Early Losses For European Stocks Amidst New Trump Tariffs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Early Losses for European Stocks Amidst New Trump Tariffs

European markets opened lower on Monday, mirroring anxieties in Asia, as investors reacted to the latest announcement of new tariffs on European goods by the Trump administration. The news sent ripples through the financial world, raising concerns about a potential escalation of the ongoing trade war and its impact on global economic growth. This latest development adds another layer of uncertainty to an already volatile market.

Tariffs Trigger Market Uncertainty

The new tariffs, targeting a range of European products including wine, cheese, and aircraft parts, are the latest salvo in the protracted trade dispute between the United States and the European Union. Analysts warn that these measures could significantly disrupt supply chains, stifle economic activity, and further fuel inflation. The immediate impact was visible in the early trading hours, with major European stock indices experiencing noticeable declines.

The CAC 40 in France, the DAX in Germany, and the FTSE 100 in the UK all showed early losses, reflecting investor apprehension about the potential consequences of the escalating trade conflict. The uncertainty surrounding future trade relations is prompting investors to adopt a more cautious approach, leading to a sell-off in several key sectors.

Impact on Specific Sectors

The automotive and aerospace industries are expected to be particularly hard hit by the new tariffs. European manufacturers heavily reliant on US exports face potential production slowdowns and increased costs, impacting profitability and competitiveness. Similarly, the food and beverage sector is bracing for disruptions, as the tariffs on European delicacies like wine and cheese threaten to reduce demand and increase prices.

- Automotive: Expect increased costs for European cars sold in the US, potentially impacting sales figures.

- Aerospace: Airbus, a major European player, could experience substantial challenges due to tariffs on aircraft parts.

- Food and Beverage: Higher prices for European wines and cheeses in the US market are likely, affecting both producers and consumers.

Analysts Weigh In

Market analysts are divided on the long-term consequences of these tariffs. Some suggest that the impact may be limited, anticipating that markets will eventually adjust to the new reality. Others express more serious concerns, warning of potential knock-on effects throughout the global economy, including slower growth and increased inflation. The uncertainty surrounding the future direction of US trade policy is a key factor fueling market volatility.

Looking Ahead: Potential for Further Escalation

The current situation underscores the fragility of global trade relations and the potential for further escalation. Negotiations between the US and the EU are ongoing, but the lack of immediate breakthroughs suggests that the trade war may persist for some time. This ongoing uncertainty is likely to continue to influence market sentiment and investor behavior in the coming weeks and months.

The situation demands close monitoring. Investors are advised to stay informed about any further developments and consider diversifying their portfolios to mitigate potential risks. The long-term effects of these tariffs remain to be seen, but the early market reaction clearly indicates a significant cause for concern within the European financial landscape. This is a developing story, and we will continue to provide updates as they become available.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Early Losses For European Stocks Amidst New Trump Tariffs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Future Of Medicaid Uncertain Recipients Demand Congressional Intervention To Secure Healthcare

Apr 10, 2025

Future Of Medicaid Uncertain Recipients Demand Congressional Intervention To Secure Healthcare

