Economic Headwinds: Markets React To Heightened Uncertainty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Headwinds: Markets React to Heightened Uncertainty

Global markets are experiencing significant turbulence as investors grapple with a confluence of economic headwinds. Heightened uncertainty surrounding inflation, interest rates, and geopolitical tensions is driving volatility and prompting a reassessment of risk across asset classes. This complex situation demands a closer look at the factors driving the current market anxieties and their potential impact on the global economy.

Inflation Remains a Persistent Threat:

The persistent inflation plaguing many economies continues to be a primary driver of market uncertainty. While inflation rates have shown some signs of easing in certain regions, they remain stubbornly high in others, forcing central banks to maintain a hawkish stance on monetary policy. This means continued interest rate hikes are on the table, potentially stifling economic growth and impacting corporate earnings. The unpredictability of inflation's trajectory is fueling investor anxiety and prompting a flight to safety.

Interest Rate Hikes and Their Ripple Effect:

Central banks worldwide are actively employing interest rate hikes as a tool to combat inflation. However, this aggressive monetary policy carries significant risks. Higher interest rates increase borrowing costs for businesses and consumers, potentially leading to a slowdown in economic activity and even recession. The impact is particularly felt in sectors sensitive to interest rate changes, such as real estate and technology. The speed and magnitude of these rate hikes are contributing to market volatility as investors attempt to anticipate the long-term consequences.

Geopolitical Instability Exacerbates Market Concerns:

The ongoing geopolitical landscape adds another layer of complexity to the economic outlook. The war in Ukraine, coupled with rising tensions in other regions, contributes to energy price volatility and supply chain disruptions. These factors further fuel inflation and create uncertainty for businesses, impacting investment decisions and market sentiment. The unpredictable nature of geopolitical events makes accurate forecasting challenging, contributing to the overall market apprehension.

Market Reactions and Investor Sentiment:

The heightened uncertainty is reflected in market reactions across various asset classes. Equity markets have experienced significant swings, with investor sentiment shifting rapidly. Safe-haven assets, such as gold and government bonds, have seen increased demand as investors seek to protect their portfolios from potential losses. The volatility highlights the challenges faced by investors in navigating the current economic climate and underscores the need for a diversified and well-managed investment strategy.

Looking Ahead: Navigating the Uncertainty:

The coming months will be crucial in determining the trajectory of the global economy. While some economists predict a soft landing, others warn of a potential recession. The effectiveness of central bank policies in controlling inflation without triggering a significant economic downturn remains to be seen. Investors must closely monitor economic indicators, geopolitical developments, and central bank pronouncements to make informed investment decisions. Diversification, risk management, and a long-term perspective are crucial for navigating this period of heightened uncertainty.

Keywords: Economic Headwinds, Market Volatility, Inflation, Interest Rates, Geopolitical Uncertainty, Recession, Investment Strategy, Risk Management, Central Banks, Monetary Policy, Global Economy, Market Reaction, Investor Sentiment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Headwinds: Markets React To Heightened Uncertainty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nuggets Vs Warriors Live Stream Watch The March 17th Nba Game

Mar 18, 2025

Nuggets Vs Warriors Live Stream Watch The March 17th Nba Game

Mar 18, 2025 -

Hollywoods Elite Meagan Good Jamie Foxx Headline La Premiere Photos

Mar 18, 2025

Hollywoods Elite Meagan Good Jamie Foxx Headline La Premiere Photos

Mar 18, 2025 -

2025 All Spring Breakout Teams Scouting The Future Stars

Mar 18, 2025

2025 All Spring Breakout Teams Scouting The Future Stars

Mar 18, 2025 -

Shifting Sands Liberal Party Gains Momentum Conservative Lead Shrinks

Mar 18, 2025

Shifting Sands Liberal Party Gains Momentum Conservative Lead Shrinks

Mar 18, 2025 -

Cybersecurity Giant Wiz Reportedly Set For 30 Billion Alphabet Acquisition

Mar 18, 2025

Cybersecurity Giant Wiz Reportedly Set For 30 Billion Alphabet Acquisition

Mar 18, 2025

Latest Posts

-

Supreme Court Hears Contentious Disability Rights Arguments Sweeping Changes Unforeseen

