El Salvador's Bitcoin Law: Lessons Learned And Why The US Should Proceed With Caution

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

El Salvador's Bitcoin Law: Lessons Learned and Why the US Should Proceed with Caution

El Salvador's bold experiment with Bitcoin as legal tender, launched in September 2021, has been a rollercoaster ride. While touted as a financial revolution by President Nayib Bukele, the reality has been far more complex, offering valuable – and cautionary – lessons for the United States as it considers its own approach to cryptocurrency regulation and adoption. The initial hype surrounding the "Bitcoin beach" narrative has given way to a more nuanced understanding of the challenges involved in integrating a volatile digital asset into a national economy.

The Initial Promise and the Harsh Reality:

The initial goal was ambitious: to boost financial inclusion, attract foreign investment, and modernize El Salvador's economy. Proponents argued Bitcoin would reduce reliance on the US dollar, lessen transaction fees, and empower the unbanked population. However, the reality has fallen short of these expectations. While some businesses embraced Bitcoin, widespread adoption has been hampered by several key factors:

-

Volatility: Bitcoin's price swings have created significant economic instability for businesses and consumers accustomed to the relative stability of the US dollar. This volatility directly impacts the purchasing power of citizens.

-

Lack of Infrastructure: The necessary infrastructure for widespread Bitcoin usage, including reliable internet access and cryptocurrency education, remains underdeveloped in El Salvador. This has limited adoption, especially in rural areas.

-

Security Concerns: The rise in Bitcoin-related scams and the lack of robust consumer protection measures have eroded public trust. The complexities of cryptocurrency transactions have proven difficult for many citizens to navigate.

-

Environmental Impact: The energy consumption associated with Bitcoin mining raises significant environmental concerns, contradicting El Salvador's commitment to renewable energy.

Key Lessons for the US:

El Salvador's experience provides several critical takeaways for the US as it navigates the complex landscape of cryptocurrency regulation:

-

Gradual Implementation: A phased approach, focusing on pilot programs and targeted initiatives, is crucial. Rushing into nationwide adoption without addressing underlying infrastructure and educational needs is risky.

-

Robust Consumer Protection: Strong regulatory frameworks are essential to protect consumers from fraud and scams associated with cryptocurrencies. Clear guidelines and consumer education are vital.

-

Financial Stability: The volatility of cryptocurrencies poses a serious threat to macroeconomic stability. Any move towards wider adoption must carefully consider its impact on the financial system.

-

Environmental Considerations: The environmental impact of cryptocurrency mining cannot be ignored. The US needs to evaluate the environmental footprint of any widespread adoption of cryptocurrencies.

-

Technological Infrastructure: Before widespread adoption, the US needs to ensure sufficient technological infrastructure, including reliable internet access and digital literacy programs, to support the use of cryptocurrencies.

Conclusion:

El Salvador's Bitcoin experiment serves as a stark reminder that integrating a volatile digital asset into a national economy is a complex undertaking with significant potential risks. While the potential benefits of cryptocurrencies are undeniable, the US must proceed with caution, prioritizing careful planning, robust regulation, and a phased approach to ensure financial stability and protect consumers. The rush to embrace Bitcoin without addressing these critical issues could have far-reaching and potentially damaging consequences. The lessons learned from El Salvador's experience should guide the US towards a more responsible and sustainable approach to cryptocurrency integration.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on El Salvador's Bitcoin Law: Lessons Learned And Why The US Should Proceed With Caution. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tilt Cove Newfoundland Towns Demise Leaves It Deserted

May 21, 2025

Tilt Cove Newfoundland Towns Demise Leaves It Deserted

May 21, 2025 -

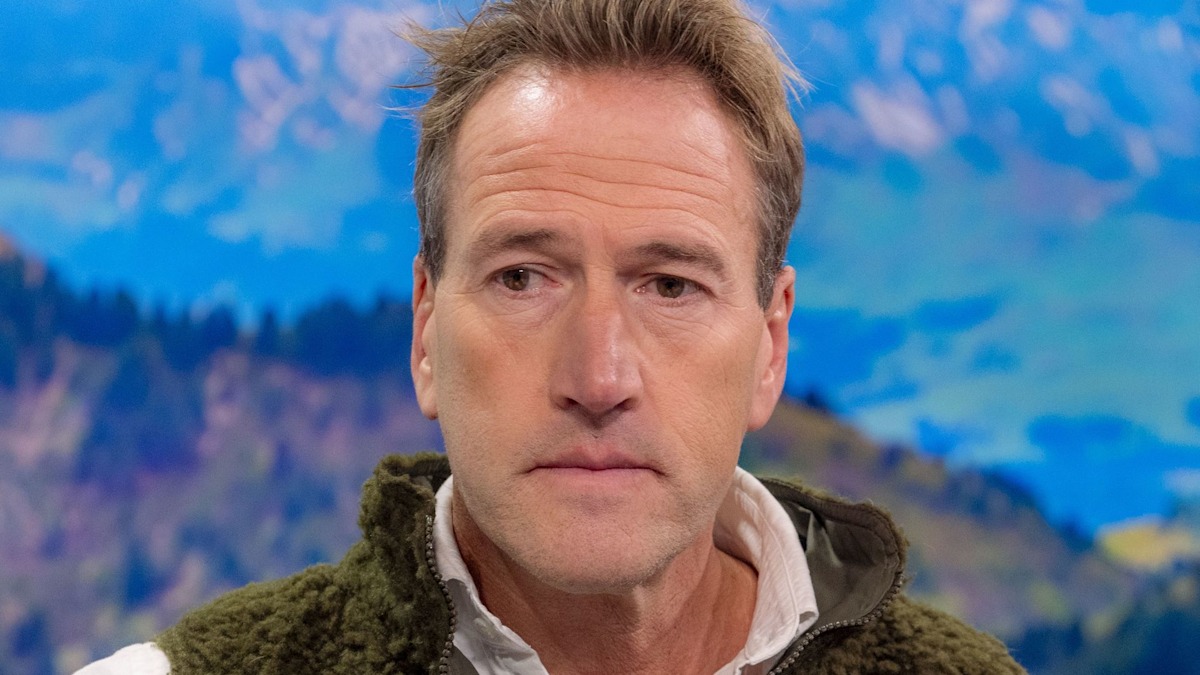

Ben Fogles Family Challenges Balancing Career And Teenage Children

May 21, 2025

Ben Fogles Family Challenges Balancing Career And Teenage Children

May 21, 2025 -

Red Sox And Astros Proposed Trade Ignites Intense Fan Debate

May 21, 2025

Red Sox And Astros Proposed Trade Ignites Intense Fan Debate

May 21, 2025 -

Exclusive Hugh Jackman And Sutton Fosters Romance Revealed Through Sweet Pda Photos

May 21, 2025

Exclusive Hugh Jackman And Sutton Fosters Romance Revealed Through Sweet Pda Photos

May 21, 2025 -

Nba Playoffs Thunder Timberwolves Series Preview And Prediction

May 21, 2025

Nba Playoffs Thunder Timberwolves Series Preview And Prediction

May 21, 2025