Energy Industry's Bitcoin Mining Shift: How Oil And Gas Companies Are Entering The Crypto Space

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Energy Industry's Bitcoin Mining Shift: How Oil and Gas Companies Are Entering the Crypto Space

The energy industry is undergoing a fascinating transformation, with major players increasingly turning their attention to Bitcoin mining. This isn't just a diversification strategy; it's a potential game-changer, leveraging existing infrastructure and resources to tap into the lucrative cryptocurrency market. But what's driving this shift, and what are the implications for both the energy sector and the future of Bitcoin?

The Allure of Bitcoin Mining for Oil and Gas Companies:

Several factors are fueling this burgeoning trend. Firstly, the energy-intensive nature of Bitcoin mining aligns perfectly with the existing infrastructure of oil and gas companies. These companies already possess significant power generation capacity, often from excess gas flaring or stranded energy sources. By repurposing this energy, they can significantly reduce waste, boost profitability, and enhance their environmental credentials – a crucial aspect in today's climate-conscious world.

- Reduced Operational Costs: Utilizing existing infrastructure drastically cuts down on the capital expenditure required for setting up a mining operation.

- Waste Reduction: Flaring excess natural gas, a common practice in the oil and gas industry, contributes significantly to greenhouse gas emissions. Bitcoin mining provides a viable alternative, transforming waste into a profitable venture.

- Diversification and Revenue Streams: The volatile nature of energy markets makes diversification crucial. Bitcoin mining offers a new, potentially lucrative revenue stream, hedging against fluctuations in traditional energy markets.

- Technological Expertise: Many oil and gas companies possess the technical expertise necessary for large-scale operations, providing a competitive advantage in the Bitcoin mining landscape.

Key Players and Their Strategies:

Several prominent oil and gas companies are already making significant strides in the Bitcoin mining space. While many remain discreet about their involvement, several have publicly expressed interest or undertaken pilot projects. The specifics of their strategies vary, but the common thread is the efficient utilization of existing resources and infrastructure. For example, some companies are partnering with specialized Bitcoin mining companies, leveraging their expertise while focusing on providing sustainable energy.

Environmental Concerns and Sustainability:

The environmental impact of Bitcoin mining is a frequently raised concern. However, the shift towards utilizing stranded energy sources or excess gas that would otherwise be flared presents a compelling argument for the sustainability of this approach. By mitigating wasteful practices and reducing emissions, oil and gas companies can contribute to a more environmentally responsible Bitcoin mining industry. Transparency and data-driven reporting will be key to building public trust and addressing these concerns.

Challenges and Future Outlook:

Despite the significant opportunities, several challenges remain. The volatile nature of Bitcoin's price poses a risk, and regulatory uncertainty in different jurisdictions adds complexity. Furthermore, competition from established Bitcoin mining players will intensify. However, the strategic advantages of leveraging existing infrastructure and expertise suggest a promising future for the integration of oil and gas companies into the cryptocurrency mining landscape.

Conclusion:

The energy industry's foray into Bitcoin mining represents a significant shift with potential far-reaching consequences. By cleverly utilizing existing resources and tackling environmental challenges, oil and gas companies are not only diversifying their revenue streams but also potentially contributing to a more sustainable and efficient Bitcoin ecosystem. The future will likely see increased engagement from the energy sector, pushing the boundaries of innovation and further blurring the lines between traditional energy and the burgeoning cryptocurrency market. This is a story worth watching closely as it unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Energy Industry's Bitcoin Mining Shift: How Oil And Gas Companies Are Entering The Crypto Space. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Caballero Como Dt El Chelsea De Enzo Fernandez Se Juega Ante Everton La Clasificacion A Champions

Apr 26, 2025

Caballero Como Dt El Chelsea De Enzo Fernandez Se Juega Ante Everton La Clasificacion A Champions

Apr 26, 2025 -

Perplexitys Chrome Bid Analyzing The Implications For The Browser Market

Apr 26, 2025

Perplexitys Chrome Bid Analyzing The Implications For The Browser Market

Apr 26, 2025 -

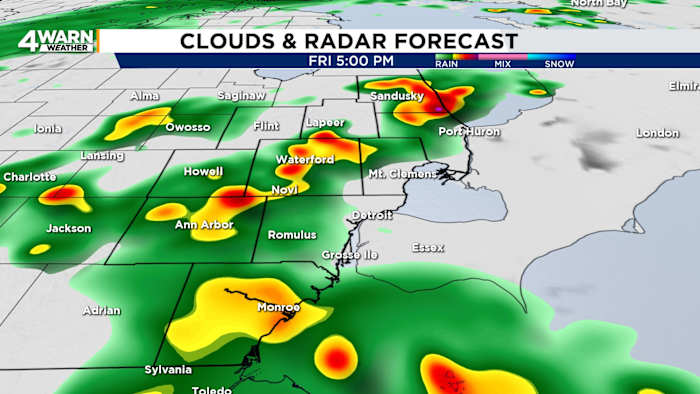

Se Michigan Weather Rollercoaster Weekend Ahead With Summerlike Conditions

Apr 26, 2025

Se Michigan Weather Rollercoaster Weekend Ahead With Summerlike Conditions

Apr 26, 2025 -

Dubois Vows To Smash Heavyweight Rival Into Retirement

Apr 26, 2025

Dubois Vows To Smash Heavyweight Rival Into Retirement

Apr 26, 2025 -

Sustained Fet Rally 36 Weekly Increase 1 Target Remains

Apr 26, 2025

Sustained Fet Rally 36 Weekly Increase 1 Target Remains

Apr 26, 2025