EIA Report: Unexpected Rise In U.S. Crude Oil And Fuel Inventories

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

EIA Report: Unexpected Surge in U.S. Crude Oil and Fuel Inventories Sends Shockwaves Through Market

The energy market experienced a jolt this week following the release of the Energy Information Administration's (EIA) latest weekly petroleum status report. The report revealed an unexpected and significant rise in U.S. crude oil and fuel inventories, defying analysts' predictions and sending ripples through oil prices. This surprising development has sparked considerable debate about the future trajectory of energy prices and the overall health of the American economy.

Key Findings from the EIA Report:

The EIA report, released on [Date of Report Release], painted a picture starkly different from the anticipated decline in inventories. Specifically, the report highlighted:

- Crude Oil Inventories: A substantial increase of [Specific number] barrels, exceeding the expected draw of [Specific number] barrels predicted by analysts. This unexpected build-up is attributed to [cite reasons given in the report, e.g., increased domestic production, lower-than-expected export demand, refinery maintenance].

- Gasoline Inventories: A significant rise of [Specific number] barrels, surpassing analyst forecasts of [Specific number] barrels. This increase suggests weaker-than-anticipated gasoline demand, possibly influenced by [cite potential factors, e.g., seasonal changes, economic slowdown, high prices].

- Distillate Fuel Inventories: An unexpected jump of [Specific number] barrels, compared to the projected decline of [Specific number] barrels. This surplus likely reflects factors such as [cite reasons from the report, e.g., reduced heating oil demand due to warmer-than-average temperatures, refinery output adjustments].

Market Reaction and Analyst Commentary:

The market reacted swiftly to the EIA's announcement. Crude oil prices experienced a [Percentage]% [increase/decrease] following the release, with [Mention specific benchmarks like WTI and Brent crude]. Many analysts attributed the price movement to the unexpected inventory build-up, questioning the strength of the current demand narrative.

“[Quote from a prominent energy analyst],” stated [Analyst's Name and Affiliation], highlighting the implications of the report for short-term price forecasts. Other experts emphasized the need for further data to fully understand the underlying factors driving the inventory surge and its potential long-term effects.

Potential Implications for the Energy Sector and Economy:

The unexpected inventory increase raises several key questions about the future of the energy market:

- Demand Concerns: The report reignites concerns about weakening global oil demand, particularly in the face of persistent economic uncertainty and potential recessionary pressures.

- Supply Dynamics: The inventory build-up raises questions about the balance between global supply and demand, and the potential for further price volatility in the coming weeks and months.

- Impact on Refineries: The surplus in fuel inventories might lead to adjustments in refinery operations, potentially impacting profitability and investment decisions within the refining sector.

- Geopolitical Factors: While the report focuses on domestic inventories, it's crucial to consider the impact of geopolitical events and their potential influence on global oil prices and supply chains.

Looking Ahead:

The EIA's report serves as a crucial data point for market participants, policymakers, and energy companies alike. Further analysis and observation are needed to determine whether this is a temporary fluctuation or a sign of a more significant shift in the energy landscape. The coming weeks will be critical in determining the lasting effects of this unexpected inventory surge on the U.S. and global energy markets. Close monitoring of future EIA reports and other economic indicators will be essential for understanding the full implications of this development. This situation underlines the inherent volatility of the energy sector and the importance of staying informed about market trends.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on EIA Report: Unexpected Rise In U.S. Crude Oil And Fuel Inventories. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Watch Jon Hamms Incredible Steal Stops Pacers Fast Break Against Haliburton

May 22, 2025

Watch Jon Hamms Incredible Steal Stops Pacers Fast Break Against Haliburton

May 22, 2025 -

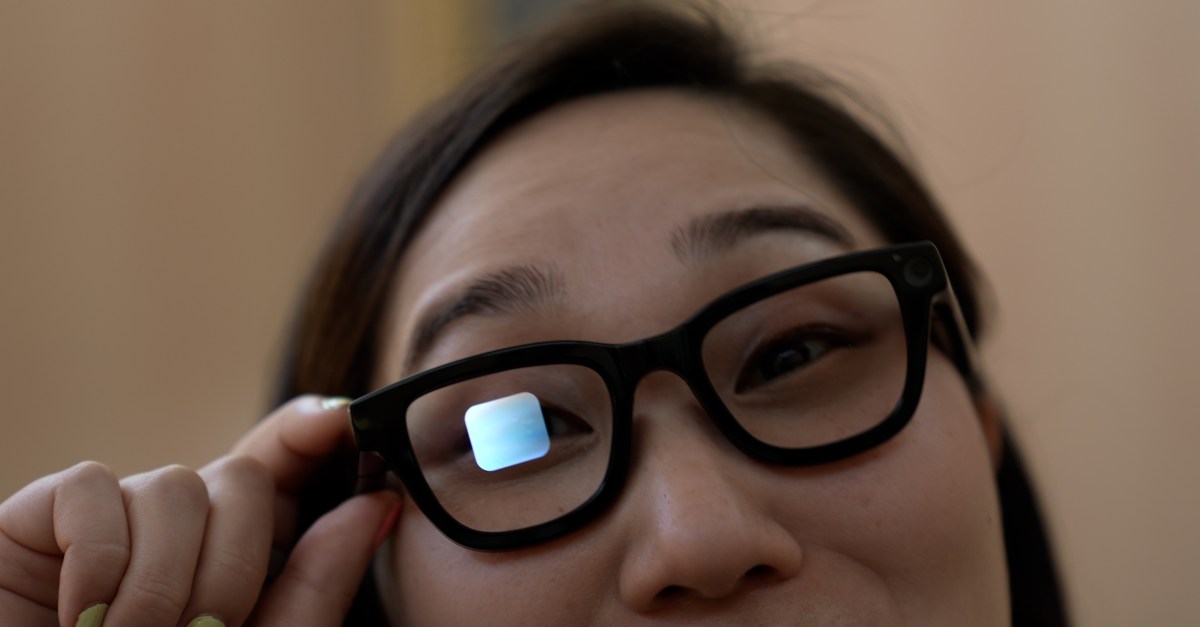

Googles Ai Smart Glasses A Hands On Review

May 22, 2025

Googles Ai Smart Glasses A Hands On Review

May 22, 2025 -

Expert Predictions Thunder Timberwolves Western Conference Clash

May 22, 2025

Expert Predictions Thunder Timberwolves Western Conference Clash

May 22, 2025 -

First Successful Flight Test Of Venus Aerospaces Rotating Detonation Engine

May 22, 2025

First Successful Flight Test Of Venus Aerospaces Rotating Detonation Engine

May 22, 2025 -

Rio Grande Do Sul Em Emergencia 75 Mortos E Crise De Agua E Energia Apos Chuvas Devastadoras

May 22, 2025

Rio Grande Do Sul Em Emergencia 75 Mortos E Crise De Agua E Energia Apos Chuvas Devastadoras

May 22, 2025