Apr 30, 2025

Supreme Court Hears Contentious Disability Rights Arguments Sweeping Changes Unforeseen

Apr 30, 2025 -

Major Data Breach Medical Software Exposes Tens Of Thousands Of Patient Records

Apr 30, 2025

Major Data Breach Medical Software Exposes Tens Of Thousands Of Patient Records

Apr 30, 2025 -

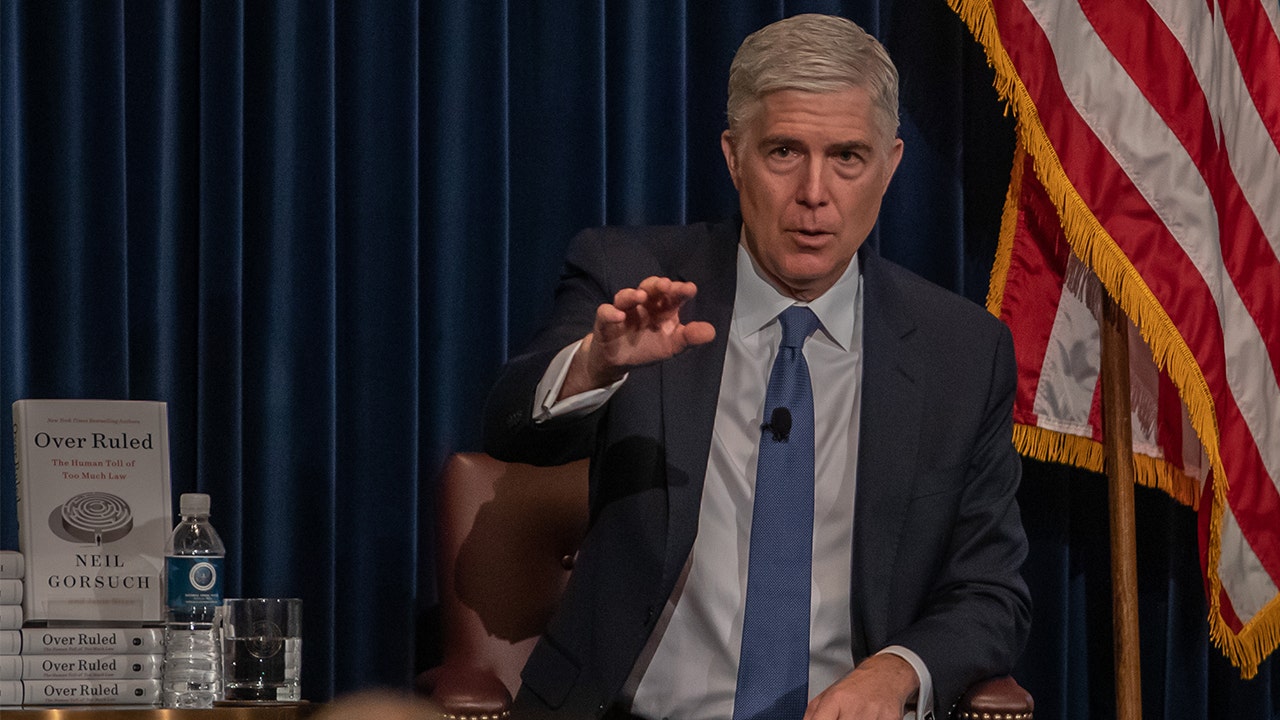

Supreme Court Tension Gorsuch And Litigator In Heated Verbal Sparring

Apr 30, 2025

Supreme Court Tension Gorsuch And Litigator In Heated Verbal Sparring

Apr 30, 2025 -

Animoca Brands Coinbase And Fabric Ventures Fuel Uks Web3 Expansion

Apr 30, 2025

Animoca Brands Coinbase And Fabric Ventures Fuel Uks Web3 Expansion

Apr 30, 2025 -

Metas New Xr Glasses Expected Launch In 2023 Beating Apples Ar Headset

Apr 30, 2025

Metas New Xr Glasses Expected Launch In 2023 Beating Apples Ar Headset

Apr 30, 2025