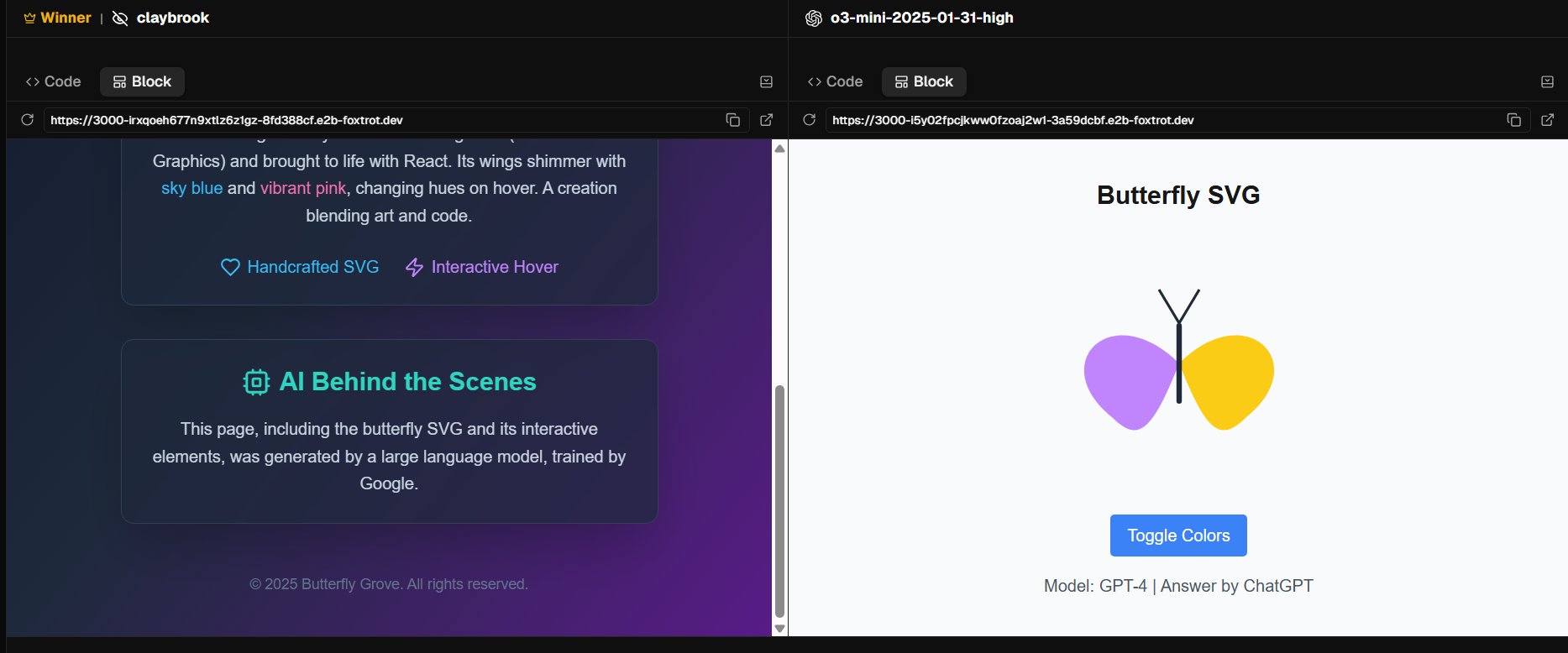

Improving Web Development Workflow With Googles Claybrook Ai

Apr 29, 2025

Improving Web Development Workflow With Googles Claybrook Ai

Apr 29, 2025 -

Investigation Into Large Scale Power Failure In Spain And Portugal Cyberattack Ruled Out

Apr 29, 2025

Investigation Into Large Scale Power Failure In Spain And Portugal Cyberattack Ruled Out

Apr 29, 2025 -

Election 2025 A Deep Dive Into Public Housing Policies

Apr 29, 2025

Election 2025 A Deep Dive Into Public Housing Policies

Apr 29, 2025