Economic Uncertainty: Is The RBA's Wait Until May A Calculated Risk In The Face Of Trump's Tariffs?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Uncertainty: Is the RBA's Wait Until May a Calculated Risk in the Face of Trump's Tariffs?

The Reserve Bank of Australia (RBA) has opted for a cautious approach, delaying its next interest rate decision until May. This strategic move comes amidst a backdrop of significant global economic uncertainty, primarily fueled by the ongoing trade war between the US and China, and the unpredictable policies of the Trump administration. Is this a calculated risk, or a sign of deeper concerns within the RBA?

The decision to hold off on a rate change until May follows months of speculation about potential cuts to address slowing economic growth. Australia's economy, heavily reliant on exports, is particularly vulnerable to the ripple effects of global trade disputes. The escalating tariffs imposed by the Trump administration have cast a long shadow over global markets, creating instability and impacting investor confidence.

The Impact of Trump's Tariffs on the Australian Economy:

Trump's unpredictable trade policies, including the imposition of tariffs on various goods, have created significant headwinds for the Australian economy. These tariffs disrupt established trade routes, increase the cost of goods, and ultimately impact consumer spending and business investment. The agricultural sector, a cornerstone of the Australian economy, is particularly vulnerable, with significant export markets affected by these trade tensions.

- Reduced Export Demand: Tariffs imposed on Australian goods, particularly agricultural products, reduce demand from key trading partners, leading to lower export revenues and impacting agricultural producers.

- Increased Input Costs: Tariffs on imported goods increase the cost of production for Australian businesses, potentially leading to price increases for consumers and reduced competitiveness in global markets.

- Investor Uncertainty: The volatile nature of Trump's trade policies creates uncertainty for investors, making them hesitant to commit capital to long-term projects in Australia.

The RBA's Cautious Stance: A Calculated Risk?

The RBA's decision to delay its next rate decision until May could be interpreted as a calculated risk. By waiting, the RBA can gain a clearer picture of the full impact of Trump's tariffs on the Australian economy and global markets. This allows them to make a more informed decision, avoiding potentially premature or ineffective interventions.

However, this wait-and-see approach also carries significant risks. Delaying a rate cut, if ultimately needed to stimulate economic growth, could prolong the period of economic slowdown, potentially leading to job losses and further dampening consumer confidence.

Alternative Economic Indicators and Considerations:

The RBA's decision is not solely based on Trump's tariffs. Other key economic indicators, including inflation, unemployment, and consumer spending, also play a crucial role in shaping monetary policy decisions. The RBA will be carefully monitoring these indicators to assess the overall health of the Australian economy before making any interest rate changes.

- Inflation: Low inflation provides the RBA with scope to cut interest rates to stimulate economic growth. However, excessively low inflation can be a sign of weak economic activity.

- Unemployment: Rising unemployment is a significant concern, as it indicates a weakening labor market and potential for reduced consumer spending.

- Consumer Spending: Consumer spending is a key driver of economic growth. A decline in consumer spending could signal a broader economic slowdown.

Conclusion:

The RBA's decision to wait until May before making its next interest rate decision is a complex one, balancing the need for economic stimulus with the inherent risks of premature action. The uncertainty surrounding Trump's trade policies remains a significant factor, but the RBA's assessment will incorporate a broader range of economic data to determine the most appropriate course of action. The coming weeks will be crucial in gauging the impact of global uncertainty on the Australian economy, and the RBA's May decision will offer critical insight into the future direction of Australian monetary policy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Uncertainty: Is The RBA's Wait Until May A Calculated Risk In The Face Of Trump's Tariffs?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Reality Tv Fallout Mickey Rourke Faces Backlash Over Creepy On Screen Actions

Apr 10, 2025

Reality Tv Fallout Mickey Rourke Faces Backlash Over Creepy On Screen Actions

Apr 10, 2025 -

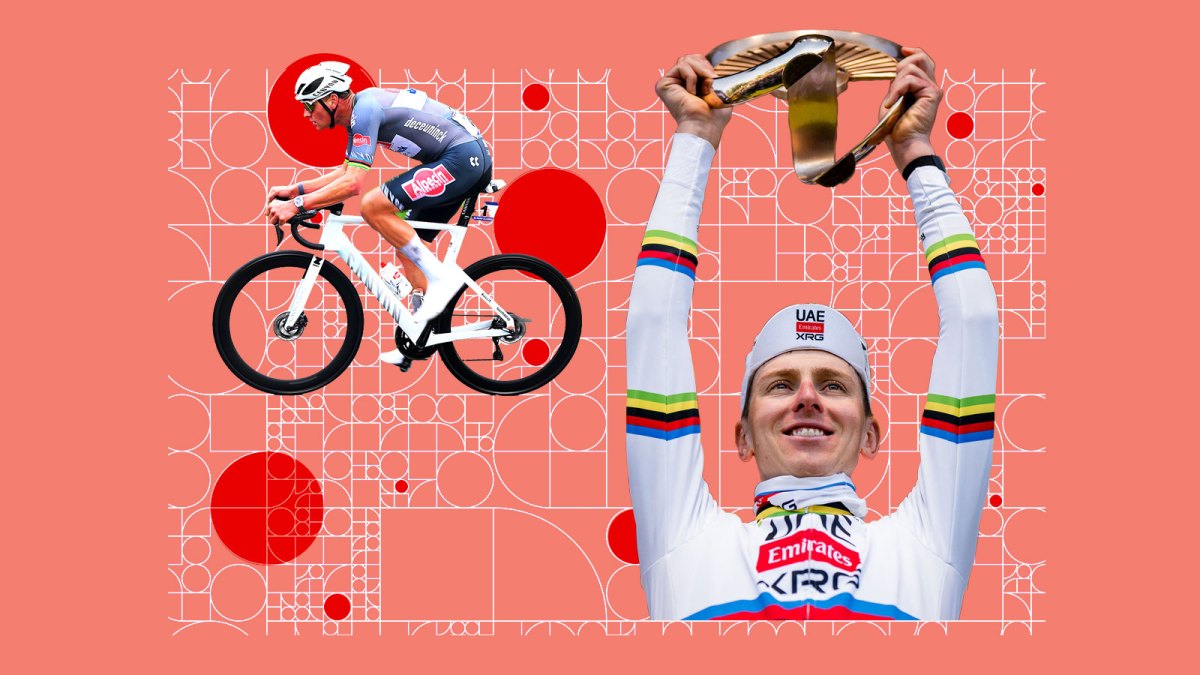

Paris Roubaix The Case For Tadej Pogacars Strong Contention

Apr 10, 2025

Paris Roubaix The Case For Tadej Pogacars Strong Contention

Apr 10, 2025 -

Benavidezs New Title Canelo Alvarezs Response And Potential Implications

Apr 10, 2025

Benavidezs New Title Canelo Alvarezs Response And Potential Implications

Apr 10, 2025 -

Celebrity Big Brother Mickey Rourkes Actions Spark Outrage

Apr 10, 2025

Celebrity Big Brother Mickey Rourkes Actions Spark Outrage

Apr 10, 2025 -

Important Notice Reduced Availability Of Singapore Airlines Award Seats

Apr 10, 2025

Important Notice Reduced Availability Of Singapore Airlines Award Seats

Apr 10, 2025