Elon Musk's XAI Purchases X: A $33 Billion Paper Deal Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Elon Musk's xAI Purchases X: A $33 Billion Paper Deal Analyzed

Elon Musk's audacious move to integrate his newly formed artificial intelligence company, xAI, with his already sprawling X (formerly Twitter) empire has sent shockwaves through the tech world. Announced last week, the purported $33 billion acquisition is raising eyebrows not for its price tag, but for its apparent lack of tangible assets exchanged. This article delves into the intricacies of this seemingly paper deal and explores its implications for both xAI and the future of X.

The Deal: More Smoke and Mirrors than Substance?

The official statement surrounding the xAI acquisition of X was remarkably brief, lacking the detailed financial breakdowns typical of such large-scale transactions. Instead, the focus was on the synergistic potential between xAI's advanced AI capabilities and X's massive user base and data trove. This vagueness has led many analysts to suspect that the $33 billion figure is largely symbolic, representing a valuation more than a direct monetary exchange.

This interpretation is fueled by several factors:

- Lack of Transparency: The absence of detailed financial disclosures leaves significant room for speculation. The exact nature of the assets transferred remains unclear, raising questions about the true value of the transaction.

- Internal Restructuring: The deal could be interpreted as an internal restructuring within Musk's broader business empire, aiming to consolidate his AI and social media assets under a single umbrella. This would simplify management and potentially unlock new revenue streams.

- Strategic Investment: The $33 billion figure might represent a strategic investment in xAI, showcasing Musk's unwavering commitment to the company's long-term goals and potential. This would be akin to a massive internal funding round rather than a traditional acquisition.

The Implications for xAI and X:

While the financial mechanics remain shrouded in mystery, the strategic implications are clearer. The integration potentially allows xAI to:

- Access Vast Datasets: X's enormous user base provides xAI with an unparalleled wealth of data for training and improving its AI models. This is crucial for developing cutting-edge AI applications.

- Enhance Product Development: Integrating AI capabilities into X's platform could revolutionize its features, from enhanced search functionalities to personalized content recommendations and advanced spam filtering.

- Drive Revenue Growth: The combination of AI and social media could lead to innovative monetization strategies, potentially boosting X's revenue and profitability.

However, challenges remain:

- Regulatory Scrutiny: The opaque nature of the deal could invite regulatory scrutiny, potentially delaying or even derailing the integration process. Antitrust concerns could also surface.

- Data Privacy Concerns: The use of X's user data by xAI raises significant data privacy concerns, requiring careful management and adherence to strict data protection regulations.

- Integration Difficulties: Merging two such disparate entities presents considerable technological and logistical challenges. Seamless integration will require significant effort and expertise.

Conclusion: A Calculated Gamble?

Elon Musk's acquisition of X by xAI remains a highly unusual transaction. While the lack of transparency raises eyebrows, the potential benefits for both companies are undeniable. Ultimately, the success of this "paper deal" will depend on the ability to effectively integrate xAI's technology into X's platform, address data privacy concerns, and navigate the complex regulatory landscape. Only time will tell if this bold move proves to be a masterstroke or a costly gamble for Musk's vast empire. The coming months will be crucial in determining the long-term impact of this enigmatic transaction on the future of AI and social media.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Elon Musk's XAI Purchases X: A $33 Billion Paper Deal Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dynamic Flooding Engulfs Queensland Impact On Small Towns Severe

Mar 30, 2025

Dynamic Flooding Engulfs Queensland Impact On Small Towns Severe

Mar 30, 2025 -

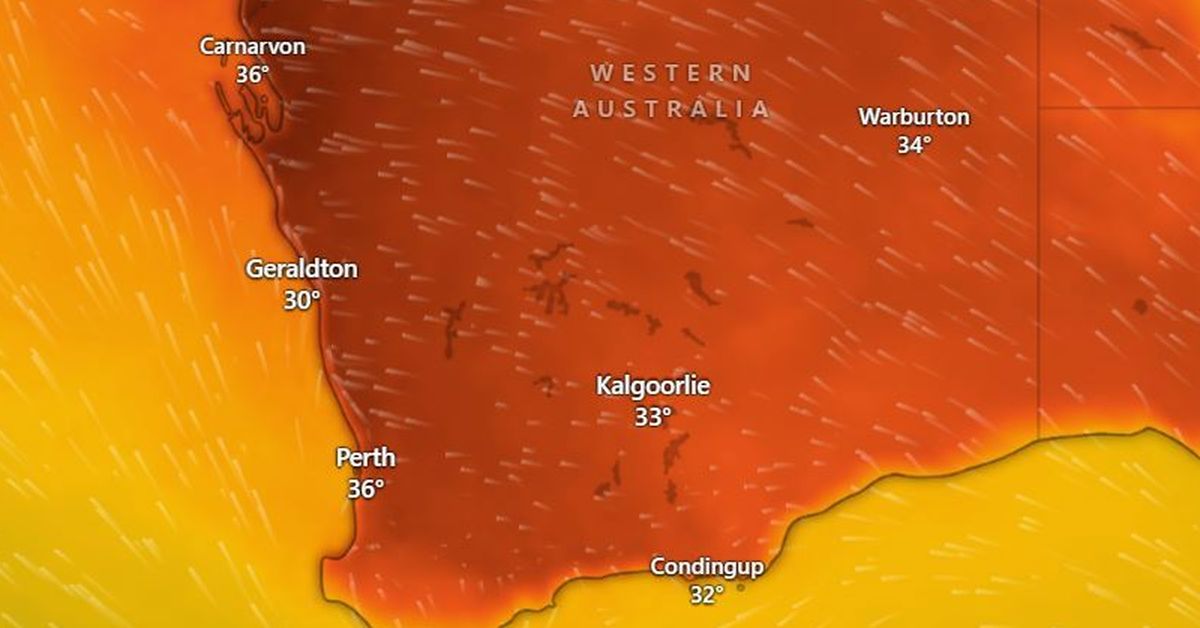

Autumn Heatwave Western Australia Battles Near Record Temperatures

Mar 30, 2025

Autumn Heatwave Western Australia Battles Near Record Temperatures

Mar 30, 2025 -

Nyt Connections Game 657 Hints And Answers For March 29th

Mar 30, 2025

Nyt Connections Game 657 Hints And Answers For March 29th

Mar 30, 2025 -

Ardwghan Yhny Alsysy Wywkd Dem Trkya Lastqrar Msr Wttwrha

Mar 30, 2025

Ardwghan Yhny Alsysy Wywkd Dem Trkya Lastqrar Msr Wttwrha

Mar 30, 2025 -

Emergency Evacuations Ordered As Queensland Battles Intense Flooding

Mar 30, 2025

Emergency Evacuations Ordered As Queensland Battles Intense Flooding

Mar 30, 2025