Apr 10, 2025 -

Bukit Duri Mengungkap Dinamika Pengepungan Dalam Bagian Ketiga

Apr 10, 2025

Bukit Duri Mengungkap Dinamika Pengepungan Dalam Bagian Ketiga

Apr 10, 2025 -

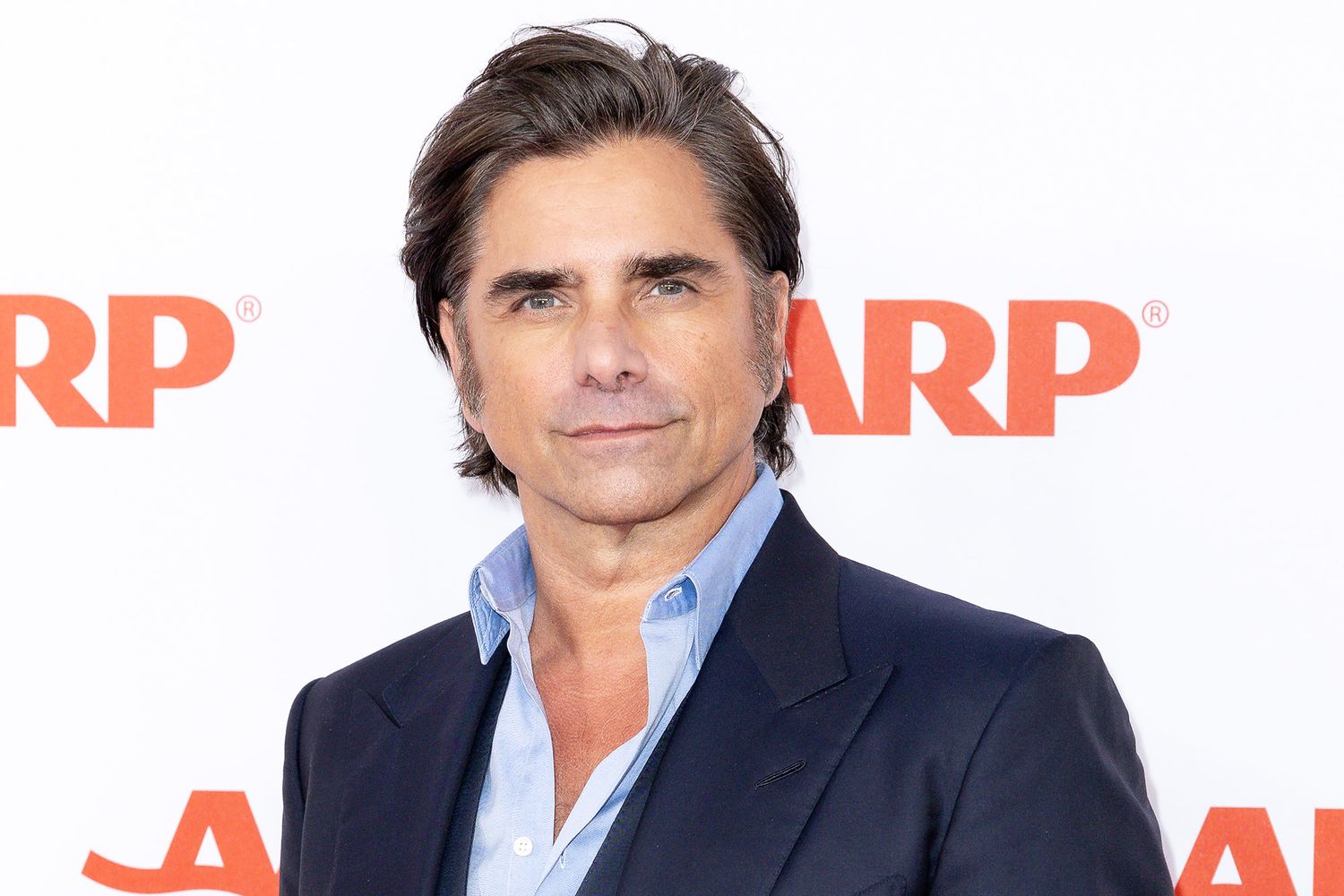

Backlash Over Mar A Lago John Stamos Defends His Political Position

Apr 10, 2025

Backlash Over Mar A Lago John Stamos Defends His Political Position

Apr 10, 2025 -

Track The Masters Live Leaderboard Scores And Daily Updates

Apr 10, 2025

Track The Masters Live Leaderboard Scores And Daily Updates

Apr 10, 2025 -

Matic Slams Onana Man Utds Worst Goalkeeper Lyon Performance Fuels Debate

Apr 10, 2025

Matic Slams Onana Man Utds Worst Goalkeeper Lyon Performance Fuels Debate

Apr 10, 2025