Economic Slowdown: OCBC Retains 2025 Guidance For Singapore Operations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Slowdown: OCBC Retains 2025 Guidance for Singapore Operations Despite Headwinds

Singapore's robust financial sector is facing a period of uncertainty amidst a global economic slowdown. However, one of the nation's leading banks, Oversea-Chinese Banking Corporation (OCBC), has demonstrated resilience, retaining its 2025 guidance for its Singapore operations despite mounting headwinds. This decision reflects OCBC's confidence in its long-term strategy and its ability to navigate the challenging economic landscape.

The announcement comes as several key economic indicators point towards a potential slowdown in Singapore's growth. Rising inflation, global geopolitical instability, and weakening external demand are all contributing factors. Many analysts have expressed concerns about the impact on the banking sector, with predictions of reduced profitability and loan growth.

OCBC, however, remains optimistic. The bank's Chief Executive Officer, Helen Wong, stated that while the current economic climate presents challenges, OCBC's diversified business model and strong risk management framework provide a solid foundation for future growth. The bank's continued commitment to its 2025 targets underscores this confidence.

<h3>OCBC's Strategic Resilience in the Face of Economic Uncertainty</h3>

OCBC's decision to maintain its 2025 guidance highlights several key strengths:

- Diversified Business Model: OCBC's operations extend beyond Singapore, offering resilience against localized economic shocks. Its presence in key Asian markets mitigates risks associated with a slowdown in any single region.

- Strong Risk Management: The bank's robust risk management practices allow it to proactively identify and mitigate potential threats, ensuring financial stability even during periods of economic downturn.

- Digital Transformation: OCBC's ongoing investment in digital technologies enhances operational efficiency and improves customer experience, contributing to sustained growth.

- Focus on Key Sectors: The bank's strategic focus on key growth sectors, such as technology and sustainable finance, positions it to capitalize on emerging opportunities.

<h3>Navigating the Challenges: A Closer Look at the Singaporean Economy</h3>

The Singaporean economy, renowned for its stability and resilience, is not immune to global economic fluctuations. The current slowdown presents several challenges:

- Inflationary Pressures: Rising inflation is impacting consumer spending and business investment, slowing economic growth.

- Global Geopolitical Uncertainty: The ongoing war in Ukraine and rising US-China tensions contribute to global economic instability, affecting Singapore's trade and investment flows.

- Weakening External Demand: Reduced global demand for Singaporean goods and services further dampens economic activity.

Despite these headwinds, OCBC's sustained confidence in its Singapore operations suggests a belief in the long-term potential of the Singaporean economy. The bank's commitment to its 2025 guidance signals a proactive approach to navigating the current challenges and capitalizing on future opportunities.

<h3>What This Means for Investors and the Broader Market</h3>

OCBC's unwavering commitment to its 2025 targets provides a degree of stability in an otherwise uncertain market. For investors, this reinforces the bank's perceived strength and long-term viability. The announcement could also boost investor confidence in the Singaporean financial sector as a whole.

However, it's crucial to remember that the global economic outlook remains uncertain. While OCBC's strategic position is robust, continued monitoring of macroeconomic indicators is vital for understanding the long-term implications for both the bank and the broader Singaporean economy. The coming months will be critical in determining the actual impact of the global slowdown on Singapore and its financial sector. Further updates from OCBC and other key players will be closely followed by investors and analysts alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Slowdown: OCBC Retains 2025 Guidance For Singapore Operations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Set For Life Lottery Results Winning Numbers For May 8th

