Emiten Konglomerat Tawarkan Obligasi Rp 1 Triliun, Bunga 9,3%: Prospek Investasi?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Emiten Konglomerat Tawarkan Obligasi Rp 1 Triliun, Bunga 9,3%: Prospek Investasi Menarik?

Sebuah emiten konglomerat terkemuka di Indonesia menawarkan obligasi senilai Rp 1 triliun dengan tingkat kupon yang cukup tinggi, yaitu 9,3%. Tawaran ini menarik perhatian para investor, namun seberapa menjanjikan prospek investasinya? Mari kita bahas lebih dalam.

Indonesia's bustling bond market is abuzz with the news of a major conglomerate offering a Rp 1 trillion (approximately US$66 million) bond issuance, boasting an attractive coupon rate of 9.3%. This significant offering presents a compelling investment opportunity, but a thorough analysis is crucial before diving in. Understanding the issuer's financial health, the market conditions, and the inherent risks is paramount for any prospective investor.

Analisis Emiten dan Kondisi Pasar

The identity of the conglomerate remains undisclosed at this time, pending official announcements. However, the high coupon rate suggests a few possibilities: either the issuer is facing higher-than-average risk, or the current market conditions are favorable for attracting investors with a higher yield.

Several factors influence the attractiveness of this bond issuance:

- Kondisi Makroekonomi: The current state of the Indonesian economy plays a significant role. Factors such as inflation rates, interest rate policies by Bank Indonesia, and overall economic growth will influence investor sentiment and demand for bonds. A robust economy generally supports higher bond prices.

- Kredit Rating: The credit rating of the issuing conglomerate will be a crucial factor in determining the risk involved. A higher credit rating indicates lower default risk, making the bond a more attractive investment. Investors should carefully review the credit rating before making any investment decisions.

- Tenor Obligasi: The maturity date of the bond will influence the overall return. Longer tenors generally offer higher yields but also carry greater interest rate risk.

- Perbandingan dengan Instrumen Investasi Lain: Comparing the 9.3% yield against other available investment options, such as government bonds (Surat Berharga Negara or SBN) or other corporate bonds, is essential for determining its competitiveness.

Risiko Investasi

While the high coupon rate is tempting, investors should be aware of potential risks:

- Risiko Default: Even for established conglomerates, there's always a risk of default, meaning the issuer might fail to make timely interest payments or repay the principal.

- Risiko Likuiditas: The ability to easily sell the bond before maturity is a key factor. Less liquid bonds might be harder to sell quickly if needed, potentially resulting in losses.

- Risiko Suku Bunga: Fluctuations in interest rates can impact the value of the bond. Rising interest rates can decrease the bond's value.

Kesimpulan: Prospek Investasi?

The Rp 1 trillion bond issuance with a 9.3% coupon rate presents a potentially attractive investment opportunity, but only after thorough due diligence. Investors should carefully assess the issuer's financial health, the prevailing market conditions, and the inherent risks before committing their capital. Seeking professional financial advice is highly recommended. Information regarding the specific issuer and further details on the bond offering should be sought through official channels once publicly released. Stay informed and make informed investment decisions.

Keywords: Emiten Konglomerat, Obligasi, Rp 1 Triliun, Bunga 9.3%, Prospek Investasi, Pasar Obligasi Indonesia, Risiko Investasi, Surat Berharga Negara (SBN), Investasi Bond, Kredit Rating, Yield Obligasi.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Emiten Konglomerat Tawarkan Obligasi Rp 1 Triliun, Bunga 9,3%: Prospek Investasi?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How To Fund A Us Bitcoin Reserve Without Increasing The Deficit

Mar 18, 2025

How To Fund A Us Bitcoin Reserve Without Increasing The Deficit

Mar 18, 2025 -

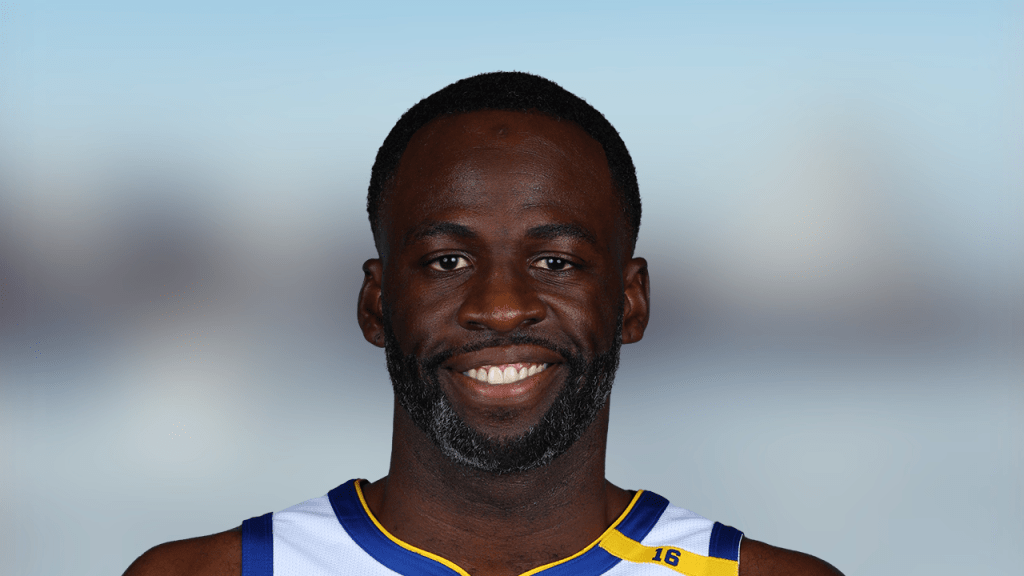

Josh Harts Take Draymond Green Should Apologize To Karl Anthony Towns

Mar 18, 2025

Josh Harts Take Draymond Green Should Apologize To Karl Anthony Towns

Mar 18, 2025 -

The Great Egg Price Decline Half Off The Peak

Mar 18, 2025

The Great Egg Price Decline Half Off The Peak

Mar 18, 2025 -

Another Absence For Monte Morris Fantasy Basketball Adjustments Needed

Mar 18, 2025

Another Absence For Monte Morris Fantasy Basketball Adjustments Needed

Mar 18, 2025 -

Sundays Showdown Clippers Vs Hornets Complete Injury Report

Mar 18, 2025

Sundays Showdown Clippers Vs Hornets Complete Injury Report

Mar 18, 2025

Latest Posts

-

Unnamed Country Holds Up Trade Deal Commerce Secretary Lutnicks Statement

Apr 30, 2025

Unnamed Country Holds Up Trade Deal Commerce Secretary Lutnicks Statement

Apr 30, 2025 -

Snowplow Accident Leaves Jeremy Renner Near Death Exclusive Details

Apr 30, 2025

Snowplow Accident Leaves Jeremy Renner Near Death Exclusive Details

Apr 30, 2025 -

Analyzing Axar Patels Death Overs Bowling Decisions

Apr 30, 2025

Analyzing Axar Patels Death Overs Bowling Decisions

Apr 30, 2025 -

User Survey Exposes The Shortcomings Of Current Ai A Figma Perspective

Apr 30, 2025

User Survey Exposes The Shortcomings Of Current Ai A Figma Perspective

Apr 30, 2025 -

Arsenal Psg Un Choc Europeen Pour Debuter La Ligue Des Champions

Apr 30, 2025

Arsenal Psg Un Choc Europeen Pour Debuter La Ligue Des Champions

Apr 30, 2025