Early R9 Trading Strategies: What Traders Are Doing Now

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Early R9 Trading Strategies: What Traders Are Doing Now

The recent release of the R9 trading platform has sent ripples through the financial world, sparking both excitement and uncertainty. While the long-term implications are still unfolding, savvy traders are already developing and implementing early strategies to capitalize on this new technology. This article delves into the current approaches traders are taking, highlighting both the potential rewards and the inherent risks.

Understanding the R9 Platform:

Before diving into trading strategies, it's crucial to understand the core functionalities of the R9 platform. Unlike traditional brokerage systems, R9 offers [mention key features, e.g., decentralized exchange, advanced charting tools, AI-powered analytics]. These features significantly alter the trading landscape, demanding new approaches and strategies.

Popular Early R9 Trading Strategies:

Traders are currently experimenting with several strategies, each carrying its own level of risk and reward:

-

Arbitrage Opportunities: The initial period after a platform launch often presents arbitrage opportunities. Sharp traders are actively seeking discrepancies in pricing across different exchanges to capitalize on these fleeting advantages. However, this requires speed, precision, and a deep understanding of market dynamics.

-

High-Frequency Trading (HFT): The low latency of the R9 platform makes it ideal for HFT. Sophisticated algorithms are being deployed to execute a high volume of trades at lightning speed, seeking small but frequent profits. This strategy necessitates significant technical expertise and substantial capital investment.

-

Long-Term Holding Strategies: Despite the focus on short-term gains, some traders are adopting a long-term approach. They are identifying promising assets and holding them for extended periods, anticipating significant growth. This strategy is less risky but requires patience and a robust understanding of fundamental analysis.

-

Leveraged Trading: R9's leveraged trading capabilities allow traders to amplify their potential profits. However, it’s important to note that this also magnifies potential losses. Careful risk management is paramount when employing leverage.

Risks and Considerations:

While the potential rewards are tempting, early R9 trading presents significant risks:

- Volatility: New platforms are inherently volatile. Sudden price swings and unexpected events can wipe out profits quickly.

- Liquidity: While R9 aims for high liquidity, it's still early days. Traders may encounter difficulties executing large orders quickly.

- Security: Security remains a primary concern with any new platform. Traders should prioritize secure storage of their assets and carefully vet the platform's security measures.

Best Practices for Early R9 Traders:

- Start Small: Begin with small trades to test strategies and minimize potential losses.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify across multiple assets to mitigate risk.

- Stay Informed: Keep abreast of the latest news and updates concerning the R9 platform and the broader cryptocurrency market.

- Utilize Risk Management Tools: Employ stop-loss orders and other risk management strategies to protect your capital.

Conclusion:

The early stages of the R9 trading platform present exciting opportunities for savvy traders. However, success requires careful planning, risk management, and a thorough understanding of the platform's functionalities and the inherent risks. By adopting a measured approach and staying informed, traders can navigate this evolving landscape and potentially reap significant rewards. Remember that this is a rapidly changing environment, and staying informed is critical for success. Always conduct thorough research and consider consulting with a financial advisor before making any trading decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Early R9 Trading Strategies: What Traders Are Doing Now. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