May 10, 2025

Set For Life Lottery Results Winning Numbers For May 8th

May 10, 2025 -

Unseeded Gilmore Creates Surfing History Defeats Reigning World Champion

May 10, 2025

Unseeded Gilmore Creates Surfing History Defeats Reigning World Champion

May 10, 2025 -

Archibald Prize 2024 Julie Fragar Crowned Winner

May 10, 2025

Archibald Prize 2024 Julie Fragar Crowned Winner

May 10, 2025 -

Kali Uchis Sincerely Album Review Exploring Themes Of Peace And Reflection

May 10, 2025

Kali Uchis Sincerely Album Review Exploring Themes Of Peace And Reflection

May 10, 2025 -

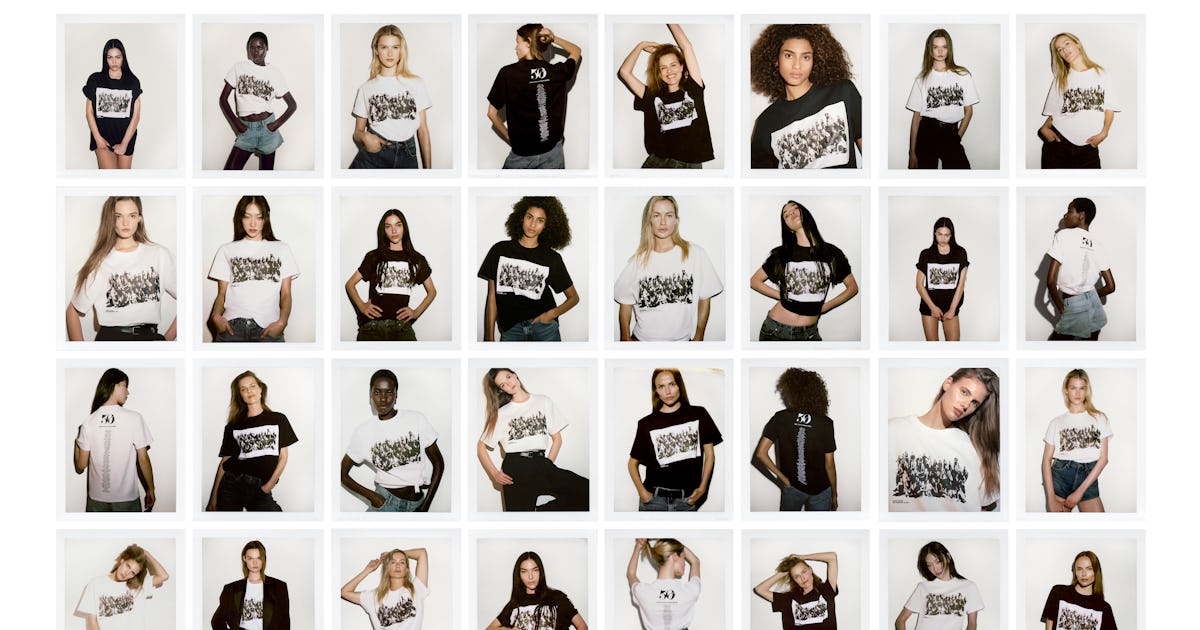

Zara Showcases Diverse Models In Latest Campaign

May 10, 2025

Zara Showcases Diverse Models In Latest Campaign

May 10, 2025

Latest Posts

-

Cavaliers Vs Pacers May 9 2025 Game Recap And Highlights

May 10, 2025

Cavaliers Vs Pacers May 9 2025 Game Recap And Highlights

May 10, 2025 -

Taylor Swifts Eras Tour A Scientific Exploration In Boston

May 10, 2025

Taylor Swifts Eras Tour A Scientific Exploration In Boston

May 10, 2025 -

Emmanuel Clase Faces Oaa Action Implications And Analysis

May 10, 2025

Emmanuel Clase Faces Oaa Action Implications And Analysis

May 10, 2025 -

Bill Gates To Dissolve Foundation Donate Nearly All His Wealth Over Two Decades

May 10, 2025

Bill Gates To Dissolve Foundation Donate Nearly All His Wealth Over Two Decades

May 10, 2025 -

From Billionaire To Philanthropist Bill Gates Legacy Of Giving

May 10, 2025

From Billionaire To Philanthropist Bill Gates Legacy Of Giving

May 10, 2025