In Depth Analysis Minnesotas 4 1 Win Against Miami May 11 2025

May 11, 2025

In Depth Analysis Minnesotas 4 1 Win Against Miami May 11 2025

May 11, 2025 -

Bitcoin Soars Past 100 000 Fueling Metaplanets 5 555 Btc Profit Bonanza

May 11, 2025

Bitcoin Soars Past 100 000 Fueling Metaplanets 5 555 Btc Profit Bonanza

May 11, 2025 -

Wwe Backlash 2025 Results Complete Event Recap And Key Moments

May 11, 2025

Wwe Backlash 2025 Results Complete Event Recap And Key Moments

May 11, 2025 -

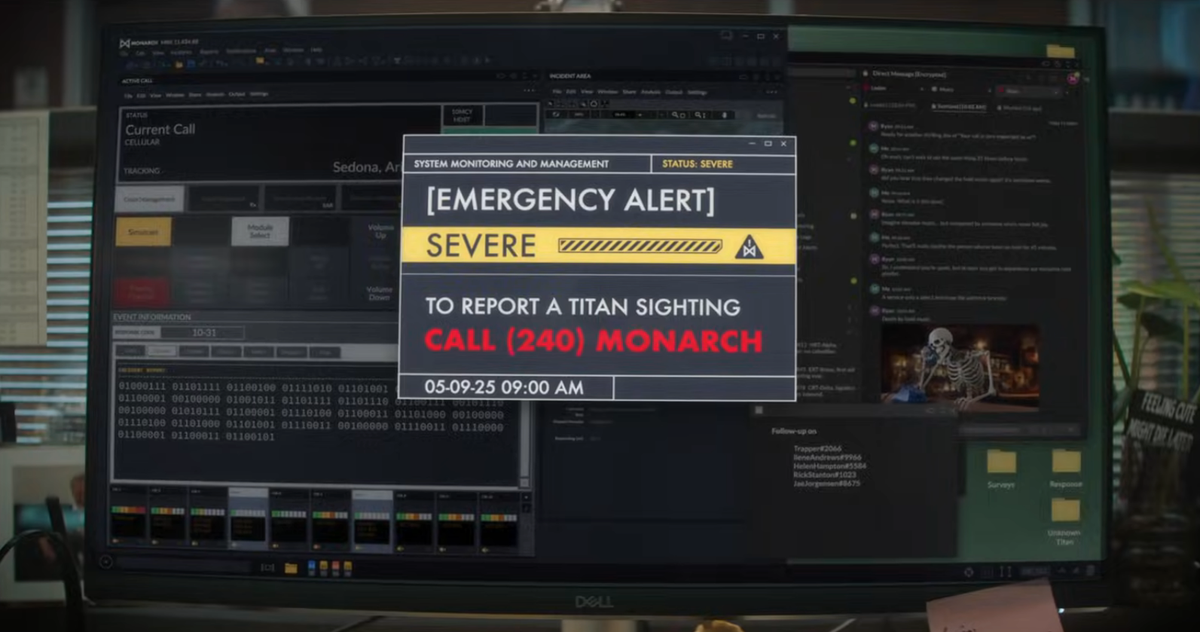

Legendary Pictures Confirms Godzilla And Kong Sequel

May 11, 2025

Legendary Pictures Confirms Godzilla And Kong Sequel

May 11, 2025 -

Danny Dyer Reveals Pinters Death Triggered A Mental Health Crisis

May 11, 2025

Danny Dyer Reveals Pinters Death Triggered A Mental Health Crisis

May 11, 2025

Latest Posts

-

Necaxa Vs Guido Resumen Del Encuentro Y Evaluacion Del Jugador

May 12, 2025

Necaxa Vs Guido Resumen Del Encuentro Y Evaluacion Del Jugador

May 12, 2025 -

Setor Publico Em Greve Empresas Contabilizam Prejuizos Multimilionarios

May 12, 2025

Setor Publico Em Greve Empresas Contabilizam Prejuizos Multimilionarios

May 12, 2025 -

David Beckham Condemns Minnesota Uniteds Instagram Provocation Of Inter Miami

May 12, 2025

David Beckham Condemns Minnesota Uniteds Instagram Provocation Of Inter Miami

May 12, 2025 -

Nba Draft Combine 2024 Cooper Flaggs 5 On 5 And Other Must See Prospects

May 12, 2025

Nba Draft Combine 2024 Cooper Flaggs 5 On 5 And Other Must See Prospects

May 12, 2025 -

Shocking Results American Idol Announces Its Top 5 Singers

May 12, 2025

Shocking Results American Idol Announces Its Top 5 Singers

May 12, 2025